Crypto Today: Microsoft Rejects Bitcoin Reserve Plan, as Cardano, XRP Lead Market Rebound

The cryptocurrency sector's valuation held firm at $3.37 trillion on Tuesday, halting a bleedout of $13 billion in outflows over the last 24 hours.

- Marathon Digital (MARA), the largest cryptocurrency miner, announced another $1.1 billion Bitcoin purchase after issuing debt convertible notes.

- In the derivatives markets, 288,367 traders were liquidated, with $626 million in long positions wiped out, accounting for 77% of the $809 million total liquidations.

Altcoin Market Updates: XRP and Cardano flash rebound signals as Bitcoin retakes $97K

Amid an escalating geopolitical crisis, the global crypto market crash on Monday saw over $1.5 billion worth of liquidations, triggering double-digit losses across top-ranked digital assets.

However, as Bitcoin price reclaimed $97,000 after dipping to $94,200 within the 24-hour timeframe, the altcoin markets showed recovery signals. On Tuesday, Ripple (XRP), Cardano (ADA), and Binance Coin (BNB) all reclaimed key resistance levels.

- Ripple (XRP) price rebounded above $2.35, reflecting 3% gains on the day.

Ripple secured vital approval from New York State regulators for its newly launched RLUSD stablecoin on Tuesday, providing an additional boost to the bullish market.

- Cardano (ADA) reclaimed the vital $1 psychological support after a hack of the team’s official Twitter account exacerbated a 15.8% correction to $0.91 on Monday.

- Binance Coin (BNB) prodded above $680 at press time, as the native coin continues to draw demand amid heightened trading activity on the exchange.

Chart of the Day: Ethereum Whales Maintain Positive Momentum Amid Crypto Crash

Ethereum price has been subject to intense volatility since the start of December, with bullish tailwinds from Trump’s regulatory changes nullified by geopolitical risk factors.

After breaching the $4,000 mark on December 6 for the first time in three years, ETH price succumbed to a sharp 10% correction, tumbling as low as $3,519 on Tuesday.

Despite volatile price swings, on-chain data trends show Ethereum’s largest investors remained reluctant to sell into market FUD (Fear, Uncertainty, and Doubt).

