Less Than 1% Of Bitcoin Investors In Loss After BTC Reclaims $100,000

On-chain data shows less than 1% of all Bitcoin holders are still in loss following the surge in the asset’s price above the $100,000 level.

Very Few Bitcoin Addresses Are Sitting Underwater At Current Price

In a new post on X, the market intelligence platform IntoTheBlock has discussed about the profit-loss distribution of the Bitcoin userbase after the recovery run that the cryptocurrency has seen.

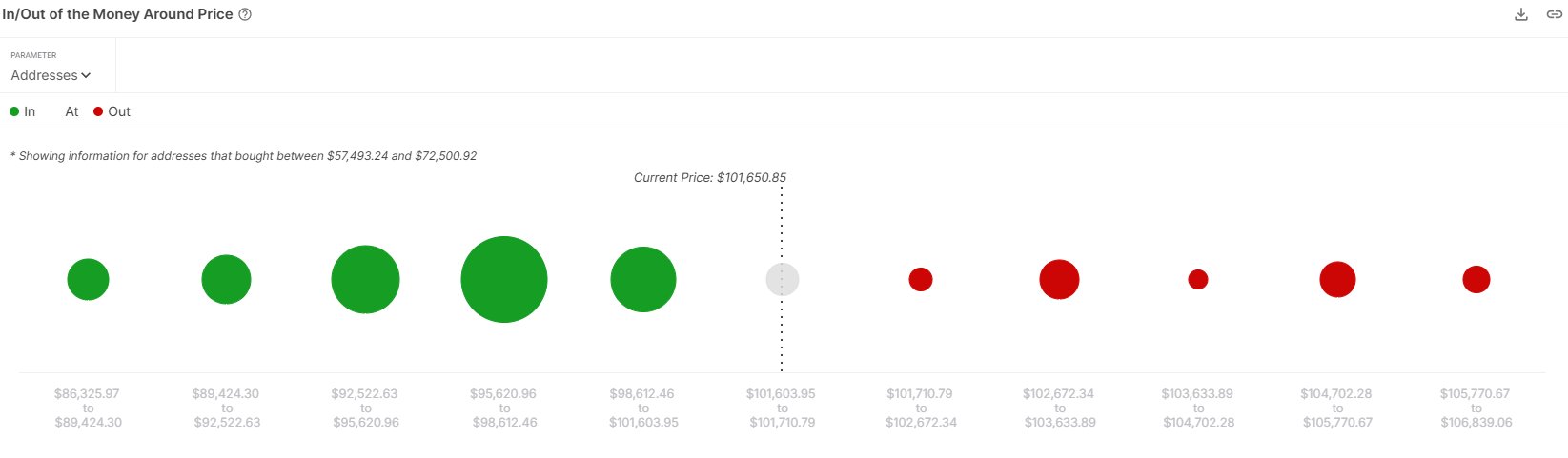

BTC is now not too far from its all-time high, so there wouldn’t naturally be many investors left in loss. Below is the chart shared by the analytics firm that shows the price ranges inside which these few addresses still underwater bought their coins.

In the graph, the size of the dot corresponds to the amount of BTC that the holders last purchased inside the corresponding price range. Evidently, there are only very small dots associated with the levels ahead of the current spot price.

In total, these ranges contain the cost basis of approximately 380,000 addresses. This may sound like a lot, but given the sheer size of the BTC userbase, this number makes up for less than 1% of all holders of the asset.

Address cost basis levels are considered important in on-chain analysis due to the fact that investors are more prone to making moves whenever their profit-loss status is about to flip.

Holders who were in loss prior to the retest (that is, when the retest takes place from below) might respond by selling, as they could fear the price would go down again in the future, making this potentially their only opportunity in the near term to get their money back.

This selling can visibly affect Bitcoin if the level being retested contains the acquisition level of a large amount of investors. At present, though, the ranges ahead of the asset are clearly quite thin with addresses, meaning they should likely offer little in the way of resistance from such panic sellers.

This doesn’t necessarily mean crossing these levels would be a walk in the park for the coin, however, as when the profit-loss balance in the market shifts overwhelmingly towards profits, something else starts posing a significant risk: selling with the motive of profit-taking.

The more lopsided the market gets, the higher is the probability of a mass selloff happening. With almost all Bitcoin investors sitting in gains right now, some of them are bound to exit their positions. It only remains to be seen whether demand would be strong enough to offset this selling pressure or not.

BTC Price

At the time of writing, Bitcoin is trading around $97,900, up 3% over the past week.