Ripple's XRP could rally to $4.70 following a spike in its open interest

- XRP open interest surged by 40% in the past 24 hours.

- Buying pressure across exchanges and investment products helped XRP to maintain a bullish outlook.

- XRP could be on the verge of a massive breakout after testing the resistance of a bullish pennant.

Ripple's XRP trades near $2.40, up 1% on Monday following a 40% surge in its futures open interest. The surge could help the remittance-based token overcome the key resistance of a bullish pennant pattern.

XRP on-chain activity indicates rising bullish momentum after open interest surge

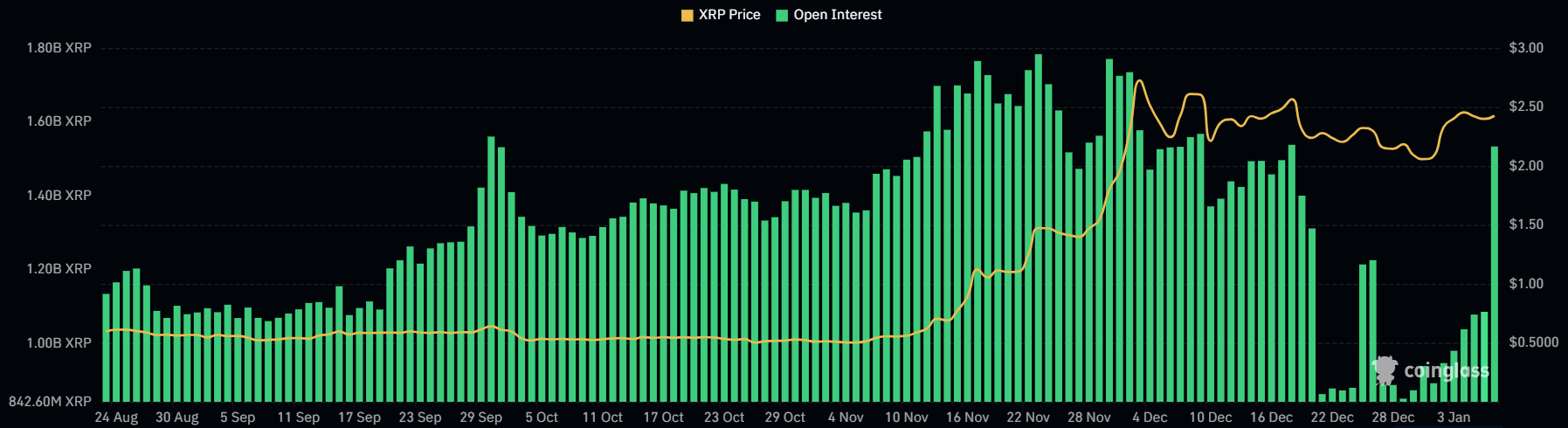

XRP futures open interest witnessed a spike on Monday, rising by over 40% from 1.09 billion XRP to 1.53 billion XRP. Open interest is the total number of unsettled contracts in a derivatives market.

XRP Open Interest. Source: Coinglass

The recent spike in open interest amid flat prices indicates the inflow of new liquidity to fuel XRP's bullish bias, especially with Donald Trump's upcoming inauguration on January 20. However, prices sometimes tend to move in the opposite direction when bullish expectations are very high.

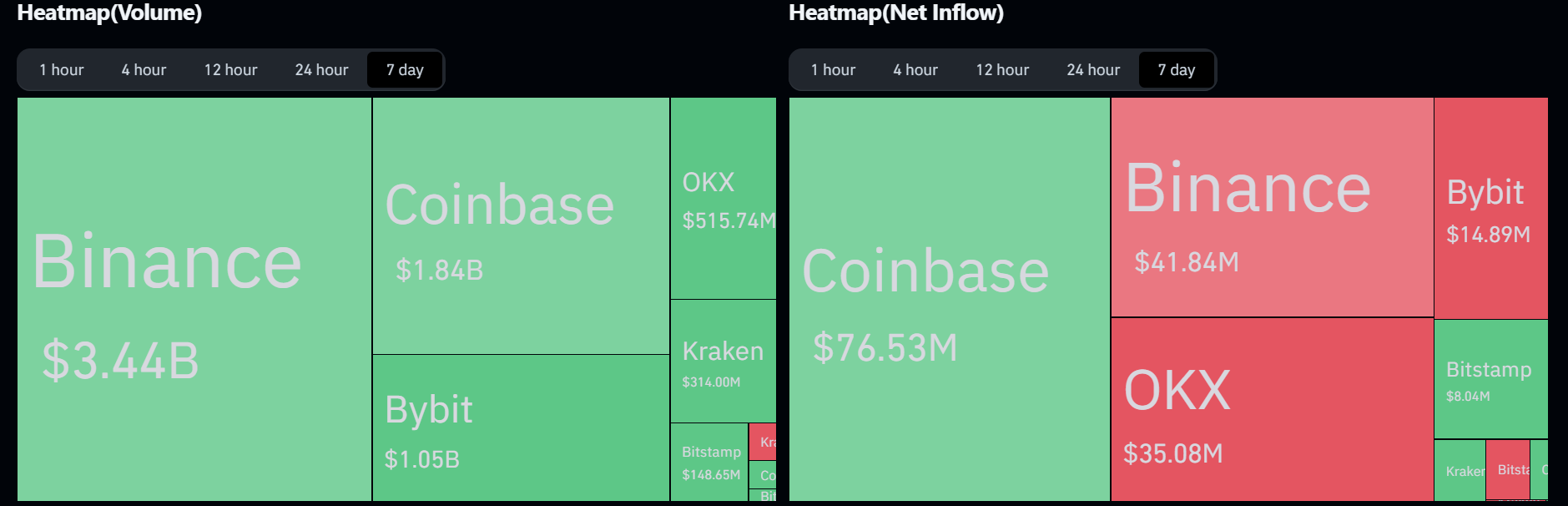

XRP exchange net flows also indicate a slight bullish bias in the past week, thanks to higher buying pressure from Binance, OKX and Bybit investors, which posted combined net outflows of $91.81 million. However, US-based investors were bearish, as indicated by the net inflow of $76.53 million into Coinbase.

XRP Exchange Flows. Source: Coinglass

Meanwhile, XRP investment products recorded positive flows last week, as it was the only major crypto asset without a negative flow. The products posted $5.7 million in net inflows, the highest across all digital assets investment products, per CoinShares data.

Inflows in crypto ETFs/investment products represent buying activity, and vice versa for outflows. However, in crypto exchange flows, inflows represent selling activity and vice versa for outflows.

XRP could post a massive rally with a break above bullish pennant resistance

XRP saw $3 million in futures liquidations in the past 24 hours, with long and short liquidated positions accounting for $1.72 million and $1.28 million, respectively, per Coinglass data.

XRP is on the verge of validating a bullish pennant after testing the pattern's upper boundary resistance for the second time in the past three days. If XRP posts a high volume move above this resistance, it could rally to a new all-time high near $4.78.

XRP/USDT daily chart

However, it could encounter key hurdles at its all-time high of $3.55 and near the resistance below the $3.00 psychological level.

If XRP continues seeing a rejection at the upper boundary of the pennant, it could find support at its lower boundary near the 50-day Simple Moving Average (SMA).

The Relative Strength Index (RSI) momentum indicator is above its neutral level, signaling dominant bullish momentum. Meanwhile, the Stochastic Oscillator (Stoch) is slightly in the overbought region, indicating XRP may see a moderate correction.

A daily candlestick close below $1.96 will invalidate the bullish thesis and send XRP toward $1.35.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.