Bybit stops trading activities for users from India over regulatory pressures

Bybit announced that regulatory pressures from India have led to the decision to stop all services for traders from the country. The restrictions are temporary and will affect several Bybit services.

Bybit, one of the most widely used centralized exchanges, has responded to regulatory pressures in India by suspending most services for Indian traders. The exchange has a long record of previous restrictions and will respond this time by further limiting services for Indian accounts.

Effective January 12, Bybit will suspend the opening of new trades or access to its side products. Traders from India can only withdraw their funds at any time, though new deposits will be restricted. No deadline has been given for resuming the services.

All Bybit products, including crypto and fiat trading, will be off-limits to new orders from Indian traders. All derivative positions will switch to Close-Only mode, and traders will not be able to add funds or modify their exposure.

Users with trading bots will be terminated after January 13. Campaign participation will also stop over the weekend, with no grace period for completing new or ongoing tasks or campaigns. Bybit Card will also restrict all its transactions until the regulatory issue is resolved.

The Bybit exchange aims to complete its registration as a Virtual Digital Asset Service Provider in India within a few weeks. As soon as the registration process is completed, the services will return.

In general, India has an unregulated crypto market. The country does not outright ban usage but does not have clear indications of what is considered a transparent and legal crypto market. Until now, Bybit has also been working in a grey area, with no official registration or compliance.

India is among the top 5 Bybit market

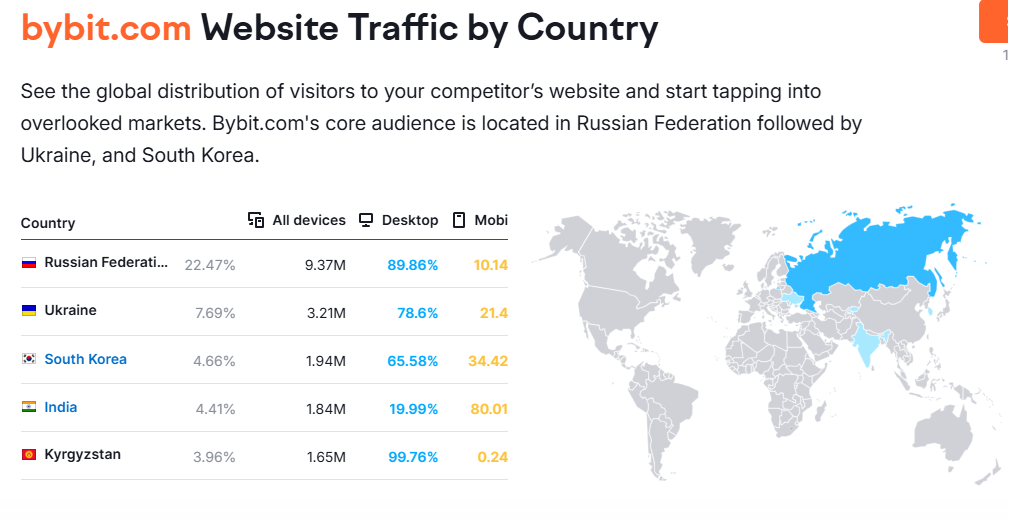

Bybit is a key exchange for meme token trading. Based on site visits, India is among the top five markets for the exchange. Traffic from India makes up 4.4% of all activity for the Bybit site.

India currently ranks the highest based on the Crypto Adoption Index by Chainalysis. The country has a 100% score with an index of 1.0, compared to 0.54% for the USA. The country has been known for the fast adoption of new trends, but also volatile trader behaviours and a trend to quickly realize gains. Traders from India are influential in many communities, especially regarding meme tokens.

Traffic from India makes up more than 9.5% of all Pump.fun visits, as the country is the second-largest region for meme token traders. Bybit is the final stage of the meme token market, listing the most liquid and popular assets. While the market will retain sufficient traffic from other regions, some specific memes tied to the Indian internet space may see lowered activity.

Most of the trades for Bybit come from mobile devices, as the exchange has tapped the low-cost token market. Bybit has been around since the 2018 market cycle, carrying $7.8B in daily volumes.

Bybit has seen extra traffic in the past few months, tapping the meme token trends and, more lately, some of the hottest AI agent tokens. BTC and ETH trading still make up 57% of all Bybit activity, yet the exchange’s advantage lies in quickly listing the newest trending assets.

With just days before the restrictions take effect, the market’s effect remains uncertain. While important for some tokens, Bybit is still a relatively niche exchange. There are also no signs of other market operators limiting their services to India.

One of the key features of Bybit is its no-KYC trading tier, allowing a non-trivial level of trading activity with minimal user verification. However, even with minimal restrictions, users are still at the mercy of regulators when holding funds on centralized exchanges.

While Bybit may reopen soon, the crackdown against non-KYC exchanges was one of the trends in the past year. Bybit fits the profile of an easily accessible exchange and is also popular in the Russian Federation, Kyrgyzstan, and Ukraine. Unlike smaller and even riskier markets, Bybit at least boasts a reputation and sufficient liquidity.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap