XRP Open Interest Jumps $1.6 Billion, Pushing Price to $3.31 All-Time High

XRP has struggled to gain upward momentum over the last few weeks, keeping the altcoin from registering any significant rise in price.

Despite this, traders remain optimistic, as seen in their recent behavior, which reflects growing confidence in a potential recovery.

XRP Traders Eye Opportunities Amid Price Recovery

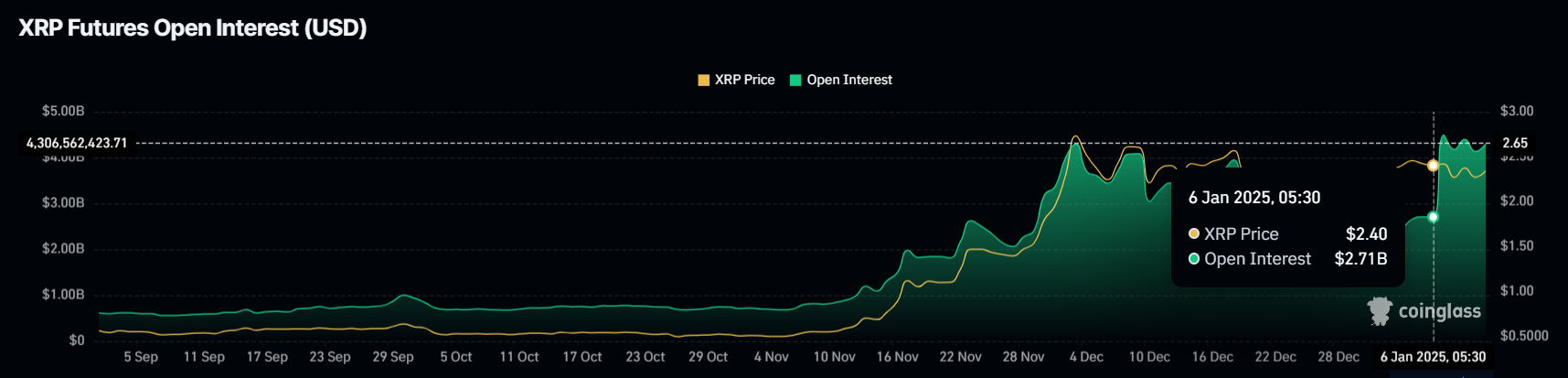

XRP’s market sentiment has seen a boost, with open interest increasing significantly by $1.6 billion this week. Rising from $2.71 billion to $4.30 billion, this growth highlights the active positioning of traders in anticipation of a potential price recovery. The increased open interest reflects heightened engagement and a renewed interest in leveraging XRP’s price fluctuations.

Additionally, the funding rate for XRP remains positive, further indicating bullish sentiment among traders. This aligns with their optimistic outlook, suggesting that many are prepared to capitalize on any upward price movement.

XRP Open Interest. Source: Coinglass

XRP Open Interest. Source: Coinglass

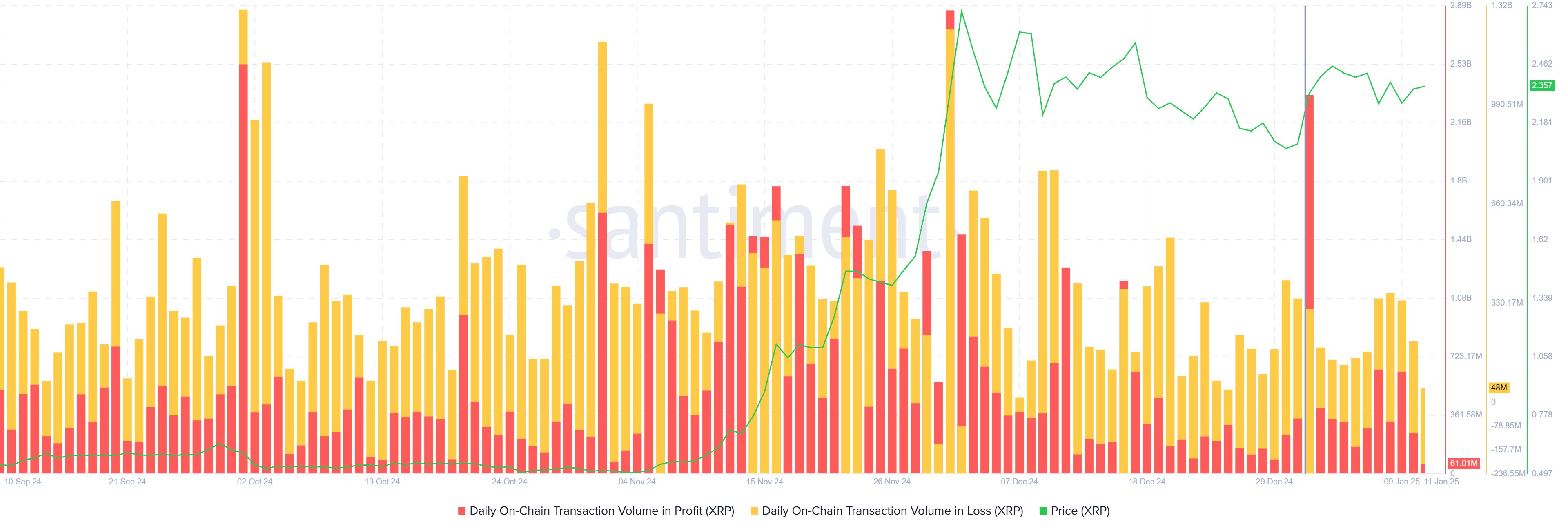

On-chain transaction volume for XRP, however, paints a more cautious picture. A significant portion of the transaction volume has been loss-bearing since the start of the year. This persistent trend reflects that many transactions are occurring at prices below the acquisition cost, which could dampen long-term investor sentiment if sustained.

If loss-dominated transaction volume continues, it risks eroding the optimism currently seen among traders. Such a scenario could trigger a pullback, reducing momentum and potentially impacting XRP’s ability to break through key resistance levels.

XRP Transaction Volume In Loss. Source: Santiment

XRP Transaction Volume In Loss. Source: Santiment

XRP Price Prediction: Rangebound Future

XRP’s price is currently consolidating, trading sideways within a defined range. The altcoin remains below the $2.73 resistance and above the $2.18 support level. This narrow band highlights the uncertainty surrounding the next significant price movement.

If the prevailing factors persist, XRP could remain stuck in this zone. A decline below the $2.18 support is possible, which could push the price down to $1.94, signaling a bearish turn for the altcoin.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, a shift in broader market sentiment towards bullishness could alter XRP’s trajectory. If XRP breaches the $2.73 resistance with strong trader support, it could rally further. In such a scenario, the altcoin might achieve its all-time high (ATH) of $3.31, reinforcing the optimism traders have shown in recent weeks.