Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

- The cryptocurrency market capitalization fell below $3.5 trillion on Monday, marking a 2.4% decline in the last 24 hours.

- Bitcoin (BTC) price declined 7.2% last week, recording its first weekly loss since Trump’s victory in the election on November 5.

- Chainlink (LINK), Hedera (HBAR), and AAVE emerged as top gainers over the weekend, with strategic bull traders stepping in to counter the market crash.

- The AI-Agents sector has captured media attention over the past week, with Pudgy Penguins and Virtuals Protocol (VIRTUAL) among the front-runners.

Altcoin market updates: Chainlink, HBAR, AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17.

Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

However, as early rebound signals emerged, Chainlink (LINK), Hedera (HBAR) and AAVE emerged top gainers on Monday.

- Chainlink (LINK) retakes $22 territory with 3% gains after integrating new memecoins

Chainlink (LINK) has surged by 3% to retake the $22 level, fueled by new integrations with popular memecoins. Over the weekend, several memecoins, including Shiba Inu (SHIB) and its ecosystem tokens Turbo (TURBO) and Apu (APU), adopted Chainlink’s Cross-Chain Token (CCT) standard.

Chainlink Integrate new memecoin data streams | Source: X.com/Chainlink, December 21, 2024 |

Chainlink Integrate new memecoin data streams | Source: X.com/Chainlink, December 21, 2024 |

This move enables these tokens to operate seamlessly across 12 blockchains, expanding their accessibility beyond their native networks.

The adoption of the CCT standard positions Chainlink as a key player in facilitating multi-chain interoperability for emerging tokens.

By leveraging Chainlink's services, these memecoins can now stream data and offer cross-network functionality, driving increased utility and liquidity.

- AAVE price broke above $340 on Monday, up 11% on the day, as third consecutive Fed rate cut sparks demand for DeFi lending products.

