Crypto Today: Bitcoin price tops $102K as Trump’s firm acquires Ethereum and Chainlink

- The cryptocurrency sector valuation broke past $3.5 trillion on Thursday, up 9.4% since the market crash halted on Tuesday.

- In the last 24 hours, 104,700 traders were liquidated with the $172.7 million in long contracts closed accounting for 58% of the $298.5 million in total liquidations.

- President-elect Donald Trump hinted at adopting a Bitcoin strategic reserve during his appearance at the New York Stock Exchange on Thursday.

Altcoin market updates: Chainlink, Avalanche emerge top gainers as Trump-backed WLFI acquires Ethereum worth $5 million

Donald Trump made bullish comments on the crypto sector as he rang the opening bell at the New York Stock Exchange on Thursday. When asked about the proposal to add Bitcoin to a strategic reserve, Trump gave a cryptic response, promising support for the cryptocurrency sector as a whole.

Investors reacted positively with top altcoins like Chainlink (LINK) and Avalanche (AVAX) entering double-digit gains as Bitcoin price hit $102,000.

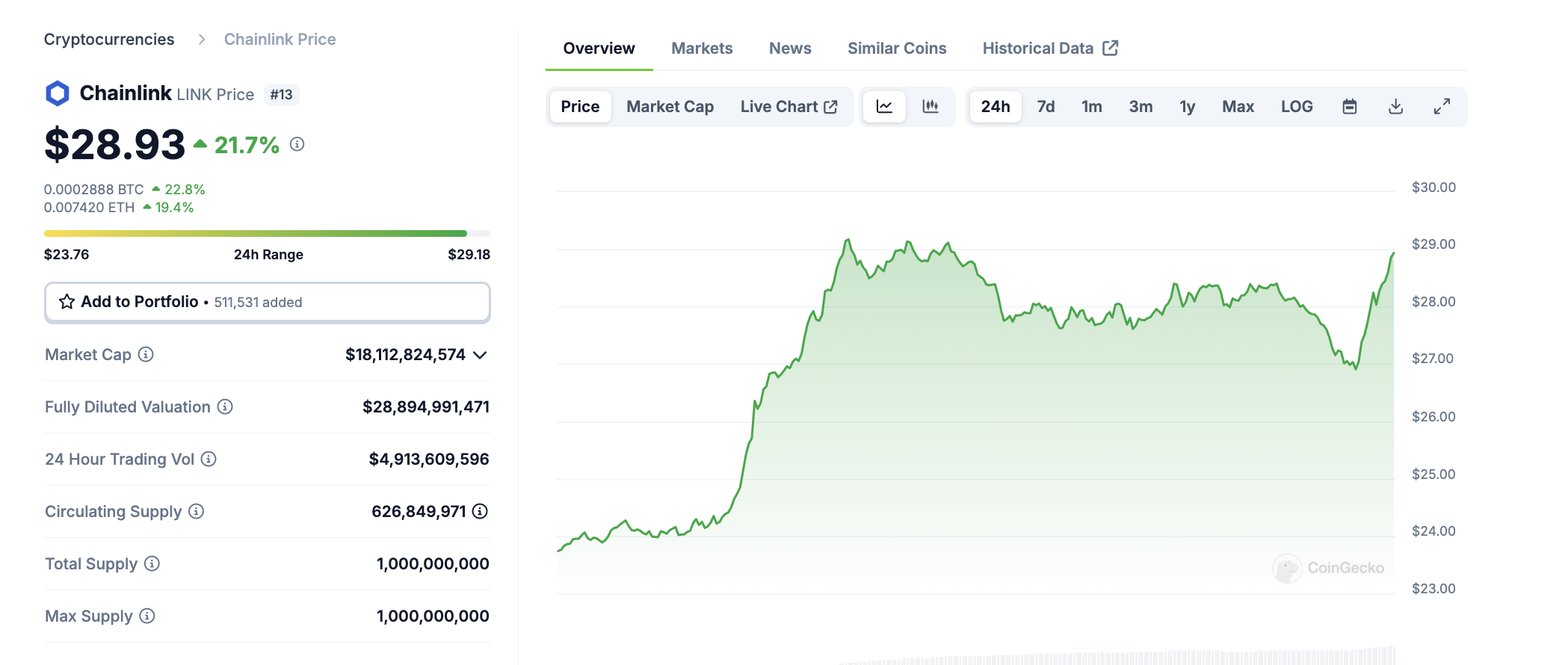

- Chainlink (LINK) price rose 20% to emerge the top performer among the top 20 coins.

Chainlink (LINK) price action, December 12 | Coingecko

Chainlink (LINK) price action, December 12 | Coingecko

The LINK price has surged above the $28 mark at press time, propelled by news of Trump-backed Firm World Liberty Financial (WLFI) acquiring the token, shortly after the Chainlink team inked a strategic partnership with NBD, a major banking institution in the United Arab Emirates.

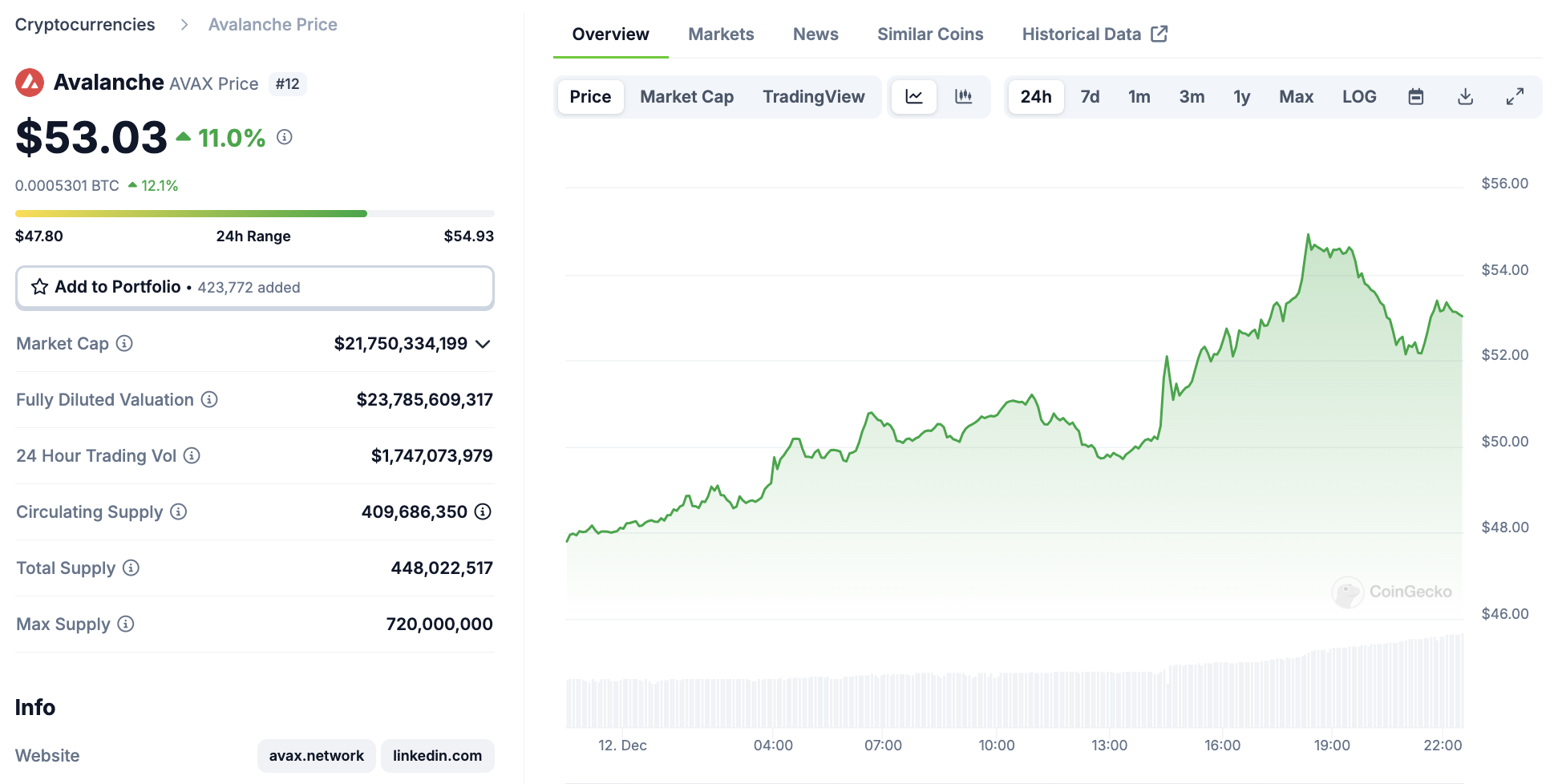

- Avalanche (AVAX) price also delivered an impressive 11% gains on the day,

Avalanche (AVAX) price action, December 12 | Coingecko

Market reports suggest AVAX is rallying on news of the Avalanche Foundation raising $250 million to carry out a technical upgrade of the blockchain network.

Chart of the day: Trump-backed WLFI acquires Ethereum worth $5M

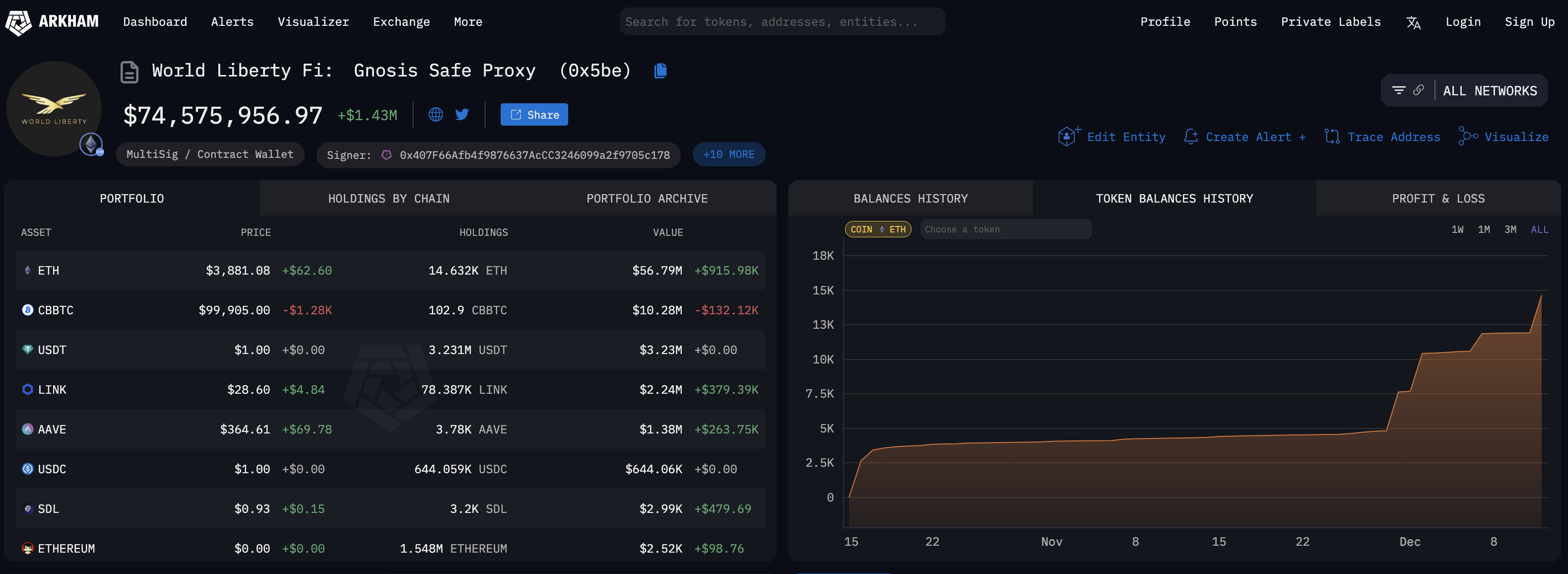

World Liberty Financial , a crypto initiative backed by President-elect Donald Trump, has acquired $5 million worth of ETH on Wednesday.

