5 Token Unlocks to Watch Next Week

Token unlocks release tokens previously restricted by fundraising agreements. Projects time these events strategically to manage market pressure and stabilize prices.

Here are five major token unlocks set for next week.

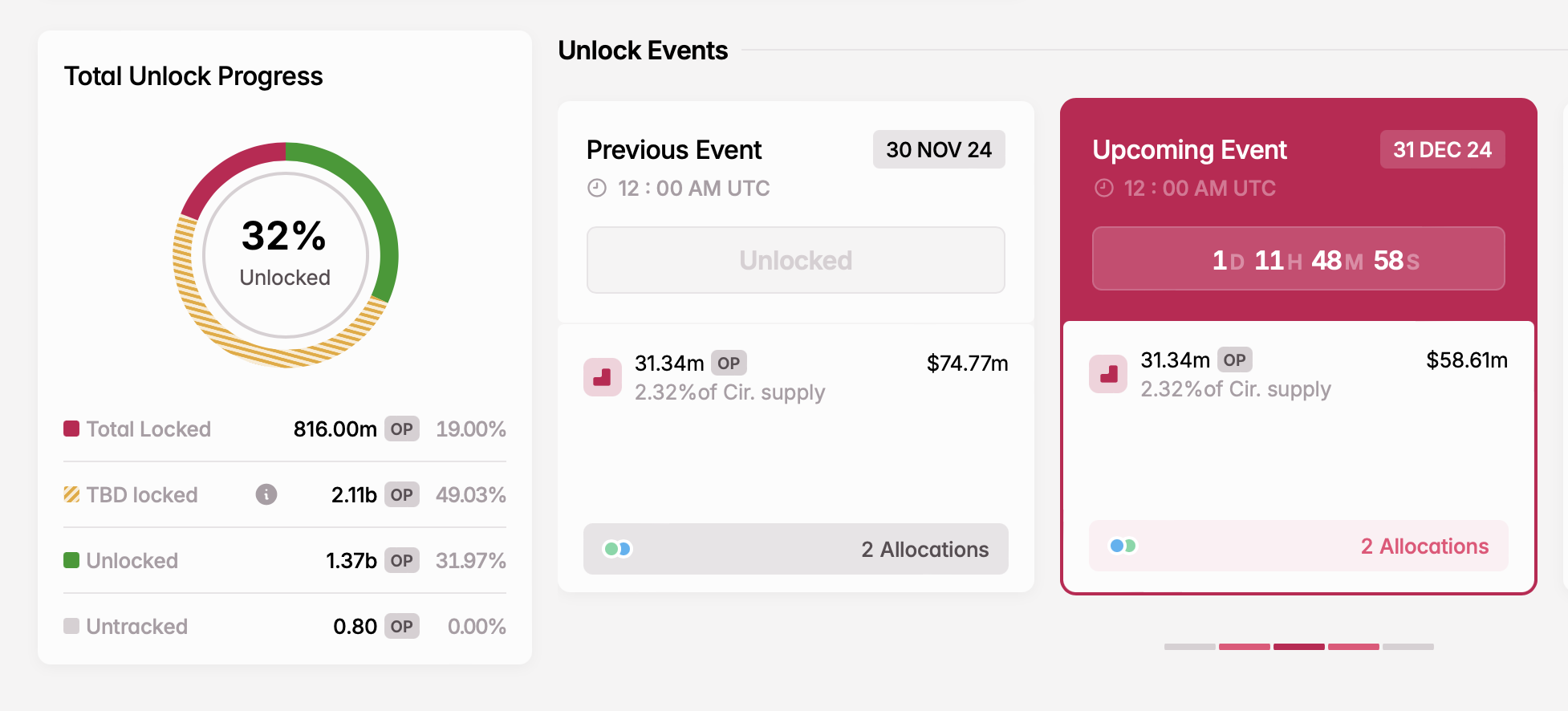

Optimism (OP)

- Unlock date: December 31

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.35 billion OP

Optimism, a Layer-2 scaling solution, improves transaction speed and lowers costs on the Ethereum mainnet. The OP token plays a key role in governance, allowing holders to vote on proposals and shape the network’s development.

On December 31, Optimism will unlock 31.34 million OP tokens. According to Tokenomist (formerly TokenUnlocks), these tokens will be distributed to core contributors and investors.

OP Unlock. Source: Tokenomist

OP Unlock. Source: Tokenomist

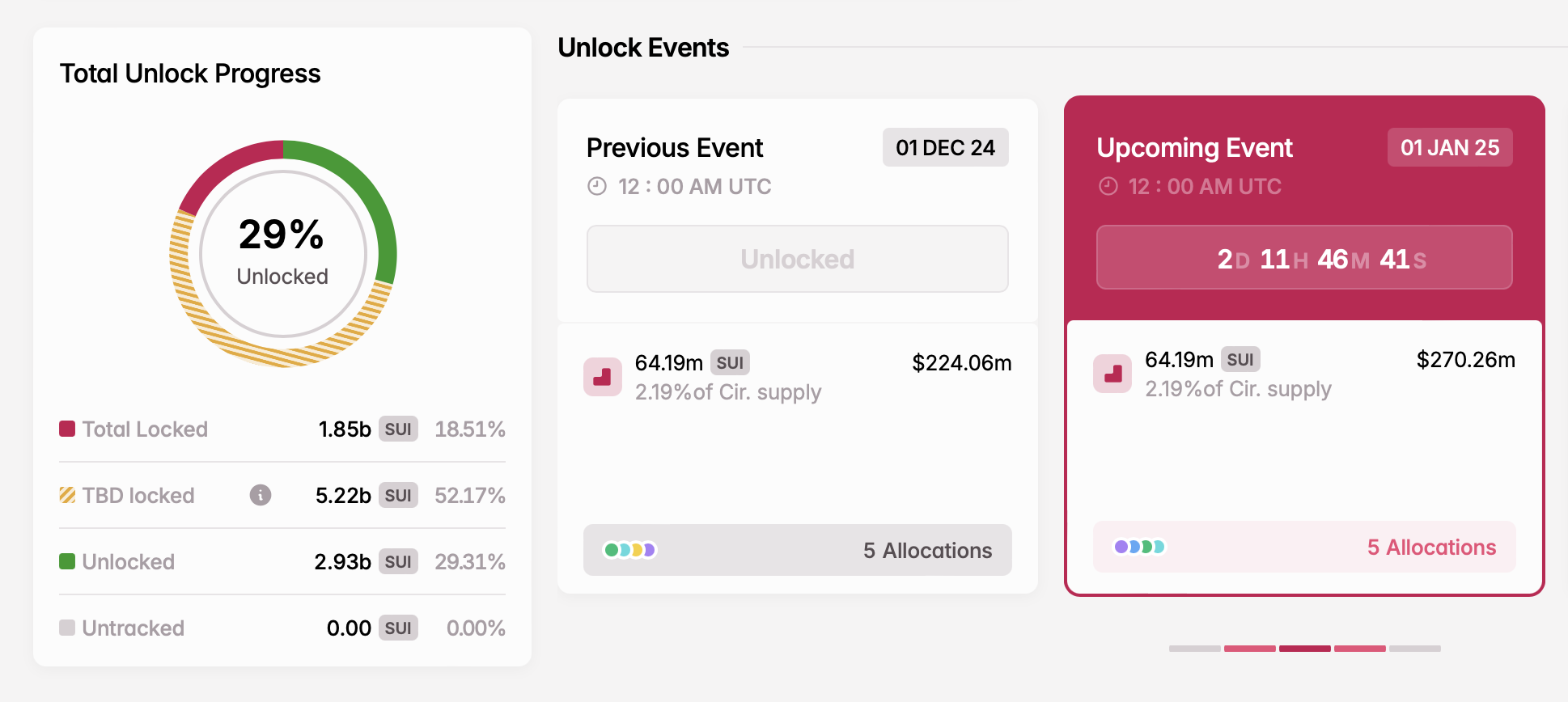

Sui (SUI)

- Unlock date: January 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 2.92 billion SUI

Sui is a high-performance Layer-1 blockchain built to optimize network operations and security through a Proof-of-Stake consensus mechanism. Launched in 2021 by Mysten Labs, the project was founded by former Novi Research employees who contributed to the development of the Diem blockchain and the Move programming language.

The SUI token enables governance, allowing holders to vote on proposals and shape the platform’s future. On January 1, a major token unlock will release tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

SUI Unlock. Source: Tokenomist

SUI Unlock. Source: Tokenomist

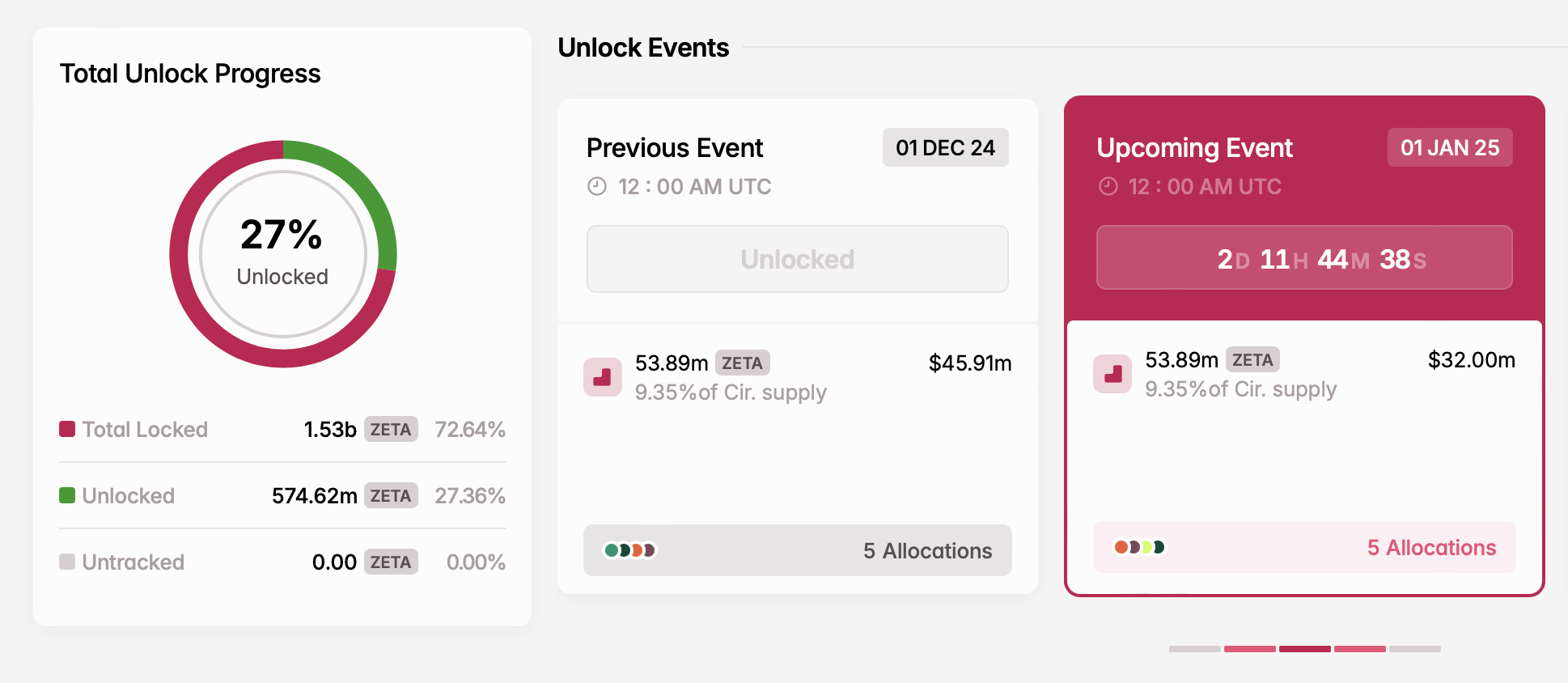

ZetaChain (ZETA)

- Unlock date: January 1

- Number of tokens unlocked: 53.89 million ZETA

- Current circulating supply: 576.11 million ZETA

ZetaChain is a decentralized blockchain platform that facilitates seamless interoperability across different blockchain networks. Its key feature allows cross-chain communication, enabling the transfer of tokens and data between blockchains like Ethereum and Binance Smart Chain.

On January 1, ZetaChain will unlock nearly 54 million ZETA tokens. These tokens will fund initiatives such as a user growth pool, an ecosystem growth fund, core contributor rewards, advisory roles, and liquidity incentives.