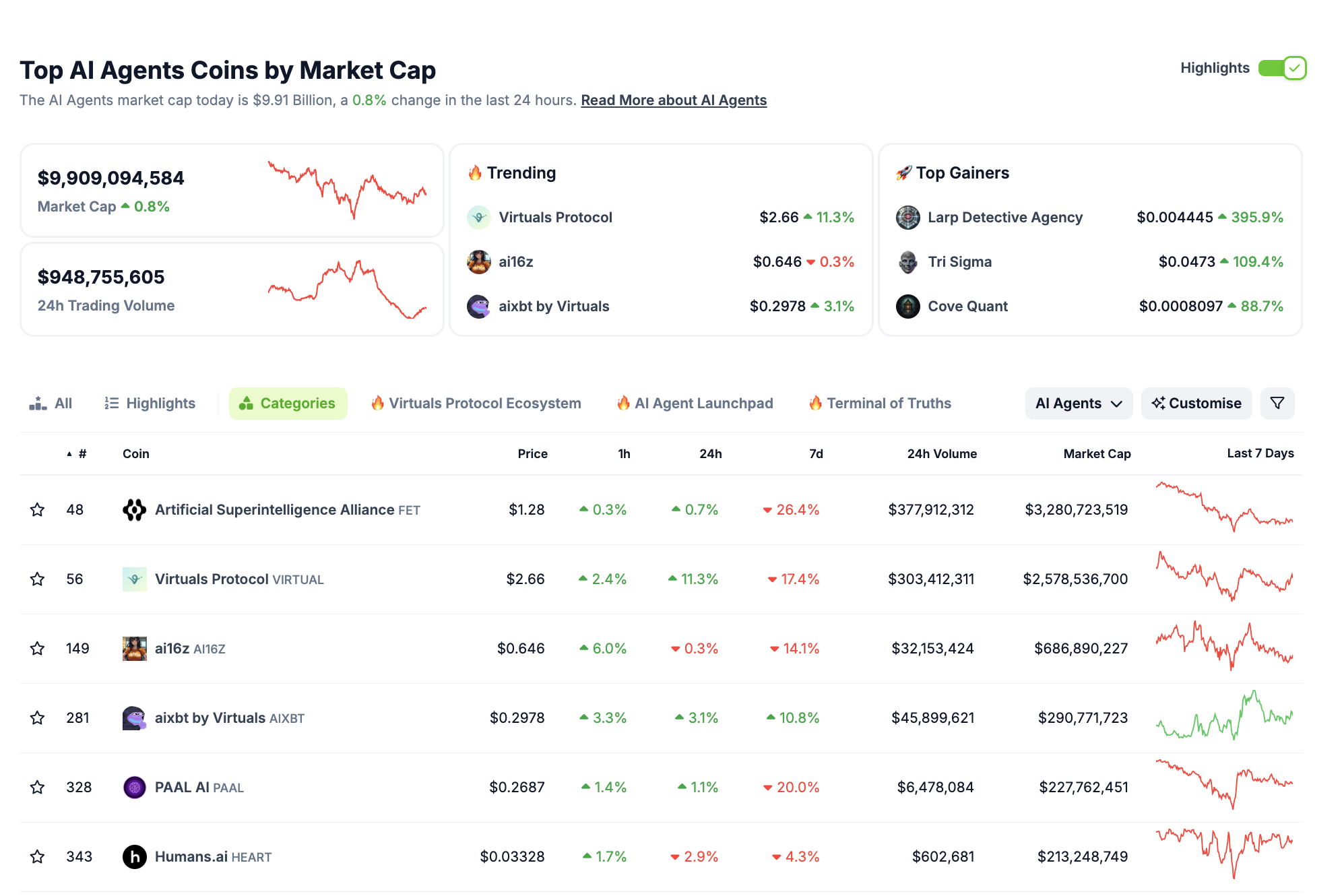

Chart of the day: Crypto AI-Agent sector hits $10B Marketcap

The Crypto AI Agent sector continues to shine amid broader market turbulence, reaching a $10 billion market cap on Monday.

Amid increasing demand for AI-integrated blockchain projects, the sector has emerged as one of the fastest growing cryptocurrency sectors in recent weeks.

Key growth drivers include the rising adoption of AI technologies across multiple industries and the interoperability of these projects within decentralized ecosystems.

Crypto AI Agent Sector Performance | Source: Coingecko

Crypto AI Agent Sector Performance | Source: Coingecko

Virtual Protocol (VIRTUAL) is among the standout performers, boasting an 11.3% daily gain and a market cap of $2.57 billion. Similarly, Aixbt by Virtuals (AIXBT) recorded a 10.8% weekly rise, solidifying its position as a key player in the ecosystem.

The Artificial Superintelligence Alliance (FET) remains the sector leader, with a $3.28 billion valuation and robust 24-hour trading activity of $377 million.

As the Crypto AI Agent sector enhances convergence between AI and blockchain technology, it could emerge a significant growth driver for the broader cryptocurrency industry in 2025 and beyond.

Crypto news updates:

- HyperLiquid Faces Record $60M USDC Outflows Amid North Korean Hacking Concerns

HyperLiquid, a prominent layer-1 blockchain and decentralized exchange specializing in perpetual futures trading, has reported a staggering $60 million outflow of USDC. The sharp exodus of funds follows rising fears of potential hacking activity linked to North Korean cybercriminal groups.

Blockchain analysts flagged movements from wallets associated with the regime, raising speculation about a possible reconnaissance mission targeting HyperLiquid's platform infrastructure. Given that USDC is essential for collateral and liquidity on the exchange, this unprecedented withdrawal has sparked discussions about the platform's security resilience.

While the outflows have raised concerns, HyperLiquid remains a leader in on-chain perpetual futures trading. Its recent launch of the native HYPE token amid a $1 billion airdrop, has triggered significant adoption traction over the past month.

- Trump Names Bo Hines as Head of Crypto Council to Boost Digital Asset Growth

President-elect Donald Trump has appointed Bo Hines, a former college football star, as Executive Director of the Presidential Council of Advisers for Digital Assets, also known as the "Crypto Council."

This marks another significant move in Trump’s efforts to shape the future of the digital asset industry. Hines, who will collaborate closely with David Sacks, the newly appointed AI and Cryptocurrency Czar, is expected to play a critical role in crafting policies that drive innovation in the blockchain and cryptocurrency sectors.

In his announcement on TruthSocial, Trump emphasized the administration's commitment to fostering growth in the digital assets space while ensuring that industry leaders have the tools necessary for success. He highlighted the council’s goal of creating an environment where cryptocurrency can thrive as a core pillar of the nation’s technological advancement.

Bo Hines’ appointment further reiterates the Trump administration's focus on positioning the United States as a leader in blockchain and cryptocurrency innovation.

- Interpol issues Red Notice for Hex Founder Richard Heart

Interpol has issued a Red Notice for Richard Heart, the founder of Hex and PulseChain, on behalf of Finland. Heart, legally known as Richard James Schueler, faces charges of gross tax evasion involving hundreds of millions of euros and allegations of a violent assault on a 16-year-old. Europol has also added Heart to its list of most wanted criminals, amplifying the international focus on the charges against him.

In response to the Red Notice, Heart publicly dismissed the gravity of the allegations, expressing indifference and maintaining a focus on his ongoing cryptocurrency projects. Despite the mounting legal troubles, the founder’s public statements have shown little concern for the potential impact on his ventures, which continue to attract significant attention in the crypto community.