According to on-chain analytics platform Arkham Intelligence, this purchase boosts the WLFI’s ETH reserves above the $50 million mark, with the majority of acquisitions occurring after Trump’s re-election.

World Liberty Financial (WLFI) total cryptocurrency holdings as of December 12, 2024| Source: Arkham Intelligence

World Liberty Financial (WLFI) total cryptocurrency holdings as of December 12, 2024| Source: Arkham Intelligence

The conversion of WLFI’s stablecoin reserves into ETH suggests that World Liberty Financial is positioning itself more actively within the broader Decentralized Finance (DeFi) ecosystem.

It could also indicate that the project views ETH as a superior reserve asset compared to the US Dollar, potentially hedging against anticipated devaluation due to rising inflation reported in the latest US Consumer Price Index (CPI) data and expected rate cuts by the Federal Reserve (Fed).

The Arkham Research chart above shows that the World Liberty wallet (0x5be9a495) now holds approximately $75 million in cryptocurrencies.

This includes over $50 million in ETH, $10 million in Coinbase’s wrapped Bitcoin token (cbETH), $8 million in USDC, and $3 million in USDT, alongside smaller holdings of various altcoins.

Crypto news updates:

- US regulators seek public opinion on proposed Bitcoin and Ethereum ETF Listing

US regulators are inviting public feedback on NYSE Arca’s proposal to list a new cryptocurrency exchange-traded fund (ETF) developed by Bitwise.

The fund, designed as a spot Bitcoin and Ethereum index ETF, would hold actual Bitcoin and Ether, providing investors with direct exposure to the two leading cryptocurrencies in a convenient, regulated format.

This joint filing with the Securities & Exchange Commission (SEC) reflects the growing demand for crypto-based financial products among US corporate investors and TradFi players.

- Ray Dalio advocates for Bitcoin as a hedge against global debt risks

Ray Dalio, the founder of Bridgewater Associates, has voiced support for Bitcoin and Gold as safer alternatives to traditional debt-based assets.

Speaking at Abu Dhabi Finance Week, Dalio warned of escalating debt levels in major economies and their potential to trigger financial crises that could undermine fiat currencies.

While historically skeptical of Bitcoin, he revealed in 2021 that he owned some, reflecting his acknowledgment of its potential as a protective asset.

Dalio’s remarks come as he distances himself from Bridgewater, having stepped down from leadership in October 2022 after years of gradual transitions.

- Circle and Binance team up to expand USDC’s global reach

Circle and Binance have announced a strategic partnership to boost the adoption and utility of USD Coin (USDC) worldwide.

Revealed at Abu Dhabi Finance Week, the collaboration includes integrating USDC into Binance’s corporate treasury and expanding its application across financial services on the exchange.

The partnership aims to solidify USDC's position as a key stablecoin in the global digital asset ecosystem.

Circle will also support Binance in fostering international finance and commerce relationships, paving the way for broader stablecoin adoption.

This joint effort highlights both companies' commitment to advancing stablecoin-driven solutions for seamless transactions and enhanced financial accessibility.

- Grayscale launches investment funds for Lido and Optimism tokens

Grayscale Investments has unveiled two new crypto funds: the Grayscale Lido DAO Trust and Grayscale Optimism Trust.

These funds focus on Lido's LDO token, tied to Ethereum’s largest liquid staking protocol, and Optimism's OP token, which supports a leading Layer-2 scaling solution.

Both projects play crucial roles in improving Ethereum's efficiency, security and scalability.

Exclusively available to accredited investors, these additions expand Grayscale’s growing portfolio of digital asset trusts.