Solana Price Prediction: SOL market share dips $3B as Trump propels Ethereum rally

- Solana price fell 4% in 48 hours to hit $225 on Friday, decoupling from the broader altcoin market resurgence.

- The $3 billion SOL market cap decline coincided with Trump-backed WLFI’s latest crypto acquisitions, drawing investor attention toward the Ethereum ecosystem.

- Average balance in buying addresses increased from 383 SOL to 1,096 SOL, signalling a 186% rise in Solana whale demand over the last three days.

Solana price fell 4% in 48 hours to hit $225 on Friday, decoupling from the broader altcoin market resurgence. While Trump-backed WLFI’s latest crypto acquisitions drew retail mass market attention toward the Ethereum ecosystem, on-chain data shows Solana whales increasingly buying the dip.

Solana price tumbles 4% as traders shift focus to ETH, LINK, AAVE amid Trump’s latest buys

Following a lagging start to the week, steeper inflation on the US CPI report triggered a crypto market rebound on Wednesday.

However, while the likes of Bitcoin, Ethereum and XRP rebound above key psychological support, Solana, the fourth largest crypto asset, has struggled for traction.

Recent market reports suggest recent purchases made by World Liberty Financial (WLFI), a crypto firm backed by US President-elect Donald Trump, momentarily drew investor attention toward the Ethereum ecosystem, while Solana lost nearly $3 billion in market capitalization.

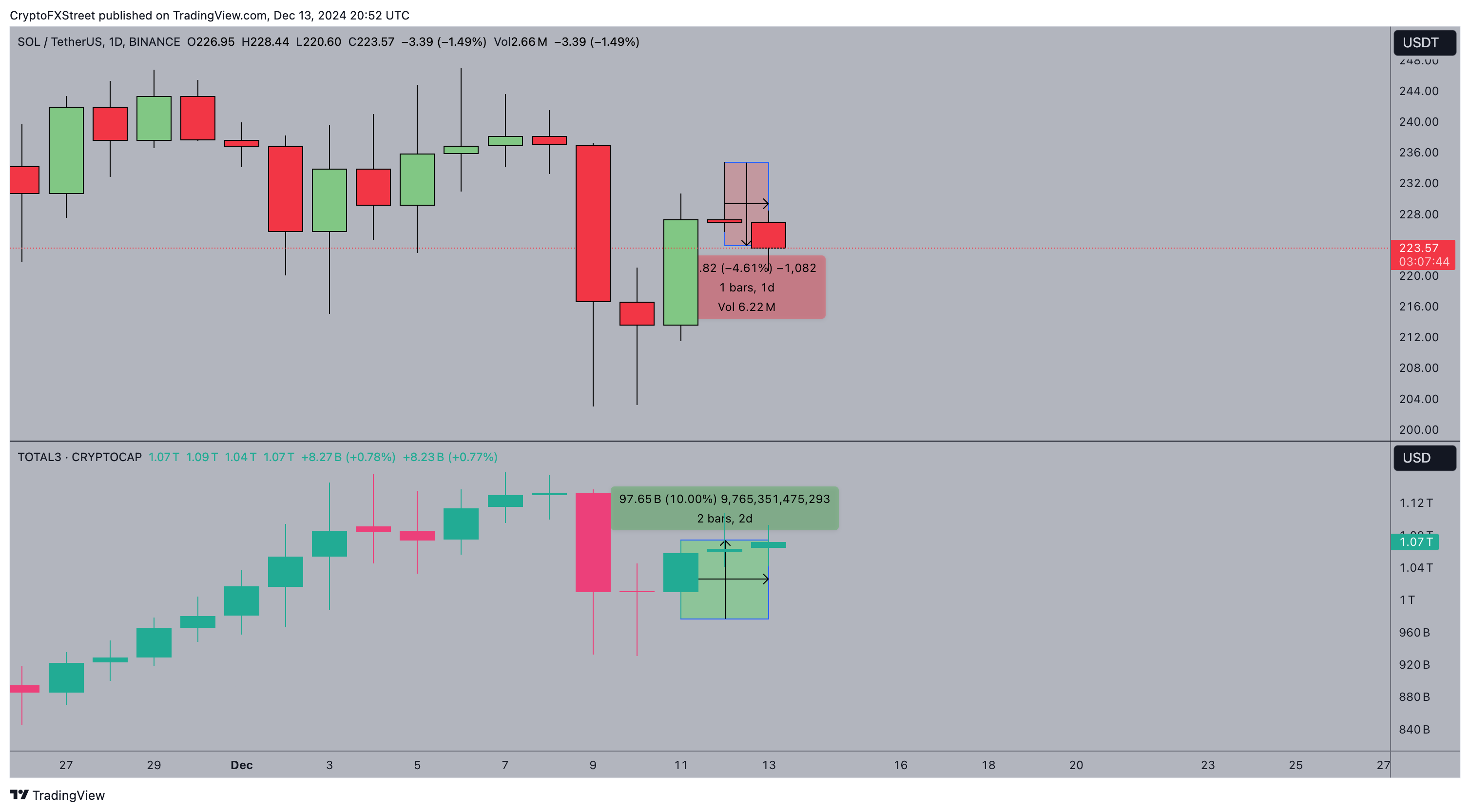

Solana price action vs TOTAL3 (Total Altcoin Market Capitalization)

Solana price action vs TOTAL3 (Total Altcoin Market Capitalization)

On December 11, WLFI acquired millions worth of ETH, Chainlink and AAVE, which saw all three Ethereum-hosted assets enter double-digit gains within the last 48 hours.

