Ripple's XRP looks set to rally in January 2025 as on-chain data indicates buy-side bias

- XRP long-term holders soaked up short-term holders' recent profit-taking as they resumed accumulation.

- Buyers across top exchanges have dominated sellers since the beginning of 2025.

- XRP could test the $2.9 resistance after breaking out of a key symmetrical triangle pattern.

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

XRP on-chain activity shows long-term holders and buying pressure dominance

Following a 12% jump in XRP's price on Wednesday, investors booked over $1 billion, the highest realized profits since December 16.

[18.20.20, 02 Jan, 2025]-638714375988938948.png)

XRP Network Realized Profit/Loss. Source: Santiment

The profit-taking was mainly from investors that have held XRP in the past 90 days, as indicated by a spike in the Dormant Circulation (90d) metric. However, long-term holders have adopted a somewhat opposite attitude, accumulating the sell-pressure from these short-term holders as reflected by an increase in the Mean Coin Age metric.

The Mean Coin Age metric measures the average amount of time all XRP tokens have stayed in their current address. As seen in the chart below, an increase indicates accumulation is dominant over distribution.

[18.20.57, 02 Jan, 2025]-638714376541617701.png)

XRP Dormant Circulation and Mean Coin Age. Source: Santiment

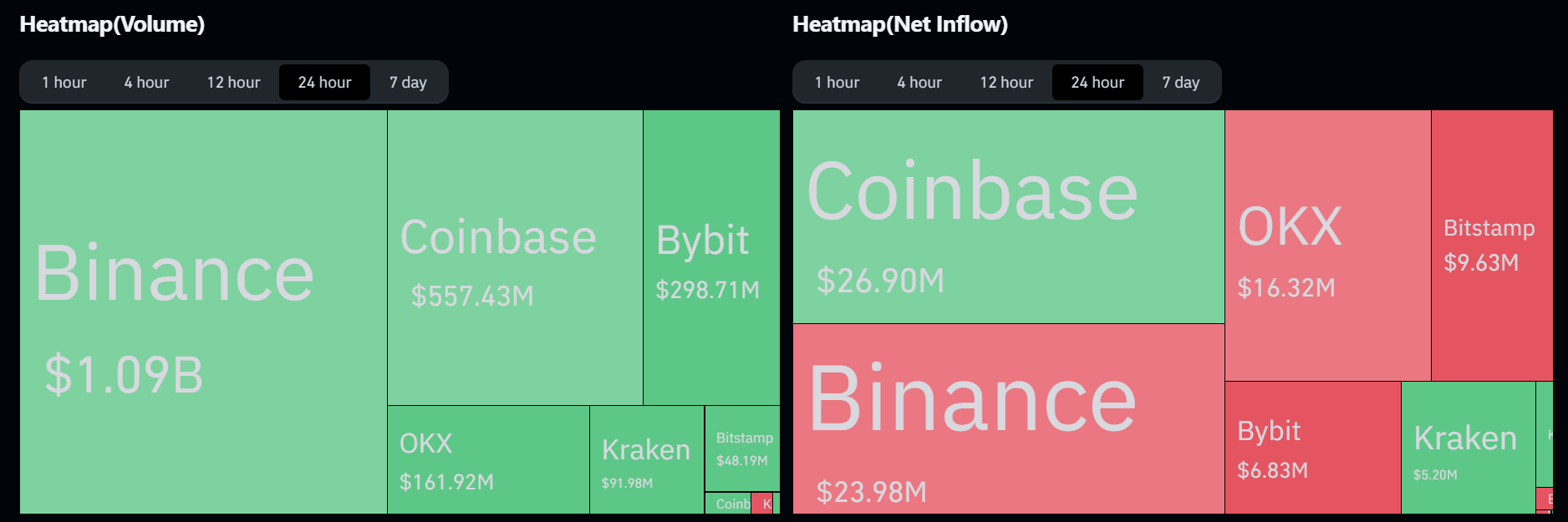

XRP's net flow and volume across top crypto exchanges in the past 24 hours show a similar trend, with Binance, OKX, Bitstamp and Bybit all showing net outflows. The only net inflow was recorded in Coinbase. Exchange net outflows indicate buying pressure is dominant and vice versa for net inflows.

XRP 24-hour Volume and Net Flow. Source: Coinglass

Meanwhile, with pro-crypto Paul Atkins potentially assuming the role of the United States Securities and Exchange Commission (SEC) Chair on January 20, it's unlikely the agency will pursue its appeal against Judge Analisa Torres's ruling in its case against Ripple. The SEC faces a January 15 deadline to file the opening brief for its appeal.

XRP eyes $2.9 resistance following move above key symmetrical triangle

XRP has sustained over $11.03 million in liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions reached $2.72 million, while short liquidations accounted for $8.31 million.

XRP broke above a symmetrical triangle pattern on Thursday, extending its New Year's Day rally. With the breakout, XRP could rally toward the resistance level at $2.9. The move could be strengthened if XRP sees a slight downturn and bounces off the triangle's upper boundary line.

XRP/USDT daily chart

The Relative Strength Index (RSI) is above its neutral level, indicating dominant bullish momentum. Meanwhile, the Stochastic Oscillator (Stoch) is in its oversold region, signaling a potential correction could be imminent.

A daily candlestick close below the triangle's lower boundary line and the 50-day Simple Moving Average (SMA) would invalidate the thesis and send XRP toward the $1.35 level.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.