Bitcoin and S&P 500 hit 2-month lows as bond yields surge – Is the post-election rally over?

Bitcoin has tumbled to $90,000, its lowest level since November 18. That’s a 4.4% drop, a painful reminder of its December peak at $108,316.

Ether tanked 6.6%, and the entire crypto market felt the heat. Investors hit the eject button on risky assets, spooked by a sharp spike in bond yields. Meanwhile, the S&P 500 wasn’t spared, shedding $2.5 trillion in market cap over just four weeks. How crazy is that?

This market bloodbath started brewing Friday when the U.S. jobs report smashed expectations. Traders betting on quick Fed rate cuts were forced to recalibrate. Rate cuts? Forget about them. The Federal Reserve looks more likely to actually hike them instead, which is a problem for both crypto and stocks.

Bitcoin’s breaking point

Bitcoin’s fall wasn’t just about macroeconomic fears. Technically, the charts were screaming trouble. A “head and shoulders” pattern—a classic bearish signal—has formed. Bitcoin breaching the $91,600 support level was the nail in the coffin, confirming what analysts believe to be a strong technical bearish signal.

Bitcoin inflows on Binance have plummeted too. Back in November, daily inflows peaked at 28,000 BTC. Now? They’ve dropped to just 6,000 BTC. Outflows still dominate, but netflows are flatlining.

The result is a market that feels like it’s standing on a knife’s edge. Investors appear reluctant to sell but aren’t exactly buying the dip, either. If this stalemate continues, Bitcoin could either stabilize or plunge even deeper.

Rising bond yields wreak havoc on stocks and crypto

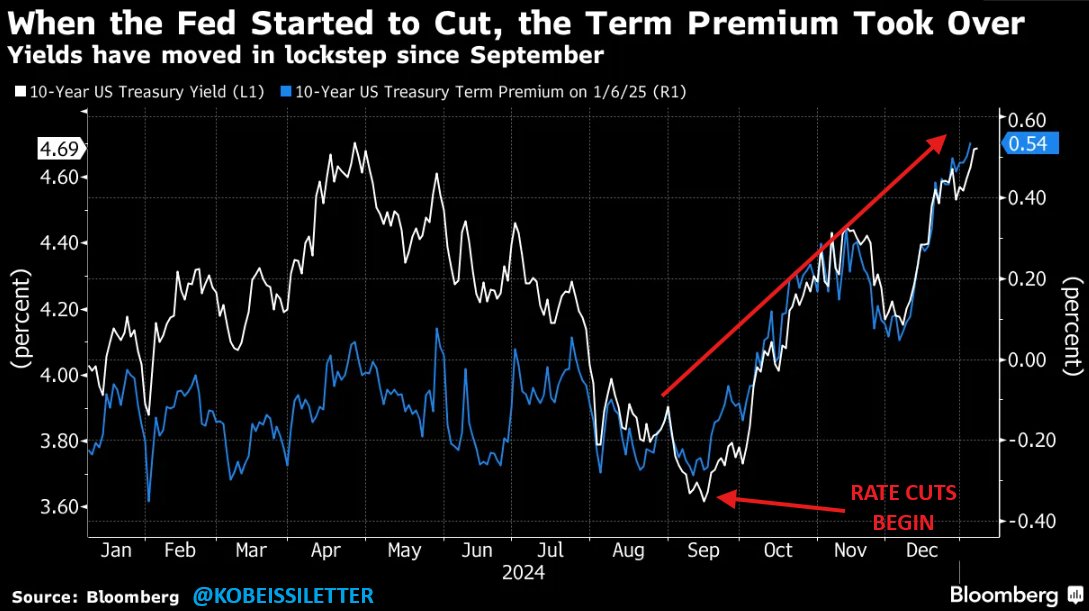

Meanwhile, the S&P 500 is grappling with a meltdown of its own. The index has slid below its November 5 levels, erasing trillions in market value. The culprit? Rising bond yields, driven by a spike in “term premiums.”

If you’re not familiar with term premiums, they are the extra compensation investors demand for holding long-term debt, especially when inflation expectations are climbing.

Here’s the thing: Inflation expectations are skyrocketing. In just a few weeks, long-term consumer inflation expectations shot up from 2.6% to 3.3%. That’s massive. Term premiums surged to 0.55%, their highest point in over a decade.

Historically, spikes in term premiums have preceded major market downturns. Think Dot-com crash; Think the 2008 financial crisis. The pattern is repeating, and fund managers are sweating bullets.

It gets worse. Cash allocations among fund managers are at historic lows, while equity exposure has soared to nearly 40%. Not even the Dot-com bubble saw levels like this. Combine that with rising term premiums, and you’ve got a toxic brew for risk assets.

Adding fuel to the fire is the U.S. Dollar Index (DXY), which just broke past 110 for the first time since November 2022. The dollar’s strength has surged 10% since rate cuts began. This kind of move isn’t what anyone expected during a Fed pivot.

A strong dollar typically means trouble for commodities, equities, and, of course, cryptocurrencies. Gold, however, is playing by its own rules. Over the last 13 months, gold’s return has quadrupled that of the DXY. That almost never happens. The markets might actually be cooked.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.