Stocks and crypto see gains. Has the Santa Rally begun?

The Santa Rally could have already started, and this year, it’s packing a punch. Every trader worth their salt knows about the magic week that starts on Christmas Eve and stretches to New Year’s Eve. It’s a golden time for the S&P 500, with an average return of 1.3%—a track record that’s hard to argue with.

Monday alone saw the index jump by 1.1%, cruising back above the 6,000 mark. History has spoken, and it’s clear: December loves a good rally. Since 2009, only three years—2015, 2016, and 2023—failed to deliver gains during this festive window.

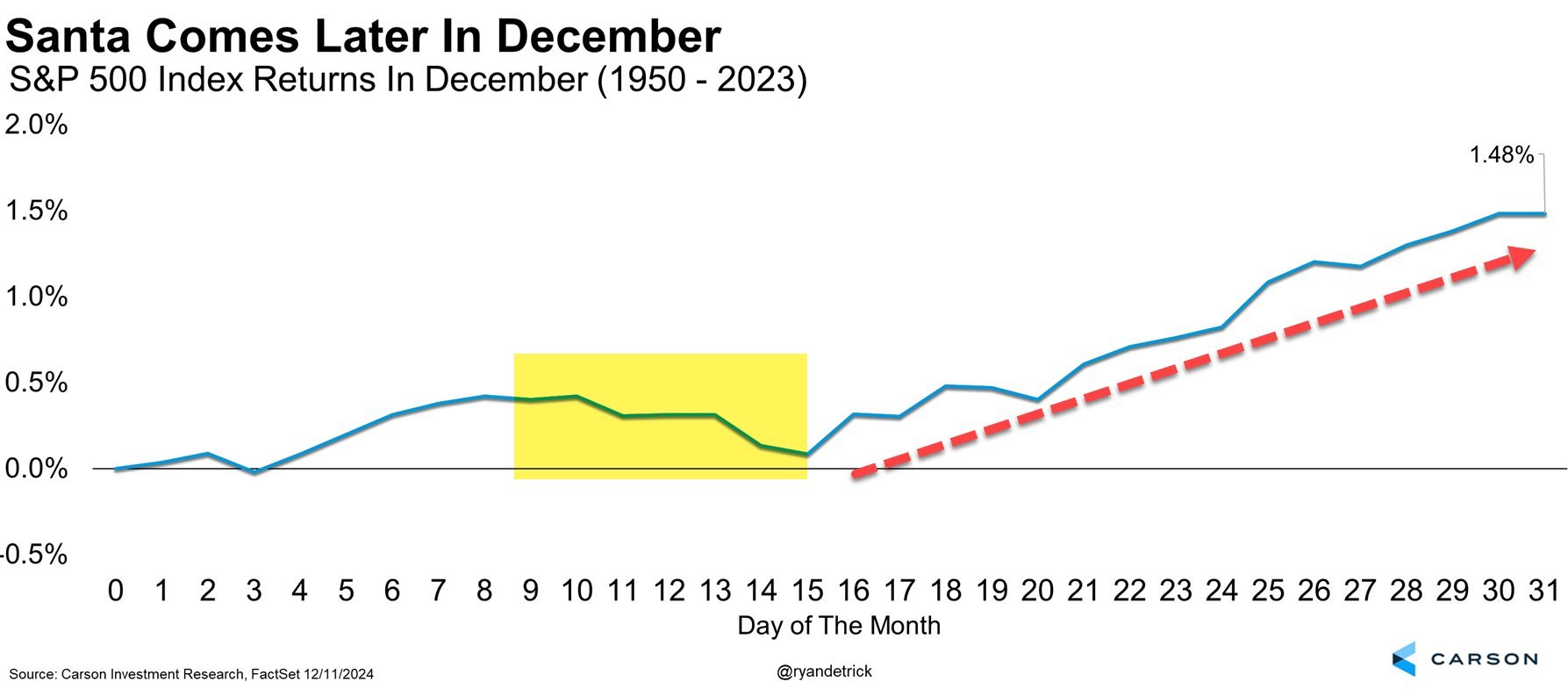

Data from the Carson Group shows the rally often comes alive later in the month. And if you zoom out to December 15–31, the S&P 500 has posted a median return of 1.4% since 1950.

The odds of back-to-back losses during this stretch are slim, happening only twice in the last 74 years. If the index pulls off another gain, it’ll keep its record of finishing this period higher 80% of the time intact.

Equity inflows, options frenzy, and market optimism

This year, markets are buzzing with more than just seasonal cheer. Over the past nine weeks, U.S. equity ETFs have sucked in $186 billion—more than twice the average inflow from the first half of 2024. It’s not just about numbers; it’s about appetite.

Investors are going all-in, chasing record-high trading volumes. Daily options trading now averages 48 million contracts, with half of those being zero-day-to-expiration (0DTE) options.

Last Friday was wild. A record $6.6 trillion worth of options contracts expired, fueling even more trading activity. Election years add an extra kick to the mix.

Historically, the S&P 500 climbs an average of 3.7% between Election Day and year-end, finishing higher 67% of the time. This year? It’s already up 4.5% since November 5, blowing past that average and setting the stage for a bigger finale.

Meanwhile, the S&P Risk Appetite Index is living its best life. It jumped another two points this month, hitting 41%—its highest level since April 2021. This is a massive surge from where it stood in August, up by a staggering 70% points. If sentiment were a stock, it’d be mooning right now.

Crypto starts a comeback

Crypto markets are riding the wave too. Bitcoin edged up 0.32% to $98,747 on Thursday, riding on news that MicroStrategy plans to issue more shares to buy even more Bitcoin.

The company has been on a buying spree, adding $561 million worth of Bitcoin last week alone. That was the seventh straight week of accumulation.

The rest of the crypto gang isn’t sitting idle. Ether, Solana, and even Dogecoin rebounded from midweek losses, riding on Bitcoin’s coattails. But traders are wary of what’s coming.

Friday will see a record $43 billion in open interest expire on Deribit, including $13.95 billion in Bitcoin options and $3.77 billion in Ether options.

That’s a lot of money on the line, and some are preparing for turbulence as market makers adjust their positions. Though many analysts think Bitcoin might reclaim $100k before January 1st.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan