5 Token Unlocks to Watch Next Week

Token unlocks release previously restricted tokens tied to fundraising agreements. Projects schedule these events strategically to limit market pressure and stabilize prices.

Here are five large token unlocks scheduled for next week.

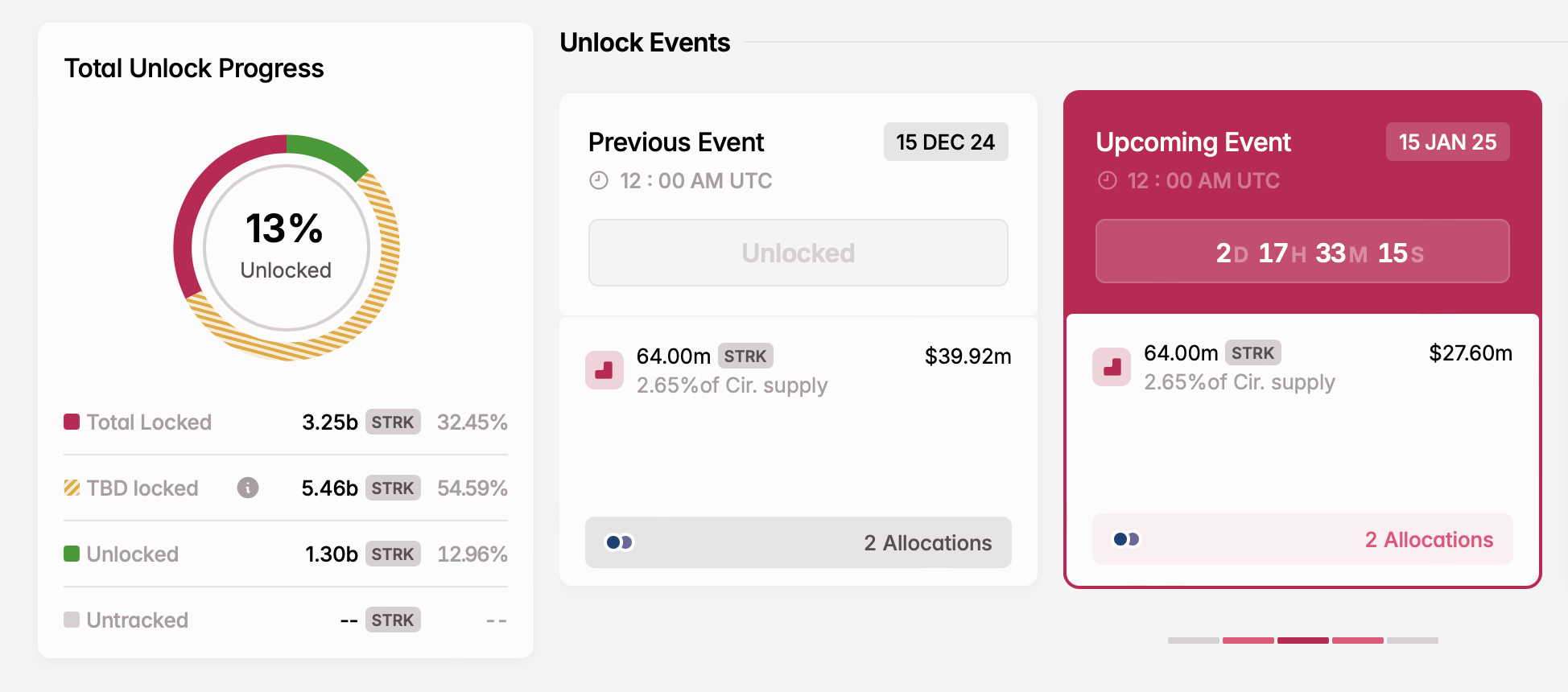

Starknet (STRK)

- Unlock date: January 15

- Number of tokens unlocked: 64 million STRK

- Current circulating supply: 2.41 billion STRK

Starknet is building a ZK-Rollup Layer-2 solution to enhance the scalability of decentralized applications on Ethereum. After completing a successful funding round, the team launched the STRK token, a key element in decentralizing the network.

