Algorand (ALGO) 360% Rally Drives Active Addresses to Highest Since November

Over the last 30 days, Algorand’s (ALGO) price has increased by 360% following a broader altcoin rally. As a result, daily active addresses on the Algorand network have surged to the highest point since November 7.

Typically, this rise in active addresses is supposed to be bullish for the price. However, this on-chain analysis explains why this may not be the case.

Algorand Network Activity Rises

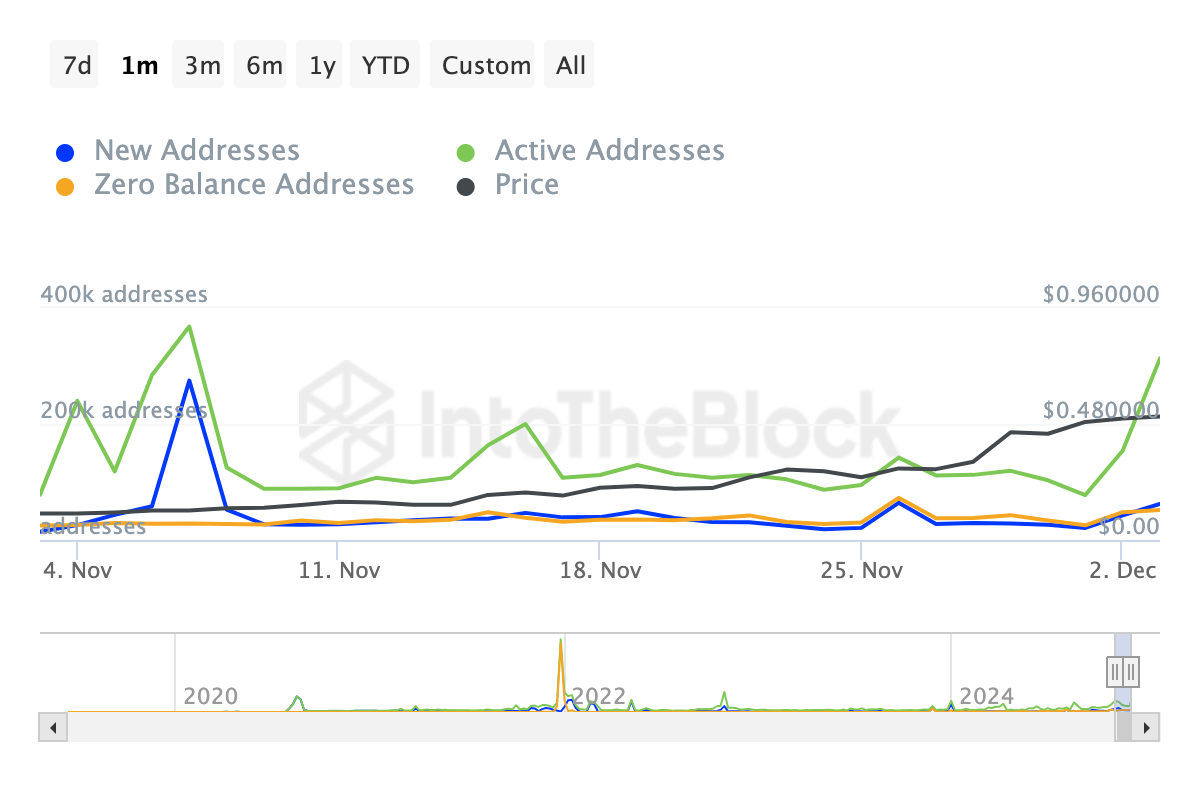

According to IntoTheBlock, Algorand’s active addresses have surged to 427,230 as of this writing. For those unfamiliar, active addresses refer to the number of unique wallets successfully transacting on a blockchain.

This metric counts both the sender and receivers. When the metric increases, it indicates rising user participation, which is mostly bullish depending on the price action. On the other hand, a decrease in active addresses means user engagement has fallen, which is bearish.

For active addresses to be bullish, it has to increase alongside the price. But in this case, ALGO’s price has decreased by 10% in the last 24 hours. Therefore, the rise in network activity might not support a further uptrend, but that’s not all.

