Tether Increases its Bitcoin Reserves with a $700 Million BTC Transfer

Tether has transferred 7,629 BTC, valued at approximately $700 million, to its Bitcoin reserve address. The transaction originated from Bitfinex’s hot wallet on the morning of December 30.

This marks the largest addition to Tether’s strategic Bitcoin reserve since March 2024, when 8,888.88 BTC were moved.

Tether’s Bitcoin Reserves Continue to Grow

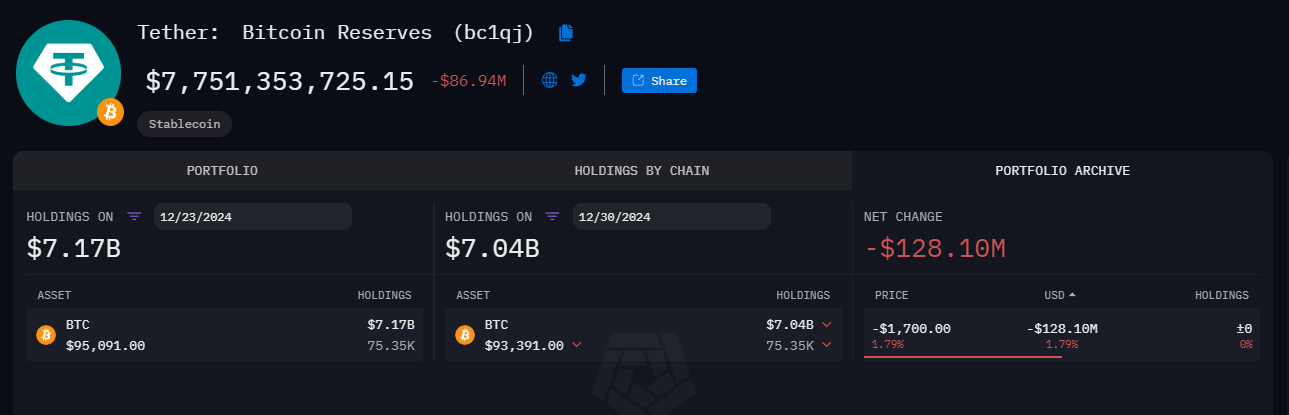

Another identical transfer occurred on December 31, 2023, based on on-chain data. According to Arkham data, Tether’s reserves now hold 82,983 BTC, acquired for $2.99 billion at an average cost of around $36,125 per coin.

The move aligns with Tether’s decision in 2023 to allocate up to 15% of its profits to Bitcoin. The company currently holds over $7.6 billion in BTC, and its Bitcoin purchases serve as part of a diversification strategy amid periods of increased USDT issuance.

Tether Bitcoin Reserves. Source: Arkham

Tether Bitcoin Reserves. Source: Arkham

Tether’s flagship stablecoin, USDT, remains primarily backed by US Treasury bonds and cash-equivalent assets. Yield generated from these holdings has fueled investments in emerging sectors, including AI, Bitcoin mining, and decentralized communications.

In 2024, the company also expanded into renewable energy and telecommunications, reflecting its broad investment focus.

A Strong Financial Year Amid Regulatory Hurdles

Tether has seen significant financial success in 2024, supported by a strong crypto market. The company’s total assets reached $134.4 billion in Q3, with $120 billion in circulating USDT.

Also, on December 6, Tether minted an additional 2 billion USDT, contributing to a total of 19 billion minted since November. This reflected the growing demand for USDT throughout the bull market.

However, Tether is facing challenges in the European Union as MiCA regulations take effect. EU exchanges have delisted USDT in recent weeks in preparing for the regulation.

“Remember, Tether holds $102 billion in US Treasuries – by not recognizing this collatoral the EU has sent a strong signal of lack of trust in US debt. The EU have explicitely demanded stablecoin issuers back EU regulated stablecoins with 60% fiat in EU banks. IMO: There are political motivs behind this charade. It ends badly for the EU,” influencer Martin Folb wrote on X (formerly Twitter).

Also, the company has ceased issuing its euro-backed EURT stablecoin, offering holders a year to redeem their assets. Increased competition has further tested Tether’s dominance.

Most recently, Ripple launched its RLUSD stablecoin in global markets, while USDC issuer Circle announced several partnerships aimed at leveraging Tether’s regulatory hurdles.

Despite these challenges, Tether remains focused on strengthening its reserves and exploring new sectors, maintaining its position as a key player in the stablecoin market.