On January 15, the project will unlock 64 million STRK tokens, allocating them to investors and early contributors.

STRK Unlock. Source: Tokenomist

STRK Unlock. Source: Tokenomist

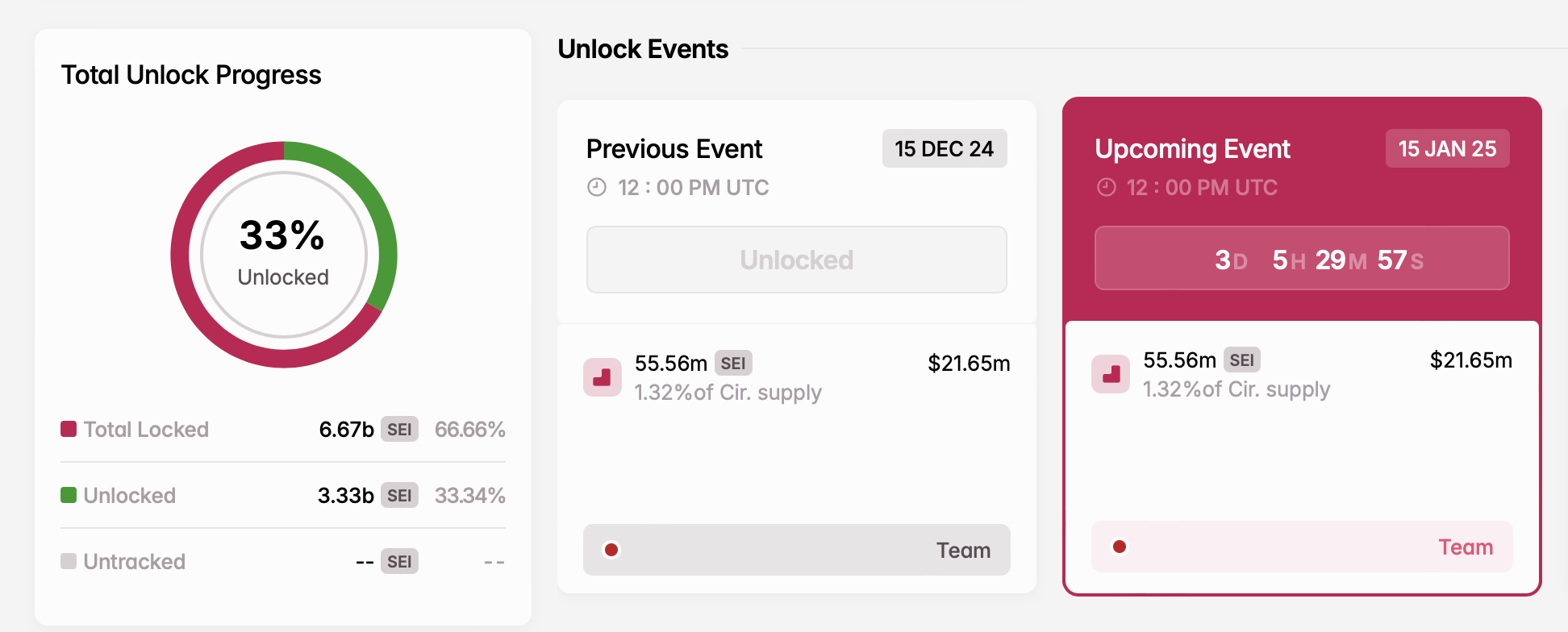

Sei (SEI)

- Unlock date: January 15

- Number of tokens unlocked: 55.56 million SEI

- Current circulating supply: 4.20 billion SEI

SEI is a blockchain platform designed to provide high-performance infrastructure for decentralized finance (DeFi) and other decentralized applications (dApps). Built on the Cosmos SDK, SEI operates as a Layer-1 blockchain with a strong focus on speed, scalability, and user-centric features.

On January 15, the project is set to release over 55 million SEI tokens allocated to its team members.

