Hedera (HBAR) Eyes $14 Billion Market Cap Comeback After Brief Decline

Hedera’s (HBAR) market cap appears ready for a rebound toward its all-time high after a decline that brought it down to $10.11 billion. HBAR’s price action and key indicators support this optimistic outlook.

If this bullish prediction holds, HBAR could recover some of its recent losses and potentially climb to much higher levels, reigniting investor confidence in the altcoin’s long-term prospects.

The Hedera Token Displays Strength

On December 3, HBAR’s market cap was $14.20 billion. This value marked the highest it has reached since its Mainnet in September 2019. Market cap is the product of circulation supply and the price of a cryptocurrency.

Currently, the project has 13.22 billion out of its 50 billion supply in circulation. However, the majority of the market cap hike could be linked to HBAR’s price increase. Recently, the altcoin’s value surged by 600% within a few weeks

While HBAR market cap showed potential for recovery, the token’s price has declined from $0.38 to $0.26, indicating a pause in bullish momentum. However, HBAR has rebounded from its recent low over the past 24 hours, hinting at renewed buying interest. If this recovery sustains, HBAR’s market cap could be on track to reclaim the $14 billion level.

Hedera Market Cap. Source: Santiment

Hedera Market Cap. Source: Santiment

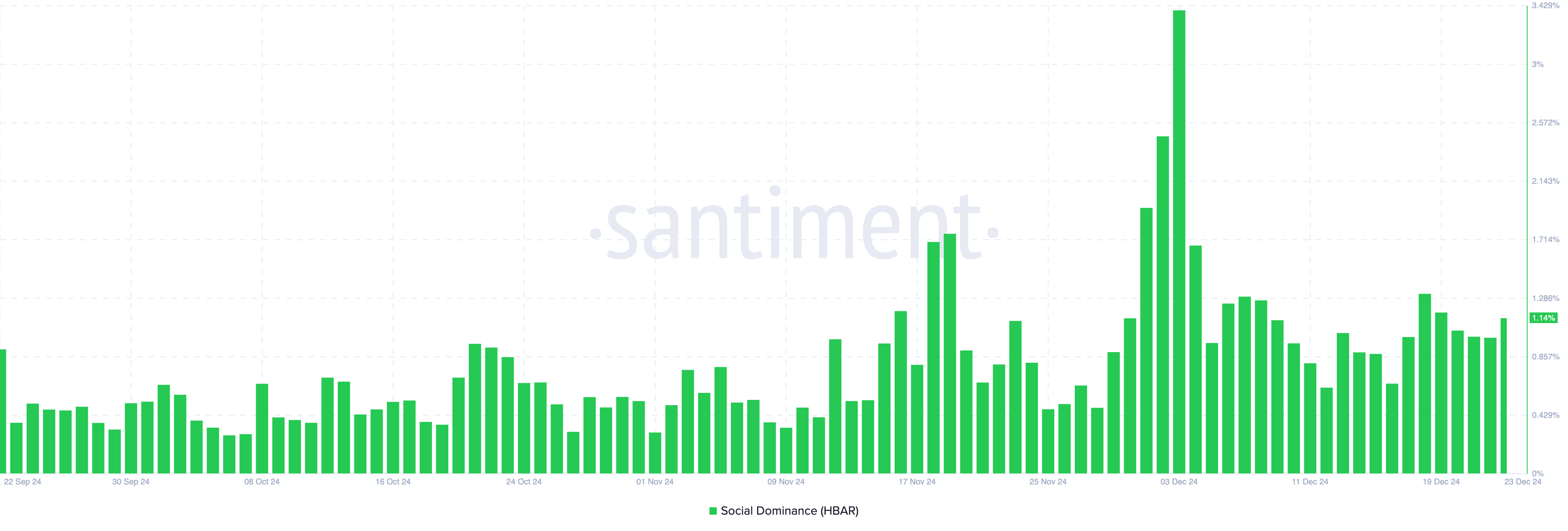

Furthermore, on-chain data from Santiment reveals a surge in HBAR’s social dominance, reaching 1.14%. This metric tracks the level of discussions surrounding a cryptocurrency compared to others in the top 100.

A rising dominance typically signals growing attention and interest in an asset, often contributing to bullish sentiment. If HBAR’s social dominance continues climbing, it could increase the token’s value and support its potential market cap recovery to $14 billion.

Hedera Social Dominance. Source: Santiment

Hedera Social Dominance. Source: Santiment

HBAR Price Prediction: $0.45 Could Be Next

From a technical perspective, BeInCrypto observed the formation of a bull flag on the HBAR/USD chart. The bull flag is a pattern that resembles a flag on a pole. It forms during a strong upward price trend, where a sharp initial rally (the “flagpole”) is followed by a period of consolidation (the “flag”).

This consolidation typically moves slightly downward or sideways, reflecting a temporary pause in market momentum. When this pattern concludes, it’s often followed by another sharp price increase.

Hedera Daily Analysis. Source: TradingView

Hedera Daily Analysis. Source: TradingView

For HBAR, it appears to be ready for another uptick. Should this be the case, then HBAR’s value could rise to $0.45. However, if selling pressure increases, the altcoin’s value might drop to $0.17.