Key PEPE Holders Avoid Selling Despite Major Price Drop

Pepe (PEPE) has faced significant price action recently, with the meme coin experiencing a 12% drop in just 24 hours. This decline interrupted a promising uptrend that appeared to be recovering losses from mid-December.

The bearish momentum stemmed from broader market cues, causing PEPE to lose critical support. Despite this setback, PEPE investors’ optimism may limit the coin’s downside potential.

PEPE Investors Are Maturing

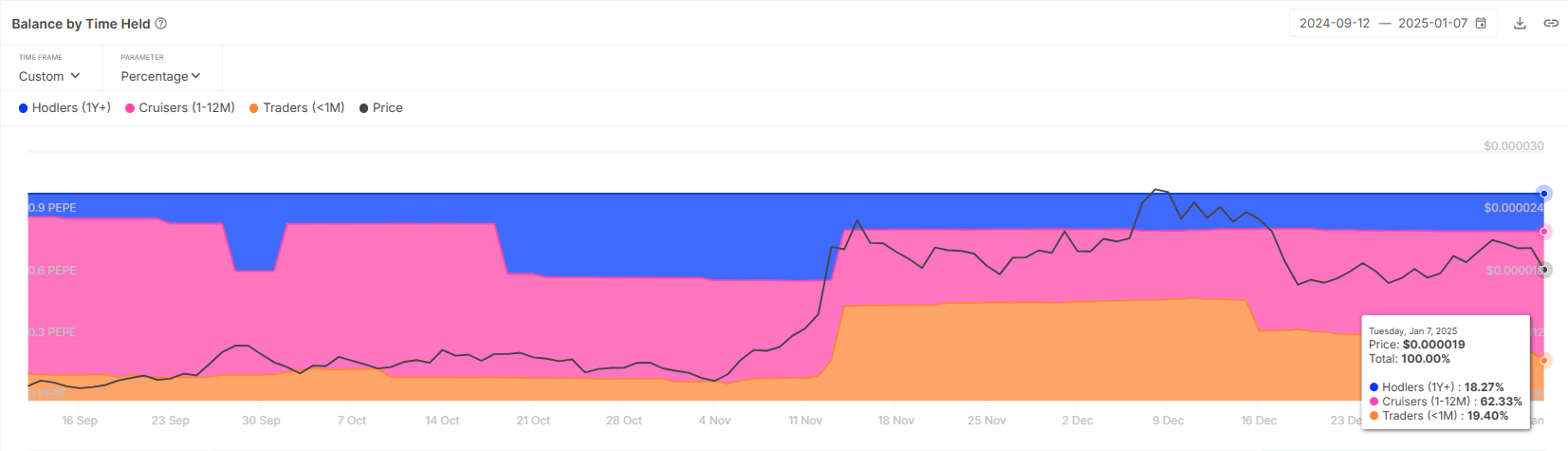

Short-term holders (STH) of PEPE have shown notable resilience by transitioning into mid-term holders (MTH) instead of selling during the downturn. Over the last two weeks, the concentration of STH fell from 48% to 19%, a substantial 27% decrease. This shift demonstrates that many investors are optimistic about the meme coin’s long-term prospects, choosing to hold rather than exit their positions.

This maturation among PEPE holders suggests growing confidence in the token’s recovery potential. Such sentiment is crucial in maintaining price stability, as it mitigates panic selling during bearish phases. It also indicates that a strong base of committed investors supports cryptocurrency.