SEI Unlock. Source: Tokenomist

SEI Unlock. Source: Tokenomist

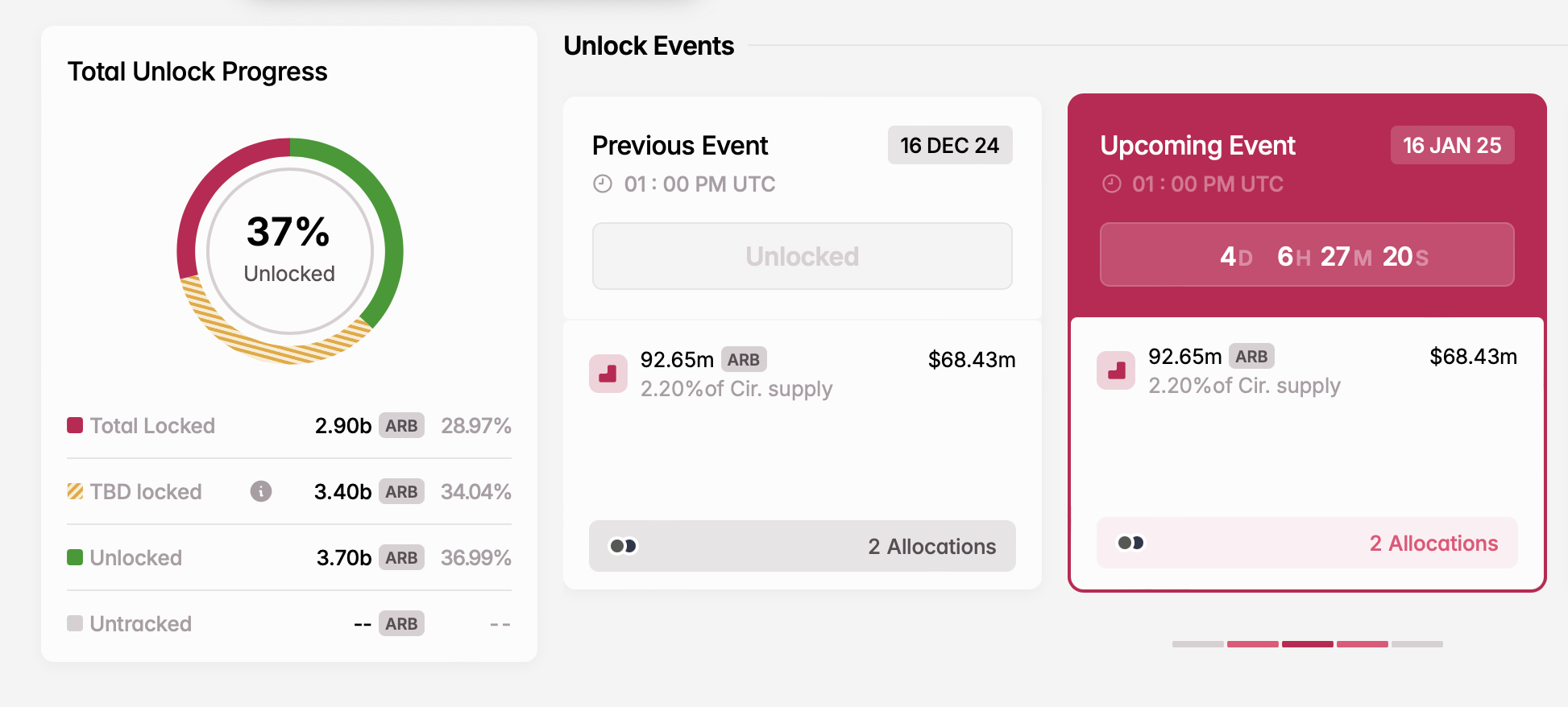

Arbitrum (ARB)

- Unlock date: January 16

- Number of tokens unlocked: 92.65 million ARB

- Current circulating supply: 4.21 billion ARB

Arbitrum, developed by Offchain Labs, is a leading Layer-2 solution for Ethereum. Launched in August 2021, it has backing from Lightspeed Venture Partners, Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, Mark Cuban, and Coinbase.