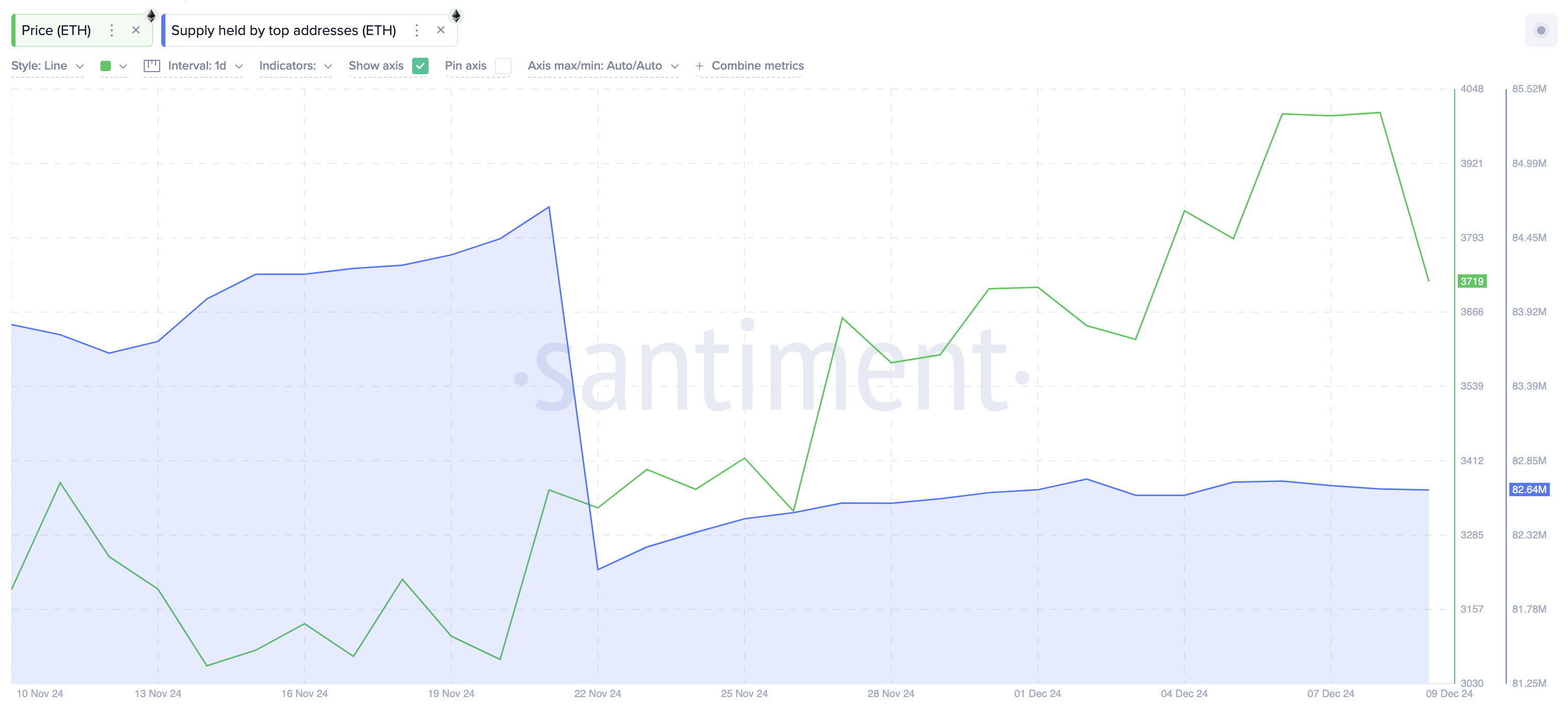

Ethereum Price vs. Top 1,000 Holders’ Balances

Santiment's chart below depicts real-time changes in balances held by the top 1,000 wallets with the largest ETH holdings.

The blue-shaded area in the chart shows Ethereum whales began buying around November 22, amid Gary Gensler’s exit confirmation, increasing their balances from 82.04 million ETH to 82.64 million ETH at press time on December 10. This indicates that whales bought 600,000 ETH in the last 18 days, worth approximately $220 million at current prices.

This data highlights that, despite intense market volatility, ETH whales maintain positive momentum, suggesting the majority of large investors anticipate an early bullish reversal.

Crypto News Updates

- Microsoft Shareholders reject Bitcoin reserve proposal

Microsoft shareholders voted against a proposal to allocate a portion of the company's reserves to Bitcoin during the annual meeting on December 10.

The plan, introduced by the National Center for Public Policy Research (NCPPR), suggested Bitcoin could diversify assets and enhance shareholder value.

The board opposed the idea, citing Bitcoin's volatility and the company’s existing robust asset management processes.

Despite references to firms like MicroStrategy and BlackRock as Bitcoin adopters, shareholders aligned with the board, prioritizing stability over cryptocurrency investments.

- Eric Trump forecasts Bitcoin reaching $1 Million

Speaking at the Bitcoin MENA event in Abu Dhabi, Eric Trump projected that Bitcoin could eventually achieve a $1 million valuation.

He highlighted Bitcoin's inherent scarcity, describing it as a transformative global asset and a hedge against inflation, economic instability, and geopolitical risks.

Trump also emphasized the decentralized nature of Bitcoin, which eliminates reliance on intermediaries, and its increasing adoption by governments and institutions.

He argued that Bitcoin's role as a store of value cements its potential for long-term appreciation.

- Tether's USDT Gains Acceptance as a Virtual Asset in Abu Dhabi Global Market

The Abu Dhabi Global Market's Financial Services Regulatory Authority (FSRA) has designated Tether's USD₮ as an Accepted Virtual Asset (AVA).

This allows licensed entities to provide services involving USD₮ within the ADGM ecosystem, bolstering the integration of digital assets into the UAE's financial framework.

This milestone reflects the UAE's commitment to becoming a global crypto hub by merging traditional and digital finance.