Litecoin Price Prediction: $150 breakout expected as miners buy $18M of LTC

- Litecoin price hit a new weekly peak of $130 on Tuesday, up 35% since December 10.

- The LTC rally has coincided with an $18 million buying spree among LTC miners.

- Technical indicators suggest LTC price could reach $150 before hitting the next major resistance cluster.

Litecoin price traded as high as $131 on Binance on Tuesday, rising 35% within the weekly time frame. On-chain data trends suggest an ongoing acquisition trend among LTC miners could propel the rally further.

Litecoin price spikes 30% ahead of US Fed decision

On Tuesday, Bitcoin price rose to a new all-time high of $108,135, driving up prices of top altcoins including Litecoin (LTC), Solana (SOL) and Ripple (XRP).

Based on current market reports, the rally can be attributed to investors placing last-minute bullish bets as the US Federal Open Market Committee (FOMC) meeting kicked off in New York.

Litecoin price action, December 17 | LTCUSDT (Binance)

Litecoin price action, December 17 | LTCUSDT (Binance)

The chart above shows how Litecoin price rose as high as $131.50 on Binance exchange, while BTC advanced to new global peaks.

Zooming out, LTC’s latest price surge brings its weekly time frame gains to above the 30% mark.

This reflects that Litecoin market momentum has been predominantly bullish since the crypto market recovered from the abrupt market crash observed on December 10.

Miners acquire $18M LTC over the past week

While the crypto market has been on the uptrend over the past week, Litecoin price has outperformed rival Layer-1 altcoins like Ethereum (ETH), Cardano (ADA) and Solana (SOL).

On-chain data shows that a rare accumulation trend observed among Proof-of-Stake miners has contributed to Litecoin’s outsized 30% gain.

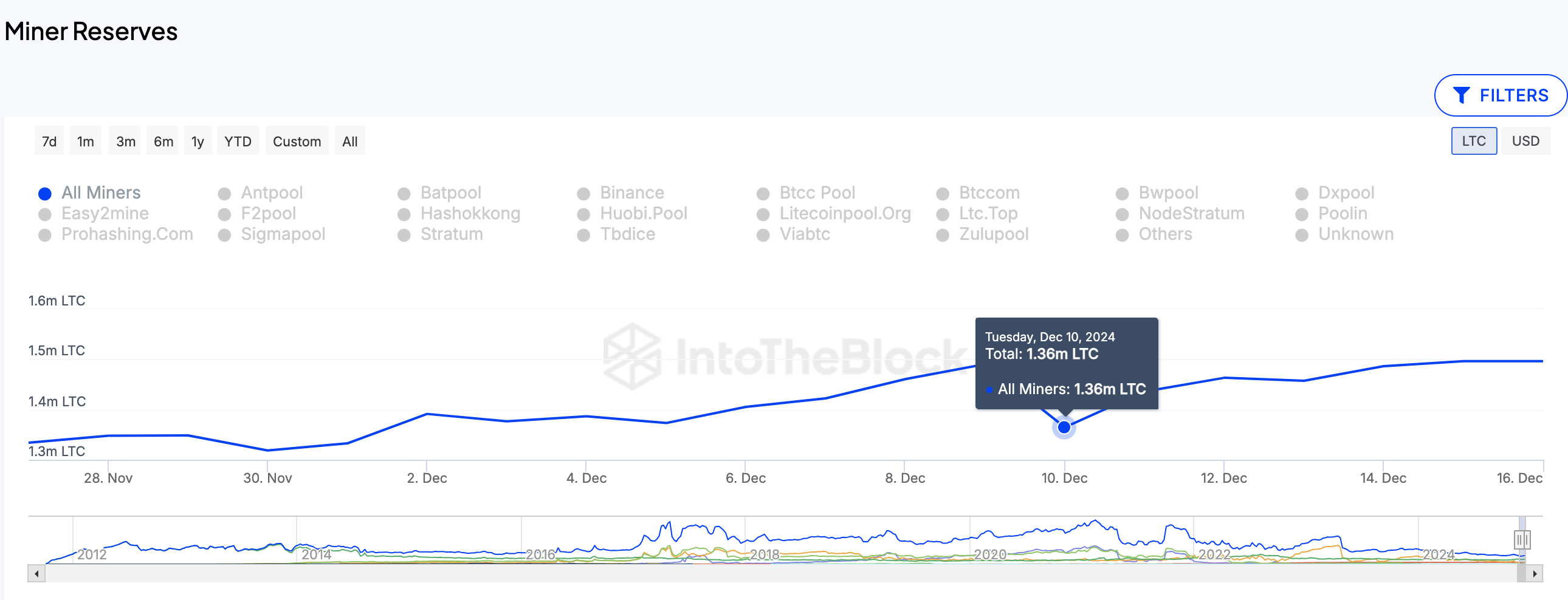

In affirmation of this stance, the IntoTheBlock chart below shows real-time changes in LTC miners’ reserve balances.

This provides real-time insights into LTC miners’ trading activity around key market cycles.

Litecoin Miners Reserves | IntoTheBlock

Litecoin Miners Reserves | IntoTheBlock

The chart above shows that the miners held only 1.36 million LTC in their cumulative balances as of December 10.

But since then, the miners flipped into accumulation mode, acquiring 140,000 LTC over the past one week to bring their current balances to 1.5 million LTC at close of December 16.

Valued at the current prices, the miners have effectively acquired LTC coins worth $17.7 million between December 10 and December 17, coinciding with the 30% price rally.

Such large acquisitions by miners often heighten bullish momentum for two key reasons.

First, by preventing newly-issued block rewards from entering the market supply, upward pressure intensifies during periods of high demand, as observed when the FOMC meeting kicked off on Wednesday.

More so, miners are highly influential stakeholders within any Proof-of-Work blockchain ecosystem.

Hence when miners take a bullish stance as shown by the $18 million acquisition over the past week, other retail traders and prospective market entrants could be incentivized to follow suit.

If the current market dynamics persist, LTC price could be on the verge of another major leg-up in the days ahead.

Litecoin Price Forecast: LTC Set for $150 Breakout if This Happens

The ongoing Litecoin (LTC) pricee rally has aligned with significant miner accumulation and a surge in trading volume, creating a bullish setup for further upside.

Between December 10 and December 17, miners accumulated $18 million worth of LTC while the price surged 35%. This prevented new supply from flooding the market, intensifying upward momentum during the Federal Reserve’s FOMC-driven sentiment boost.

Analyzing the chart, LTC price is currently testing the upper boundary of a consolidation phase near $127. A clear breakout above this resistance could trigger a run towards $135 and subsequently $150, fueled by increasing bullish momentum and heightened Volume Delta.

Litecoin Price Forecast | LTCUSDT

Litecoin Price Forecast | LTCUSDT

The notable volume spike seen on December 18 signals growing market conviction among buyers, which could propel the rally further if sustained.

On the downside, critical support lies at $118, aligned with the Donchian Channel median. A breakdown below this level would invalidate the bullish outlook, potentially causing LTC to retrace toward the $100.56 support zone.

In summary, a multi-day close above $127 could set the stage for LTC to test $150 in the coming trading sessions.