Meanwhile, the chart above shows that while the global altcoin market rose 10%, Solana price tumbled 4.6% on Wednesday to hit the $224 level at press time on Friday.

This validates the stance that Trump’s indirect endorsement of the Ethereum ecosystem may have influenced the retail mass market to shift capital away from Solana, arguably its biggest rival Layer-1 chain.

Whale demand spikes 186% amid SOL price dip

The 4.6% SOL price dip over the last 48 hours has seen it decouple from the broader altcoin market rebound.

However, vital on-chain metrics show Solana whales capitalizing on the falling prices to buy the dip, a move that could potentially trigger a bullish reversal in the days ahead.

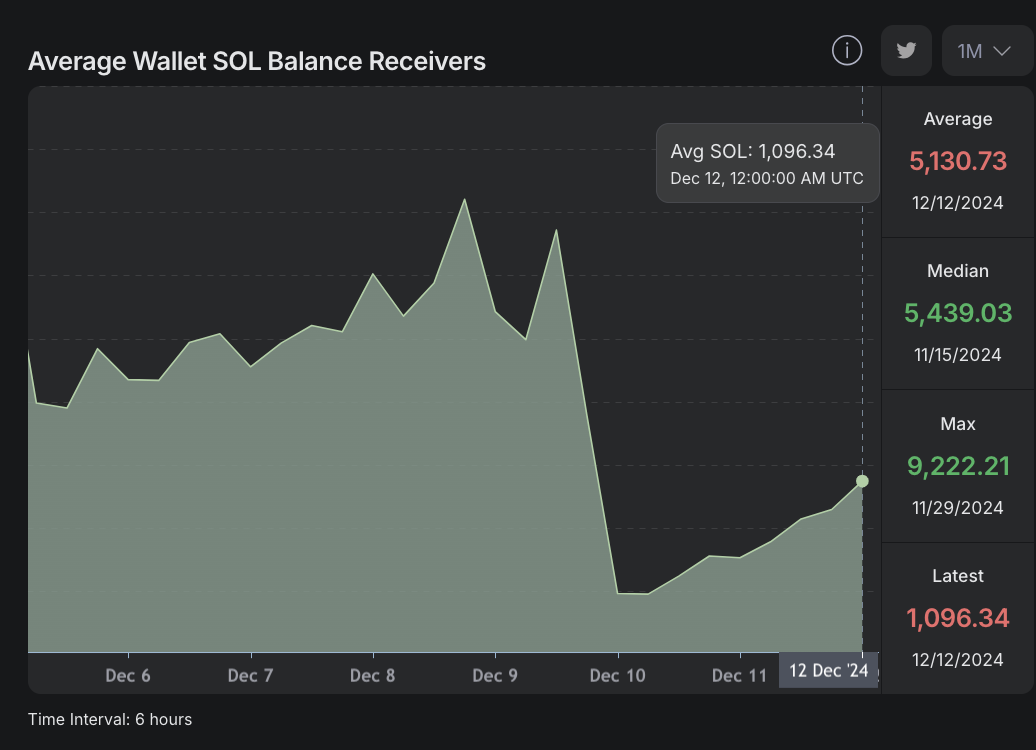

The Hellomoon chart below tracks the balances held in wallets that acquired SOL over the past week. This serves as a proxy for measuring real-time changes in whale trading activity.

Average balance in Solana (SOL) buying addresses | Source: Hellomoon

The chart above shows how the average balance in buying addresses increased from 383 SOL on Tuesday to hit 1,096 SOL on Thursday.

This signals a 186% increase in demand from large investors over the last three days, reflecting growing anticipation of a bullish reversal.

When large holders buy during a market dip, the resulting surge in market liquidity enables panic sellers to exit with minimal downward pressure on prices.

This could help SOL hold relatively high support levels, while bulls regroup for the next rebound phase.

Solana price forecast: Close above $230 could spark rebound phase

Solana's (SOL) price has shown signs of stabilizing, with technical indicators pointing to a potential rebound if key resistance levels are breached.

The RSI remains neutral at 48.36, indicating that bears are not in full control of the market.

This suggests a possible recovery if momentum shifts in favor of bulls. The midline of the Donchian Channel (DC) at $231 acts as immediate resistance.

A decisive close above this level could signal a resurgence of buying activity, setting the stage for a broader recovery phase.

Solana Price Forecast

Solana Price Forecast

If SOL successfully breaks above $231, the next target lies at the upper band of the DC at $259.

This move could attract strategic traders looking for entry opportunities at current levels.

However, failure to sustain above $230 could invalidate this bullish outlook.

On the downside, strong support is observed at $203, and a drop below this level might prompt further corrections.

Volume trends suggest caution as significant buying pressure is yet to emerge to counteract bearish momentum.

Strategic traders should monitor these levels closely for confirmation of a trend reversal.