Next week, Arbitrum will unlock 92.65 million ARB tokens, worth approximately $68 million. These tokens are allocated to the team, advisors, and investors, marking a significant event for the ecosystem.

ARB Unlock. Source: Tokenomist

ARB Unlock. Source: Tokenomist

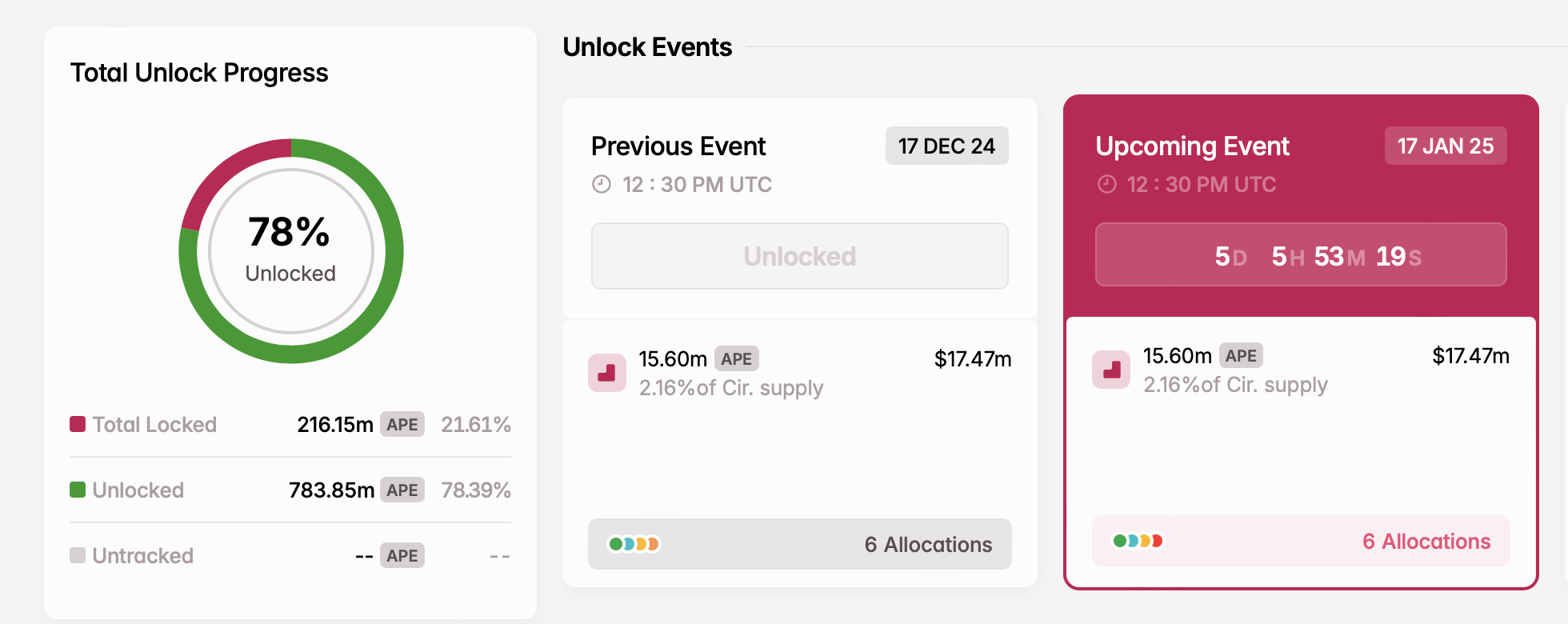

Apecoin (APE)

- Unlock date: January 17

- Number of tokens unlocked: 15.60 million APE

- Current circulating supply: 721.44 million APE

ApeCoin, the token for Yuga Labs’ Ape ecosystem, will release over 15 million tokens on January 17. These tokens will go to the treasury, founders, team, and contributors.

In the past, APE’s price has fallen after large token releases. However, with growing interest in NFTs, the price drop might not be as severe this time. Investors and traders should watch this event closely, as it could have a big impact on the token’s price.

