Chainlink Price Could Crash 30% To $15 — Here’s How

The Chainlink price has been under intense bearish pressure over the past week, mirroring the current state of the general market. The altcoin’s value continues to slide deeper after briefly touching the $30 mark in mid-December.

A prominent analyst on the social media platform X has come forward with an even more bearish forecast for the future of Chainlink. Below is how the cryptocurrency could slump as low as $15 in the near future.

This Chart Pattern Suggests Chainlink Price Could Drop 30%

In a new video on the X platform, crypto analyst Ali Martinez put forward an interesting bearish prediction for the price of Chainlink. According to the crypto pundit, the LINK price appears to be set up for at least a 30% correction.

The rationale behind this prediction is the formation of a head and shoulders pattern on the 4-hour chart of the Chainlink price. A head and shoulders pattern is a chart formation used in technical analysis characterized by three price peaks, where the outside two (shoulders) are similar in height, and the middle (head) is highest.

The head and shoulders pattern is considered one of the most reliable trend reversal patterns, which predicts the shift from a bullish trend to a bearish situation. However, a price close beneath the support line (neckline) connecting the two swing lows is needed to confirm the trend reversal.

According to Martinez, this support line lies around $21.30, and a 4-hour candlestick needs to close beneath this level in order to confirm the bearish theory. Also, the Chainlink price might also need to close beneath the $20 support level in order to fall all the way to $15.

As of this writing, the price of Chainlink stands at around $21.30, reflecting an over 7% decline in the past 24 hours. According to CoinGecko data, the altcoin’s value is down by nearly 10% over the last seven days.

LINK Investors Continue To Fill Their Bags

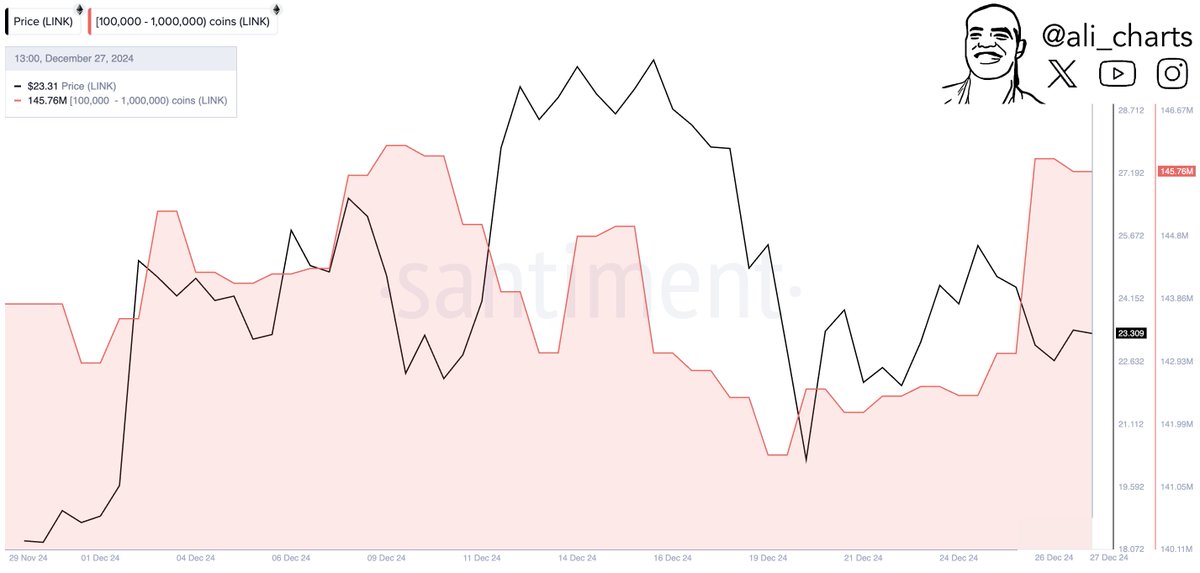

The recent price action of Chainlink has been quite discouraging, but investors appear to be doubling down on their positions. The latest on-chain data suggests that the Chainlink whales are buying the dip.

According to data from Santiment, whales acquired more than 2.7 million LINK tokens (equivalent approximately to $57 million) in the past two days. If it persists, this level of buying activity from whales could positively impact the Chainlink price.