FDIC Official Criticizes Crypto Restrictions, Calls for Policy Shift

FDIC Vice Chair Travis Hill has criticized past actions by federal agencies that limited banks’ involvement in crypto activities.

He said these measures, including the use of “pause letters,” hindered innovation and created the perception that regulators were blocking blockchain development.

Calls to End Restrictive Banking Practices Like Operation Chokepoint

Hill urged an end to practices resembling “Operation Chokepoint” and called for changes to the enforcement of the Bank Secrecy Act. He highlighted the need to reduce the pressure on banks to shut down accounts over fears of heavy penalties for non-compliance.

He also expressed support for better collaboration with the crypto sector.

In a speech published Friday, Hill suggested the FDIC take a more open approach to digital assets. He emphasized the need for clearer guidelines on how banks can safely engage with cryptocurrencies.

Hill, who has been Vice Chair since 2022, is expected to serve as acting chair of the agency, which insures US bank deposits.

“There is a healthy balance between (1) allowing banks to evolve with the times and (2) ensuring banks continue to manage risks prudently, and in recent years the FDIC has done a poor job striking that balance,” he said.

His comments come as the crypto industry raises concerns about regulatory overreach. Coinbase sued the FDIC in June, accusing the agency of trying to sever ties between the banking and crypto sectors.

The lawsuit, which also sought access to the “pause letters,” alleged that these actions unfairly targeted the industry.

Push for Clearer Crypto Guidelines

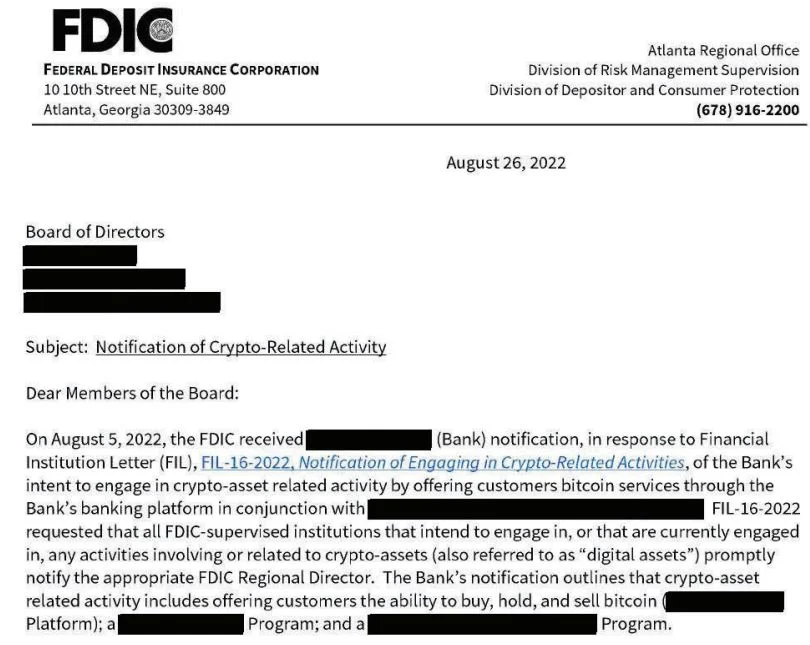

A 2023 report from the FDIC’s Office of Inspector General revealed that between March 2022 and May 2023, the agency sent “pause letters” to several banks. These letters requested that banks halt crypto-related activities while providing additional information for review.

The report highlighted a lack of clear standards for dealing with digital assets.

FDIC’s Exposed Letters to Banks About Crypto Services. Source: X (Formerly Twitter)

FDIC’s Exposed Letters to Banks About Crypto Services. Source: X (Formerly Twitter)

Hill criticized the shift toward handling crypto cases on an individual basis rather than offering transparent and consistent guidelines.

He also addressed comparisons to the 2013 Department of Justice initiative known as Operation Chokepoint. The initiative targeted industries like payday lending and firearms by restricting their access to banking services.

“While adopting a new approach to digital assets — and putting an end to any and all Choke Point-like tactics — are essential first steps, regulators also need to reevaluate our approach to implementing the Bank Secrecy Act (BSA),” Hill said.

Crypto advocates have used the term “Operation Chokepoint 2.0” to describe a covert effort by regulators to isolate the crypto industry.

Documents obtained by Coinbase suggest that the FDIC discouraged banks from engaging with crypto businesses under the guise of managing reputational risks.

“While we all share the goal of ensuring criminals and terrorists are not using the banking system to fund drug trafficking, terrorism, and other serious crimes, the current BSA regime creates an incentive for banks to close accounts rather than risk massive fines for inadequate BSA compliance,” the FDIC Vice Chair further elaborated.

Industry leaders, including Cardano founder Charles Hoskinson, have called for unity in response to what they describe as aggressive debanking measures. The controversy has also drawn attention from political figures. David Sacks, the new Crypto Czar, has vowed to address alleged banking restrictions targeting crypto businesses.