APE Unlock. Source: Tokenomist

APE Unlock. Source: Tokenomist

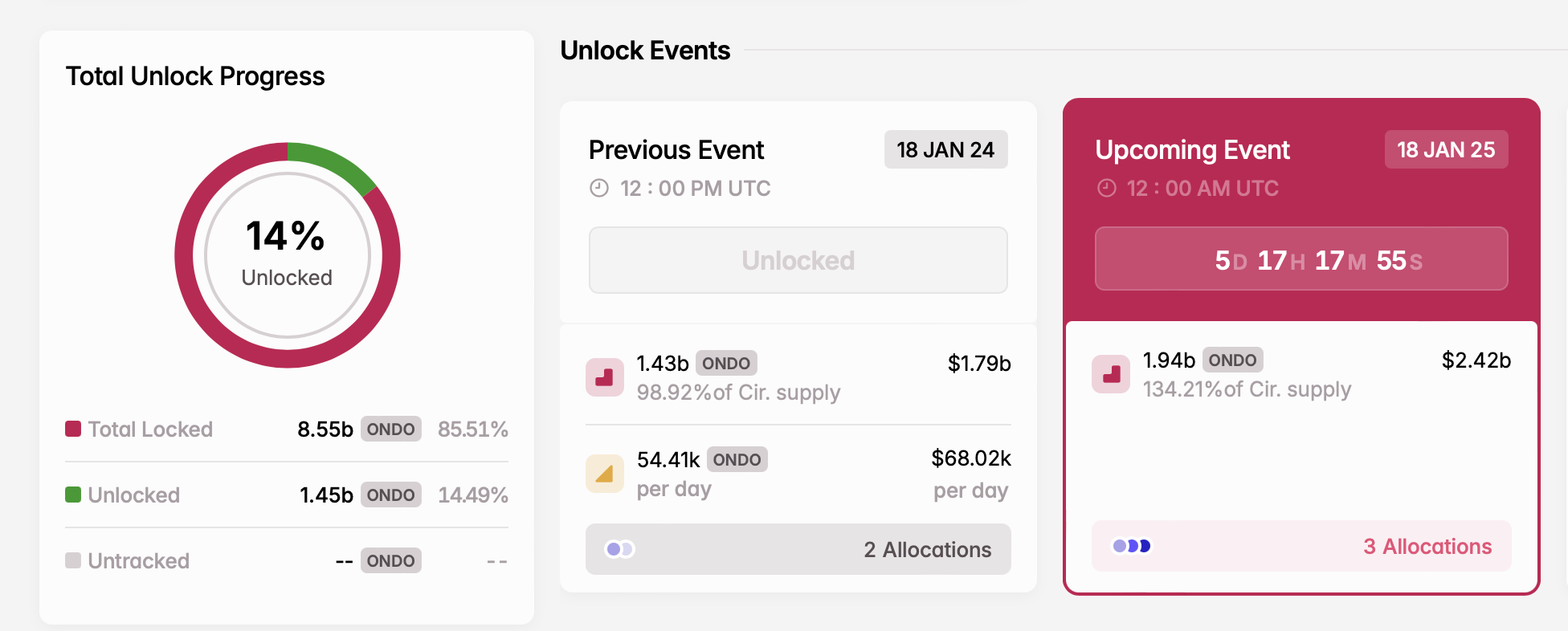

Ondo (ONDO)

- Unlock date: January 18

- Number of tokens unlocked: 1.94 billion ONDO

- Current circulating supply: 1.44 billion ONDO

Ondo Finance, a real-world asset (RWA) project, plans a major token unlock on January 18. The release, valued at $2.42 billion, represents 134.21% of its circulating supply. The tokens will be allocated for private sale participants, ecosystem growth, and protocol development.

ONDO Unlock. Source: Tokenomist

ONDO Unlock. Source: Tokenomist

Next week’s cliff token unlocks will also include Eigen Layer (EIGEN), Ethena (ENA), and Echelon Prime (PRIME), among others, with a total combined value exceeding $2.8 billion.