Is Bitcoin Bull Run Over? What This Legendary Metric Says

Here’s what the historical trend of the Bitcoin Market Value to Realized Value (MVRV) Ratio suggests regarding whether the current bull run is over or not.

Bitcoin MVRV Ratio Could Hint At Where BTC Is In Current Cycle

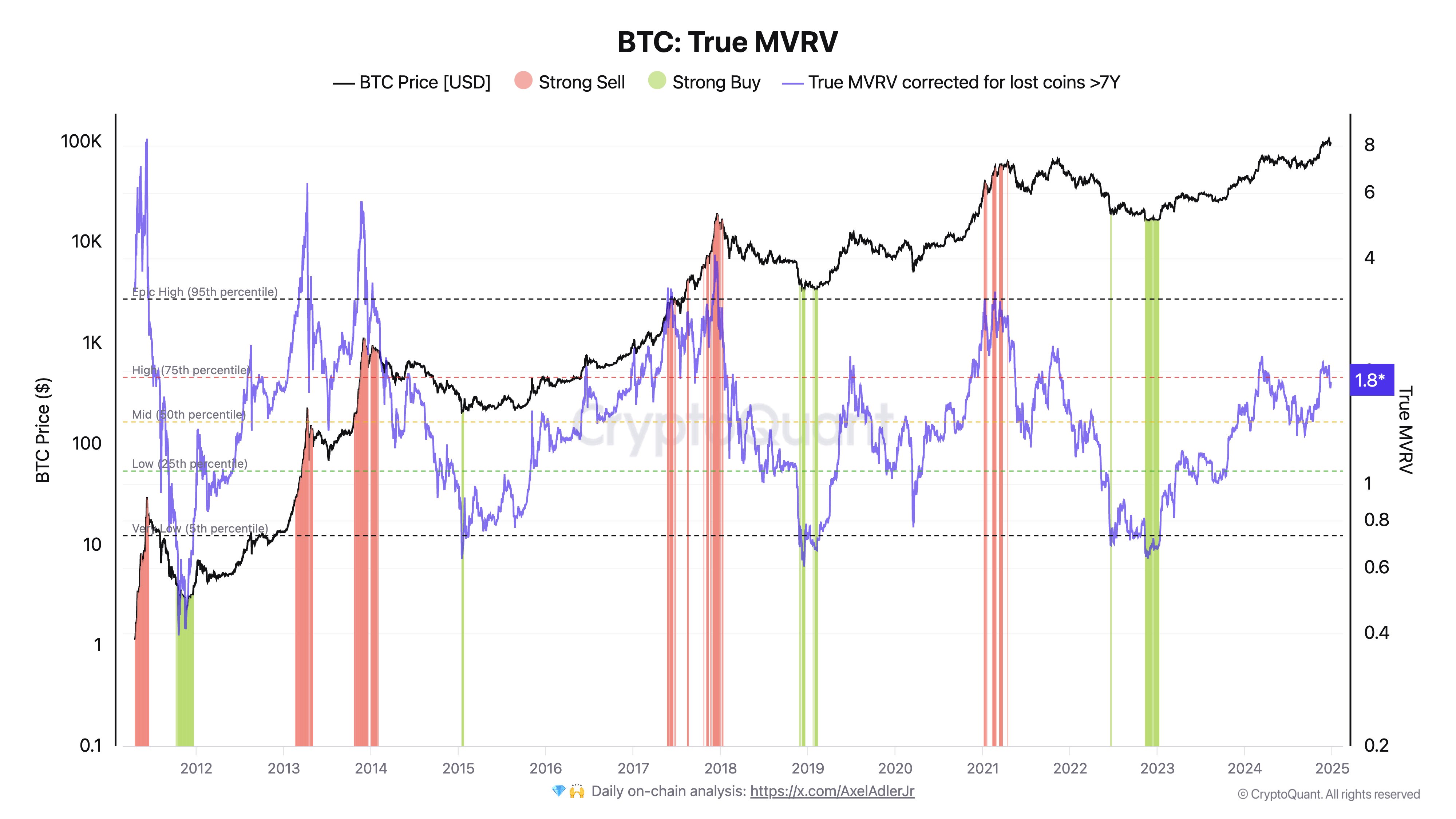

In a new post on X, CryptoQuant founder and CEO Ki Young Ju shared a chart showcasing the past pattern in the Bitcoin MVRV Ratio. The MVRV Ratio refers to a popular on-chain metric that, in short, keeps track of how the value held by the BTC investors (that is, the market cap) compares against the value that they initially put into the asset (the realized cap).

When the value of the ratio is greater than 1, it means the investors as a whole can be assumed to be in a state of profit. On the other hand, it is under the mark, implying the dominance of loss in the market.

The version of the MVRV Ratio posted by Young Ju isn’t the ordinary one, but rather a modified form called the “True MVRV.” This variation takes into account for only the data of the coins that were involved in some kind of transaction activity during the past seven years.

Coins that are older than seven years can be assumed to be lost forever, either due to being forgotten or because of having their wallet keys misplaced. As such, the True MVRV, which excludes these coins that are probable to never return back into circulation, can provide a more accurate picture of the sector than the normal version of the metric.

Now, here is a chart that shows the trend in this Bitcoin indicator over the history of the cryptocurrency:

As displayed in the above graph, the Bitcoin True MVRV has climbed to relatively high levels during this bull run. This implies the average investor is carrying notable profits.

Historically, the higher the holder gains get, the more likely they become to participate in a mass selloff with the motive of profit-taking. Thus, whenever the MVRV Ratio rises high, a top can become probable for BTC.

From the chart, it’s visible that the tops during the past cycles occurred when the indicator surpassed a specific line. So far, the metric hasn’t come close to retesting this level in the latest epoch.

According to the CryptoQuant founder, the reason the market cap hasn’t overheated relative to the realized cap yet is that there is still $7 billion in capital inflows entering the Bitcoin market every week.

If the current cycle is going to show anything similar to the previous ones, then the True MVRV being high, but not extremely high, could potentially suggest room for BTC left in the current bull run.

BTC Price

Bitcoin has retraced its Christmas rally as its value is now back down to $95,700.