ZETA Unlock. Source: Tokenomist

ZETA Unlock. Source: Tokenomist

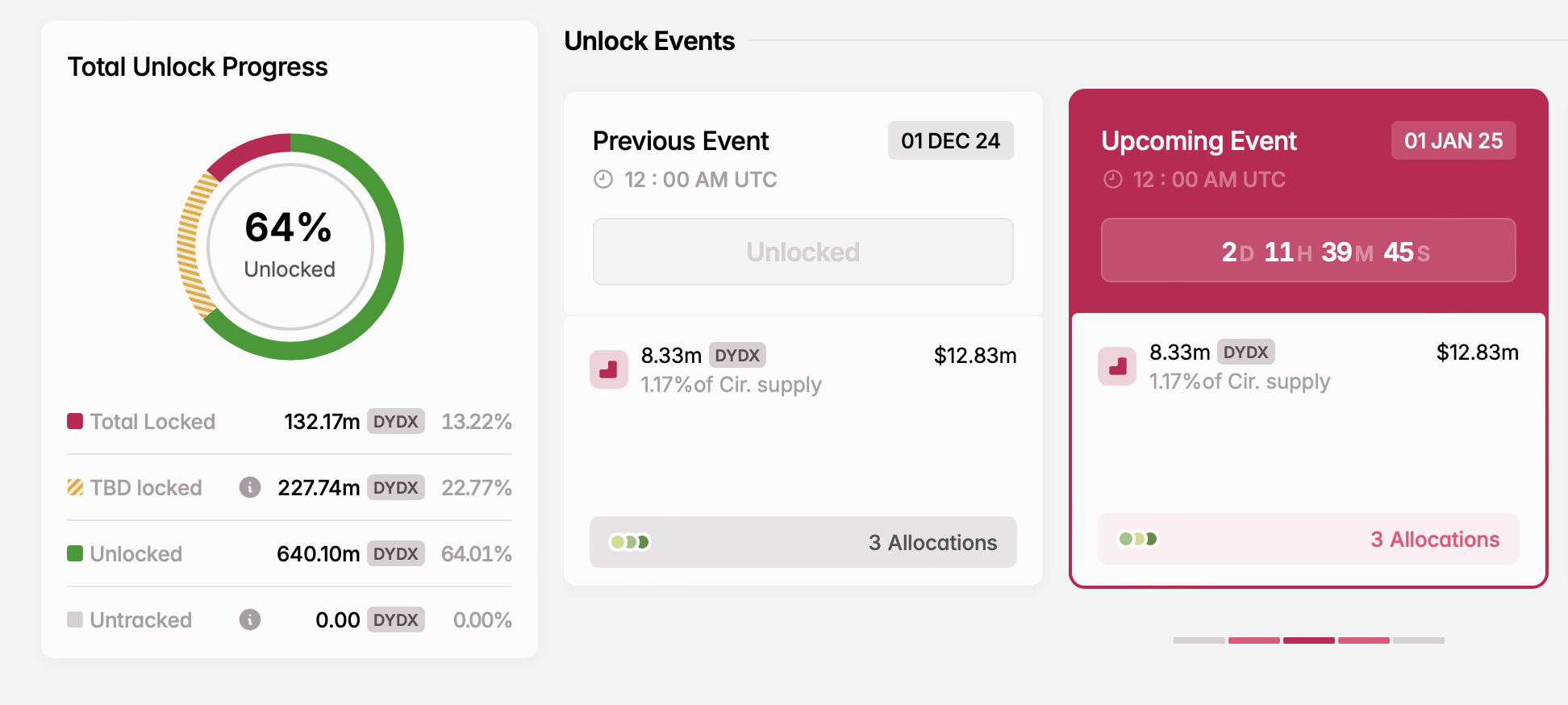

dYdX (DYDX)

- Unlock date: January 1

- Number of tokens unlocked: 8.33 million DYDX

- Current circulating supply: 712.3 million DYDX

In early 2023, dYdX, the largest decentralized perpetual futures trading protocol, announced changes to its initial tokenomics. According to the update, 27.7% of dYdX’s total supply will go to early investors, 26.1% to the treasury, 15.3% to the team, and 7.0% to future dYdX employees and consultants.

Most DYDX unlocked on January 1 will be distributed among founders and investors, with the remaining tokens reserved for current and future employees.