PEPE Supply Distribution. Source: IntoTheBlock

PEPE Supply Distribution. Source: IntoTheBlock

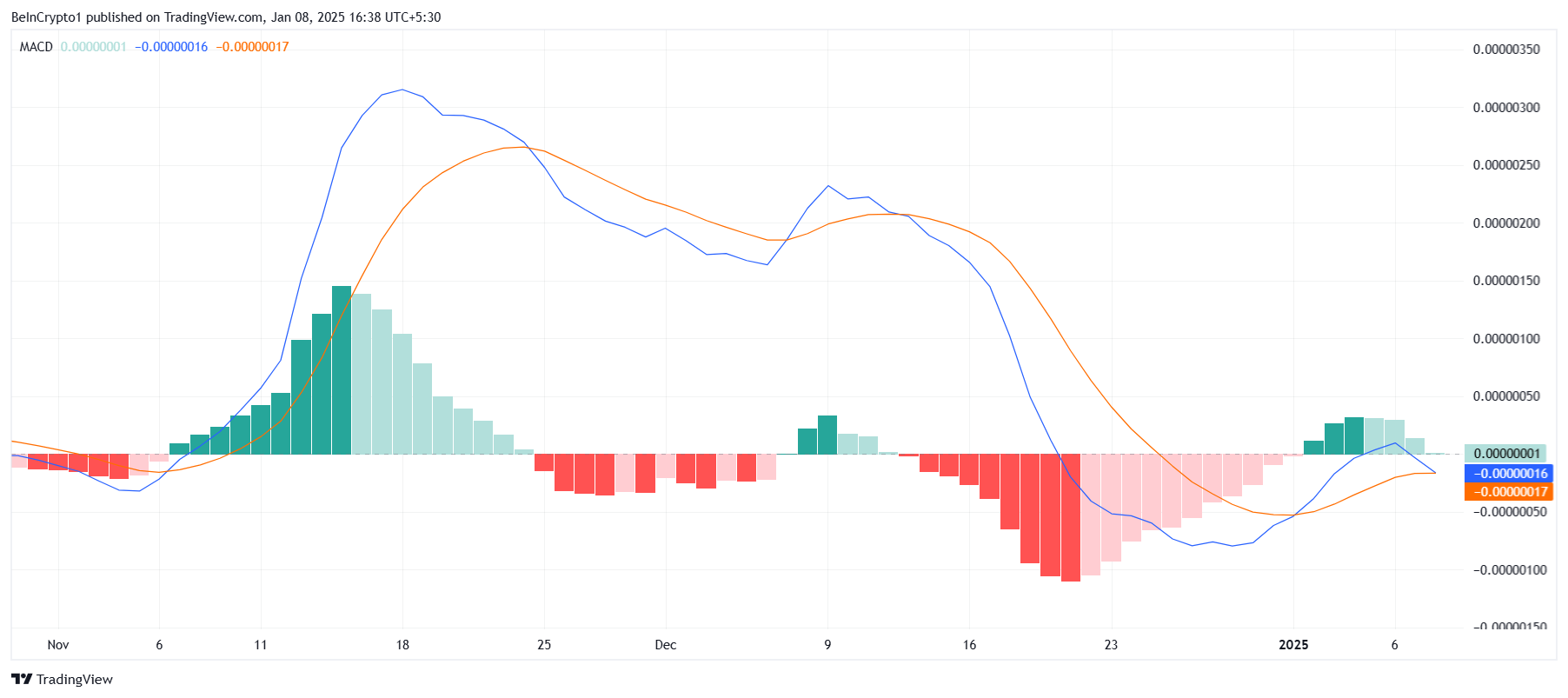

However, the macro momentum of PEPE has taken a bearish turn, as highlighted by key technical indicators. The Moving Average Convergence Divergence (MACD) is close to observing a bearish crossover, signaling the end of recent bullish momentum. This development follows a brief bullish crossover that occurred earlier, further emphasizing the current downward pressure.

This shift in momentum aligns with broader market conditions, which appear to be weighing heavily on meme coins like PEPE. If these bearish cues persist, they could suppress PEPE’s price further, challenging its ability to stage a recovery in the near term.

PEPE MACD. Source: TradingView

PEPE MACD. Source: TradingView

PEPE Price Prediction: Securing Support

PEPE is currently trading at $0.00001823 after falling by 12% over the past day. This decline occurred after the coin lost its support level of $0.00002062, highlighting the impact of the bearish market environment.

If bearish cues continue, PEPE may fall further to test lower support levels at $0.00001785 and $0.00001696. Such a scenario could extend the losses and delay any potential recovery efforts. However, a shift in broader market sentiment to bullish conditions could provide the momentum needed for a bounce-back.

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

In the event of recovery, PEPE reclaiming $0.00002062 as a support level would be pivotal. This move would invalidate the bearish outlook and help the meme coin recover the 12% loss sustained in the past 24 hours. Such a rebound would reaffirm investor confidence and set the stage for further upward momentum.