Algorand Active Addresses. Source: IntoTheBlock

Algorand Active Addresses. Source: IntoTheBlock

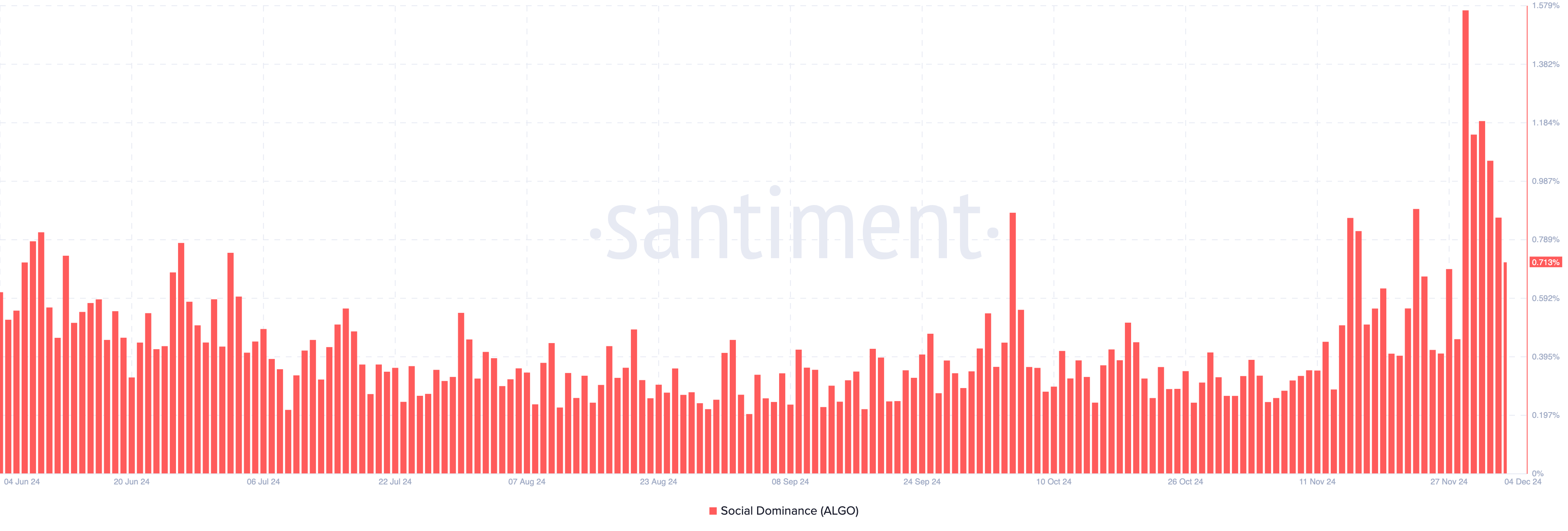

One other metric suggesting that ALGO’s price might find it challenging to recover is social dominance. Social dominance refers to the share of discussions related to a cryptocurrency compared to other assets in the top 100.

When the metric’s rating increases, there will be more discussions concerning the altcoin. In most cases, this drives higher demand, which translates to an increasing value.

However, according to Santiment, Algorand’s social dominance has dropped from 1.56% on November 30 to 0.71% today. Given the current condition, ALGO’s value might experience a further decline.

Algorand Social Dominance. Source: Santiment

Algorand Social Dominance. Source: Santiment

ALGO Price Prediction: Altcoin Could Go Lower

As of this writing, ALGO’s price is $0.51. On the 4-hour chart, the altcoin appears to be on the verge of dropping below the 20-period Exponential Moving Average (EMA).

The EMA is a technical indicator that tracks the price changes of an asset within a given period. When the price is above the EMA, the trend is bullish. But in Algorand’s situation, the declining price suggests that the token risks a major correction.

Algorand 4-Hour Analysis. Source: TradingView

Algorand 4-Hour Analysis. Source: TradingView

If validated, Algorand’s price might drop to $0.38. However, if buying pressure increases and the altcoin fails to drop below the EMA, this prediction might not come to pass. Instead, the value could climb to $0.61.