Ripple Price Prediction: $470M in dormant supply keeps XRP below $2.50

- XRP price dropped to as low as $2.30 on Tuesday, down 8% since rejecting the $2.50 resistance.

- Dormant supply in circulation rose from 8.3 million XRP on Saturday to 208 million XRP, worth $467M, as long-term investors took profits amid the positive start to 2025.

- Technically, XRP price appears positioned for a prolonged consolidation phase.

XRP price slid 8% towards $2.30 on Tuesday, as bulls failed to reclaim the $2.50 resistance level. On-chain data suggests rising selling pressure for XRP long-term investors ahead of Donald Trump’s inauguration.

XRP price stalls below $2.50 as BTC crossed $100K

XRP price has stagnated below the $2.50 mark as a major shake-up among United States (US) regulatory appointees further intensified bullish tailwinds within the crypto market this week.

On Tuesday, Bitcoin opened at $102,700 amid markets reacting positively to news of Federal Reserve (Fed) Vice Chair for Supervision Michael Barr’s resignation announcement.

However, while the likes of BTC, Cardano (ADA) and Filecoin (FIL) all hit new peaks in the last 24 hours, XRP price has struggled for momentum.

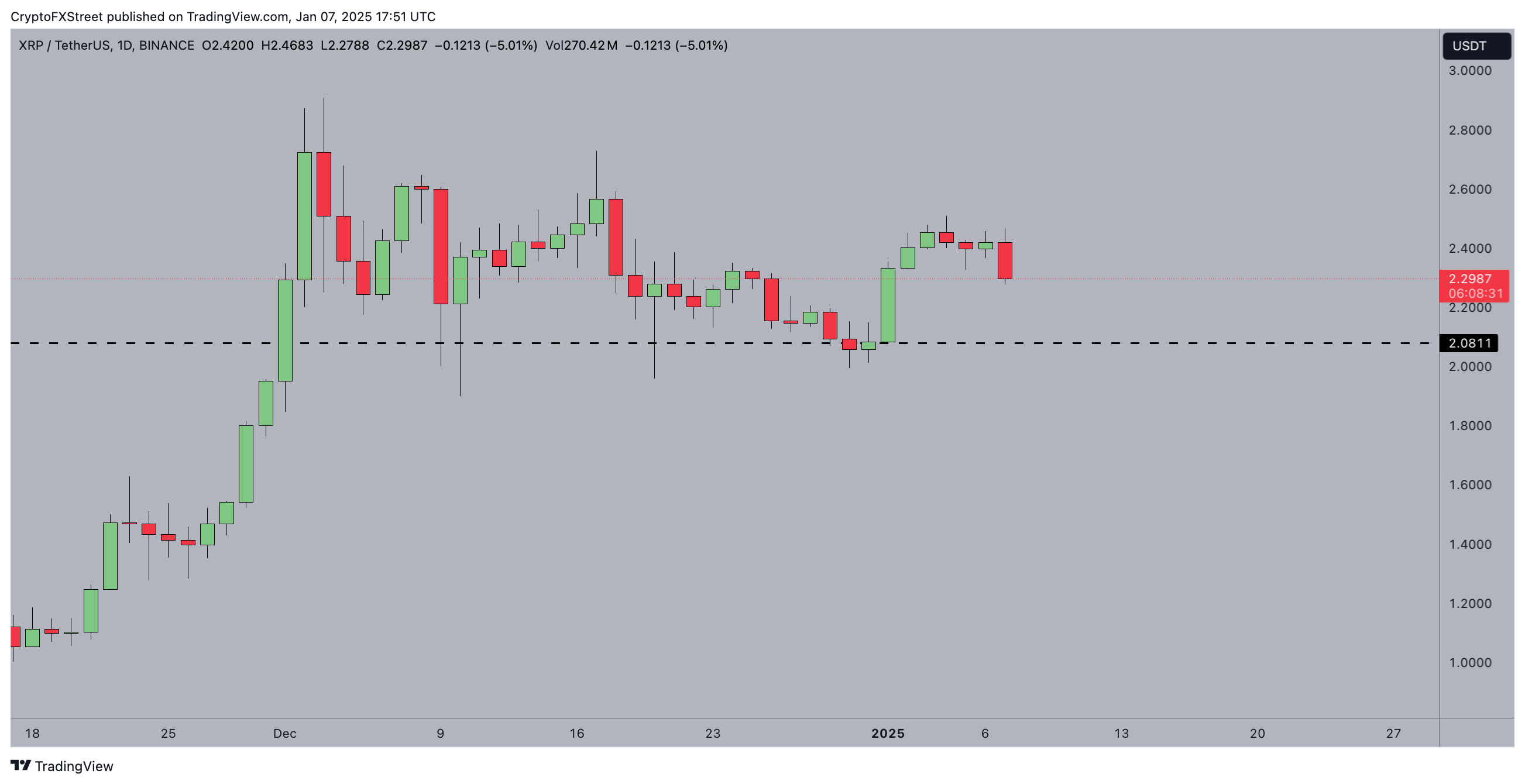

XRP/USDT daily chart

The TradingView chart above illustrates how XRP price has consolidated within the narrow channel between $2.30 - $2.50 since Saturday.

When a major mega-cap asset like XRP stagnates amid a market-wide demand surge as observed in the last three days, it often signals early profit-taking among existing investors.

Long-term holders spotted offloading XRP worth $470M

XRP price has underperformed considerably in the last three days.

Notably, Ripple CEO Brad Garlinghouse announced a 75% upturn in US hiring on Monday, a move geared towards capitalizing on gains from Trump’s proposed crypto-friendly policies.

While the news was well-received by the community, it has not moved the needle for long-term investors.

On-chain data shows that long-term investors have been on a selling spree since Saturday, dampening bullish price action.