DYDX Unlock. Source: Tokenomist

DYDX Unlock. Source: Tokenomist

Ethena (ENA)

- Unlock date: January 1

- Number of tokens unlocked: 12.86 million ENA

- Current circulating supply: 2.93 billion ENA

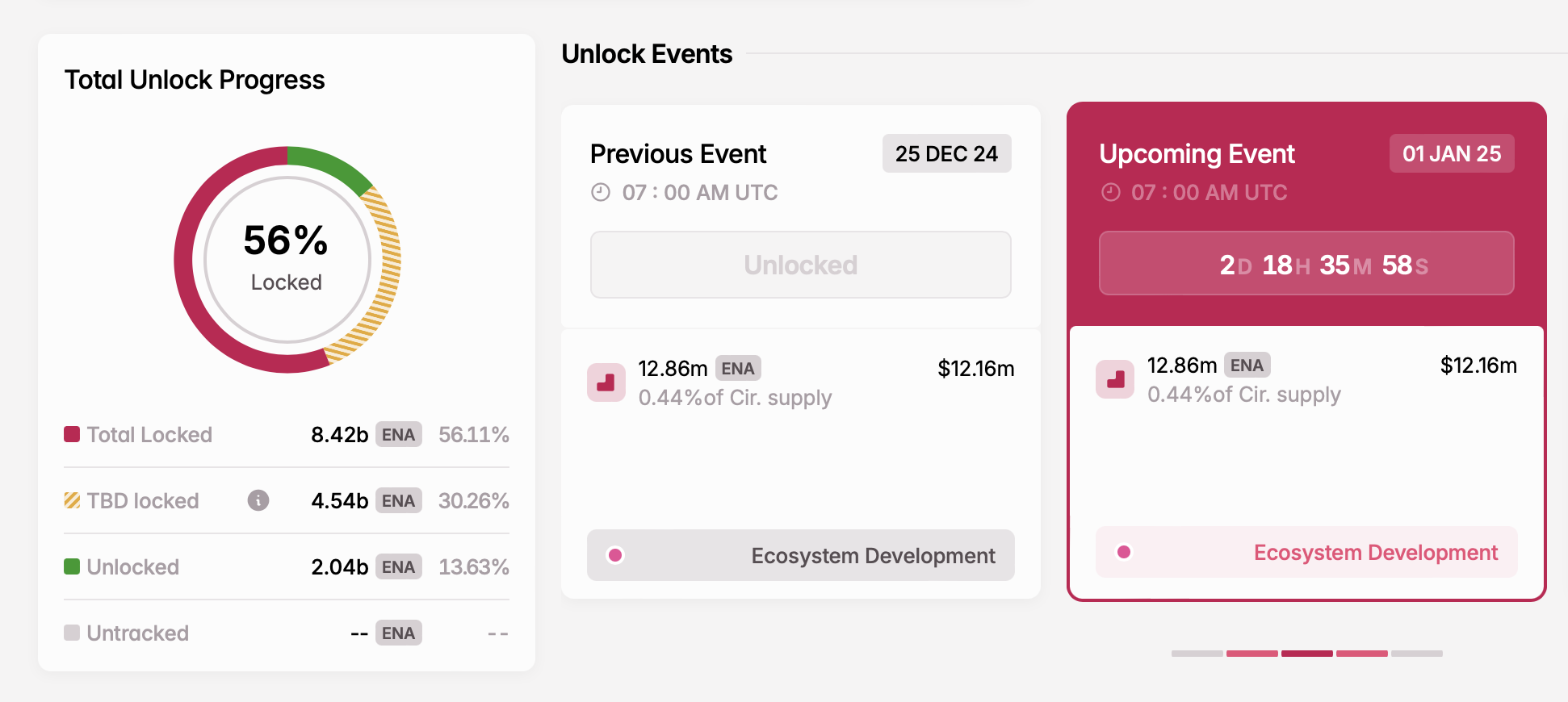

Ethena, a synthetic currency protocol on Ethereum, provides a banking-independent solution and offers global users a dollar-denominated savings tool known as the “Internet Bond.”

The protocol’s native token, ENA, allows holders to engage in governance decisions. On January 1, Ethena will unlock over 12 million ENA tokens, valued at $12.16 million, allocated toward ecosystem development.

ENA Unlock. Source: Tokenomist

ENA Unlock. Source: Tokenomist

Next week’s cliff token unlocks will also include Celo (CELO), Eigen Layer (EIGEN), Manta (MANTA), and Moca Network (MOCA), among others, with a total combined value exceeding $440 million.