AAVE rally shows no signs of stopping: 96% of holders now profitable

- AAVE hits a three-year high and rallies to $397 on Monday.

- Technical indicators suggest the DeFi token could extend its gains.

- AAVE’s 96% holders are currently profitable, and traders took large-scale profits on their holdings last week.

- AAVE eyes rally above the psychological level of $500.

AAVE, one of the largest DeFi tokens, hit a three-year peak of $397 early on Monday. AAVE’s market capitalization crossed $5.723 billion as the token rallied nearly 130% in the past 30 days.

On-chain indicators signal rising activity in AAVE as traders take profits. The AAVE price rally is undeterred by the profit-taking, however, and the DeFi token gained nearly 4% on the day.

AAVE hits a three-year peak, eyes $500 target

AAVE price surged to its highest level since 2021 to a local top of $397 on December 16. Since then, the DeFi token has observed a pullback and is trading at $379.82 at the time of writing. Technical indicators on the daily price chart supports a bullish thesis for the DeFi token.

The green histogram bars on the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) sloping upwards support AAVE’s bullish thesis.

The token could target the psychologically important $500 level next, and the $509.31 price level is the 141.4% Fibonacci retracement level of the rally from the November 21 low of $151.86 to the December 16 peak of $397.

AAVE/USDT daily price chart

96% AAVE holders are profitable

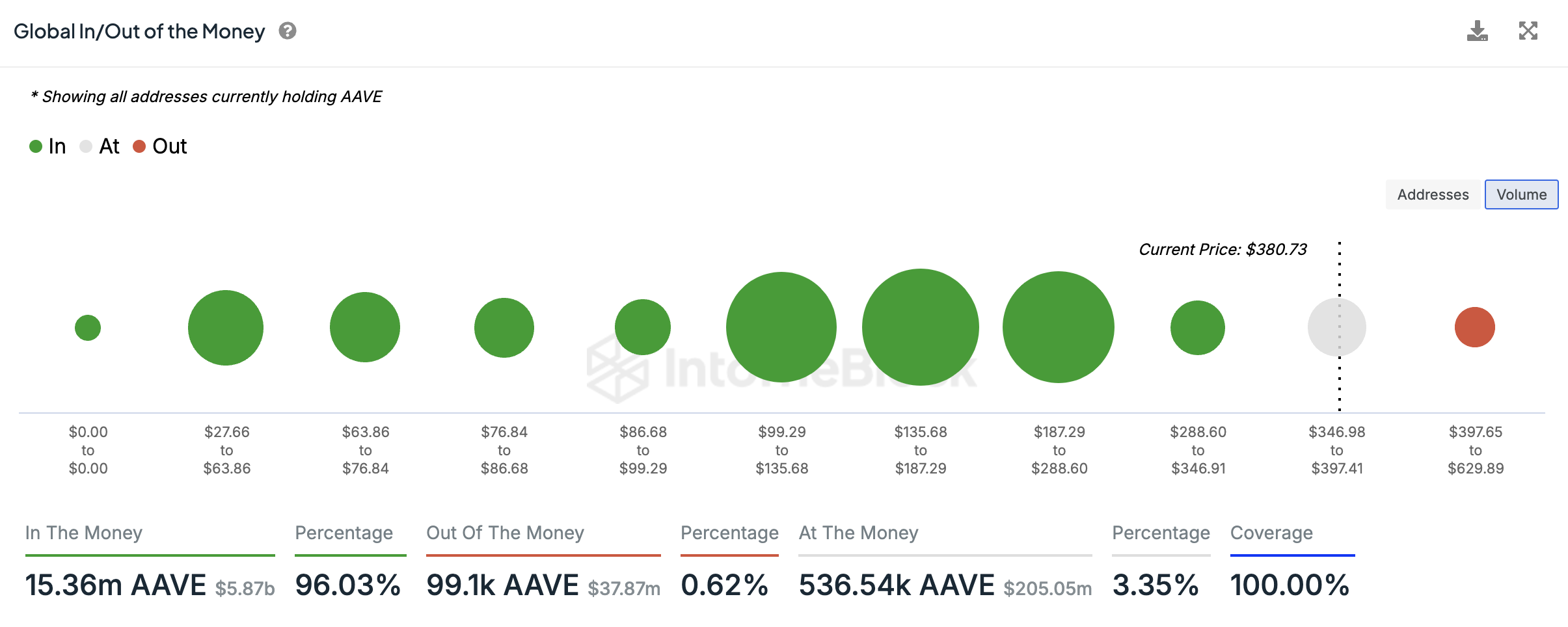

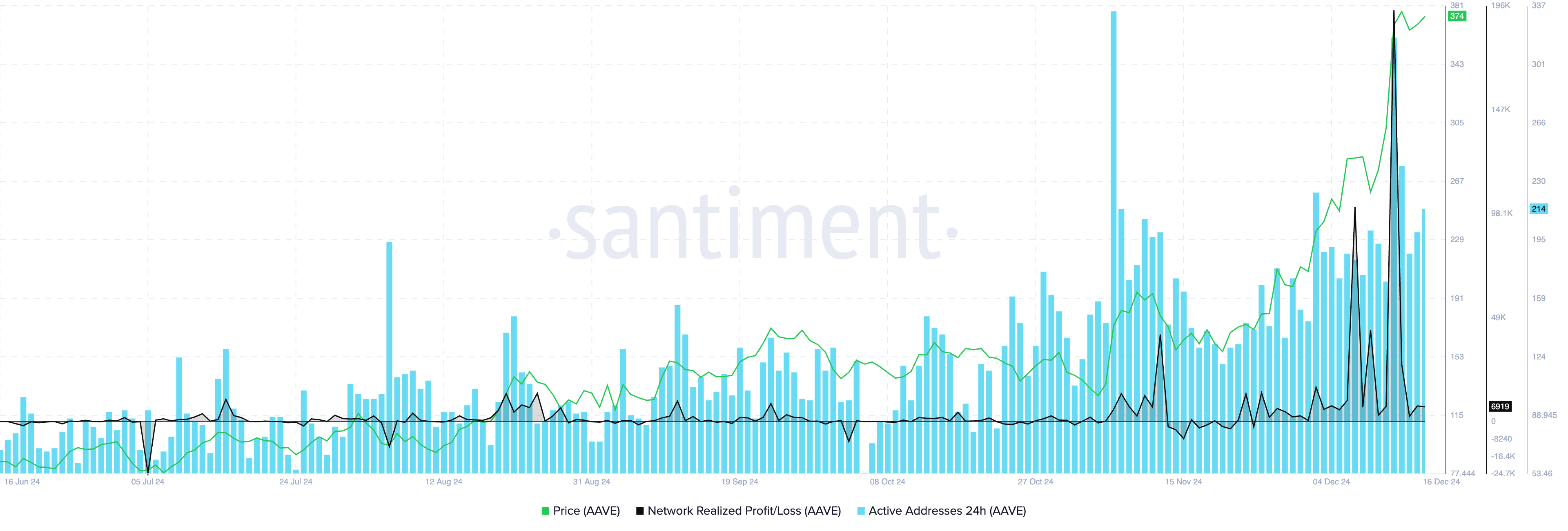

Data from crypto intelligence tracker IntoTheBlock shows that 96.03% of wallet addresses holding AAVE are currently profitable. Santiment data shows profit-taking spikes throughout last week, with the largest one on December 12, as AAVE traders take gains on their holdings.

Global In/Out of the Money | Source: IntoTheBlock

AAVE noted large spikes in activity that coincided with profit-taking, per Santiment data. This has not influenced the DeFi token’s price, however traders need to keep their eyes peeled for a correction if traders dump AAVE and take profits.

AAVE active addresses and network realized profit/loss | Source: Santiment

AAVE trades at $379.82 at the time of writing.