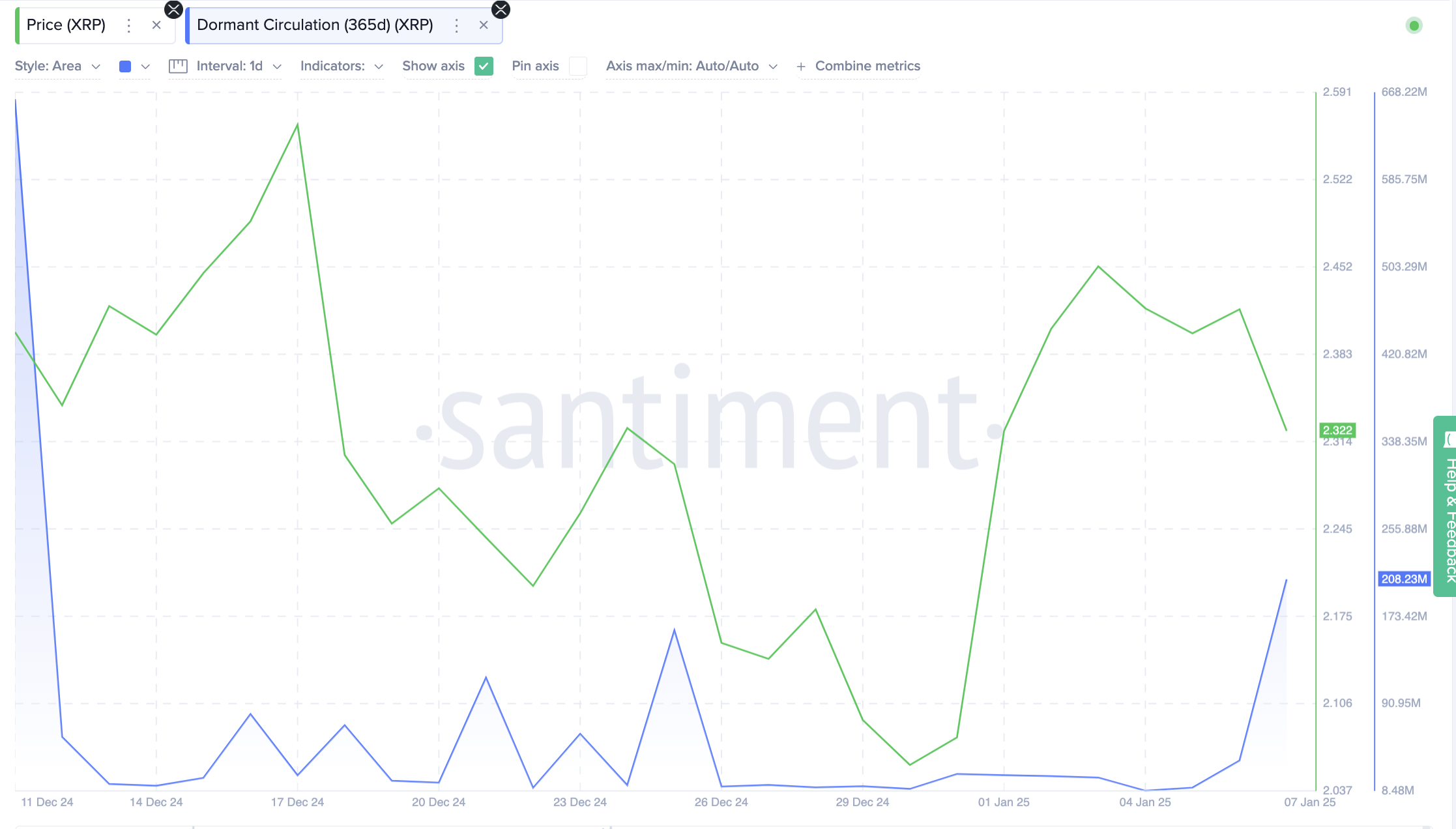

Affirming this stance, the Santiment Dormant Circulation Supply (356D) chart below tracks the number of XRP coins traded on a given day, that were previously held unmoved for one year or more. This provides real-time insights into the long-term investors' trading activity around key market events.

Ripple (XRP) Dormant Circulation Supply vs Price | Source: Santiment

As depicted above, XRP Dormant Circulation Supply rose from 8.3 million on Saturday 4 to 208.3 million XRP.

This implies that long-term investors offloaded over $467 million worth of XRP coins.

When such a large volume of long-held coins is on the move, it dilutes the market supply and puts downward pressure on prices.

Unsurprisingly, this spike in Dormant Circulation supply since Saturday has coincided with XRP's 3-day stagnation below the $2.50 mark.

If the long-term holders' profit-taking frenzy continues, XRP price faces major downward risks in the days ahead.

XRP Price Forecast: Bulls must hold $2.10 support

XRP price is consolidating near $2.33, with mixed signals suggesting indecision among market participants.

The Chande Kroll Stop indicator shows immediate support at $2.10, a critical level for maintaining bullish momentum.

If the price falls below this level, sellers could gain control, potentially triggering a decline toward $1.33, the next key support area.

XRP Price Forecast | XRPUSDT daily chart

The Choppiness Index (CHOP) reading at 53 suggests a moderately consolidating market, leaving room for a breakout or breakdown.

While bulls remain cautious, XRP must overcome resistance at $2.58, as marked by the orange line on the chart.

A rejection at this level could validate a bearish divergence, leading to further downside pressure.

A bullish breakout scenario hinges on XRP breaking the $2.58 resistance.

A close above this level could pave the way for a rally toward $3.00, fueled by renewed buying interest.

However, considering potential downside risks associated with prominent political events like Trump’s upcoming inauguration slated for January 20, the selling pressure from long-term investors could drive prices lower before the next breakout phase.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.