VIRTUAL Price Cools Down Following 133% Surge: What’s Next

Virtuals Protocol (VIRTUAL) price has skyrocketed by 133% over the past 30 days, fueled by the growing narrative around crypto AI agents. Despite its impressive monthly gains, VIRTUAL has seen a 6% dip in the last 24 hours, reflecting a potential pause in its upward momentum.

Currently maintaining a market cap of $4 billion, VIRTUAL has slipped to become the third-largest AI coin in the market, behind RENDER and TAO. With its ADX at 13.3, signaling weak trend strength, and its BBTrend turning negative at -1.51, VIRTUAL appears to be entering a consolidation phase, leaving the market to speculate on its next big move.

VIRTUAL Lacks Clear Direction

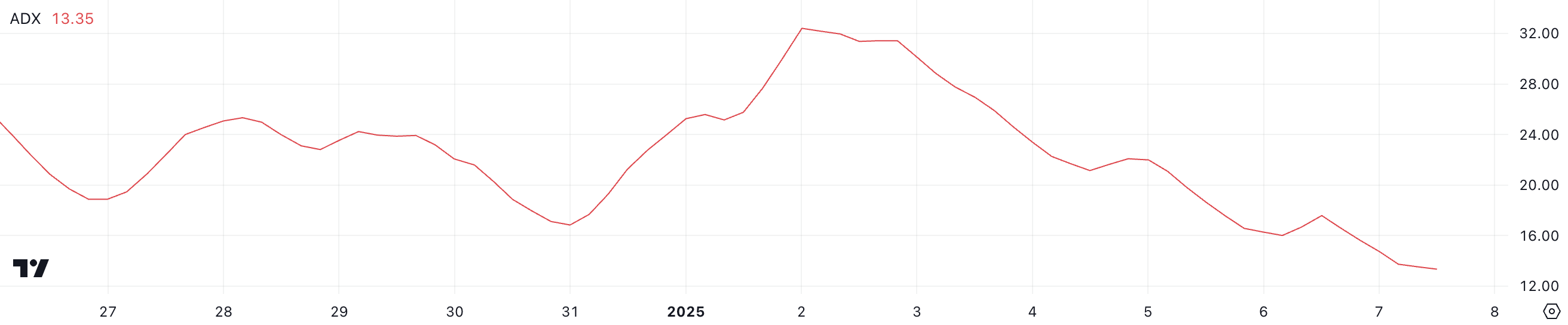

VIRTUAL Average Directional Index (ADX) has declined steadily to its current level of 13.3, down from 32.4 on January 2. ADX is a key technical indicator used to measure the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggest weak or absent momentum.

VIRTUAL’s ADX below 20 confirms that its previous trend has lost strength, signaling a potential transition into a consolidation phase.

VIRTUAL ADX. Source: TradingView

VIRTUAL ADX. Source: TradingView

At 13.3, the ADX reflects minimal trend momentum, aligning with the price behavior, suggesting reduced volatility and directional movement.

This low ADX level implies that Virtuals Protocol price is likely to remain range-bound in the short term unless a significant shift in buying or selling pressure occurs. Traders may interpret this as a period of indecision in the market, where the coin’s next direction will depend on whether momentum reasserts itself on the bullish or bearish side.

VIRTUAL BBTrend Turned Negative After 5 Days

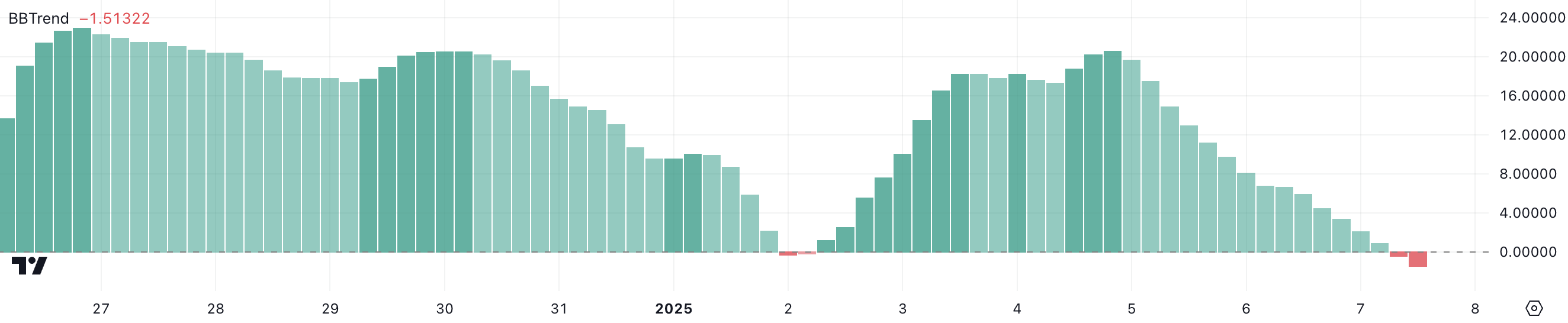

VIRTUAL BBTrend has turned negative, currently sitting at -1.51, after remaining positive between January 2 and early January 7. BBTrend is a technical indicator derived from Bollinger Bands, used to assess the strength and direction of price movements.

Positive values indicate bullish momentum, while negative values suggest bearish conditions. Virtuals Protocol recent transition to negative BBTrend levels reflects a shift in sentiment, signaling potential downward pressure.

VIRTUAL BBTrend. Source: TradingView

VIRTUAL BBTrend. Source: TradingView

This shift comes after VIRTUAL’s BBTrend peaked at 20.5 on January 4, marking a high point of bullish momentum, as the trend around crypto AI agents has been on the rise in the last few weeks. The current negative value suggests that selling pressure has overtaken buying activity, aligning with signs of a potential price decline or further consolidation.

For VIRTUAL to regain its upward momentum, the BBTrend would need to recover into positive territory, indicating renewed investor confidence and increased buying activity. Until then, the market may remain cautious, with a focus on maintaining key support levels.

VIRTUAL Price Prediction: Can AI Coin Go Below $3?

VIRTUAL price has been consistently reaching new all-time highs over the past few weeks. Despite being down 6% in the last 24 hours, it maintains a market cap of approximately $4 billion. However, with the price showing signs of cooling off, the possibility of a downtrend cannot be ignored.

VIRTUAL Price Analysis. Source: TradingView

VIRTUAL Price Analysis. Source: TradingView

If a strong negative trend develops, VIRTUAL could test the support at $3.73. Losing this level might trigger further declines, with $3.27 and $2.81 as potential next targets, representing a significant 29% decrease. Conversely, the ongoing enthusiasm for artificial intelligence coins suggests that interest in VIRTUAL may remain strong.

Should a new uptrend emerge, VIRTUAL price could challenge the resistance at $4.59. A breakout could potentially push its price above $5, marking another milestone.