Bitcoin Buyers Gear Up as More Stablecoins Flood the Exchanges

Bitcoin (BTC) has been trading within a narrow range over the past week, struggling to break above the $100,000 mark. The leading coin’s price has faced resistance at $98,804 and has found support at $94,603.

However, a decline in a critical on-chain metric suggests that the coin may be poised for a significant upward trend in the near term.

Stablecoin Power and Holder Confidence Boost Bitcoin Outlook

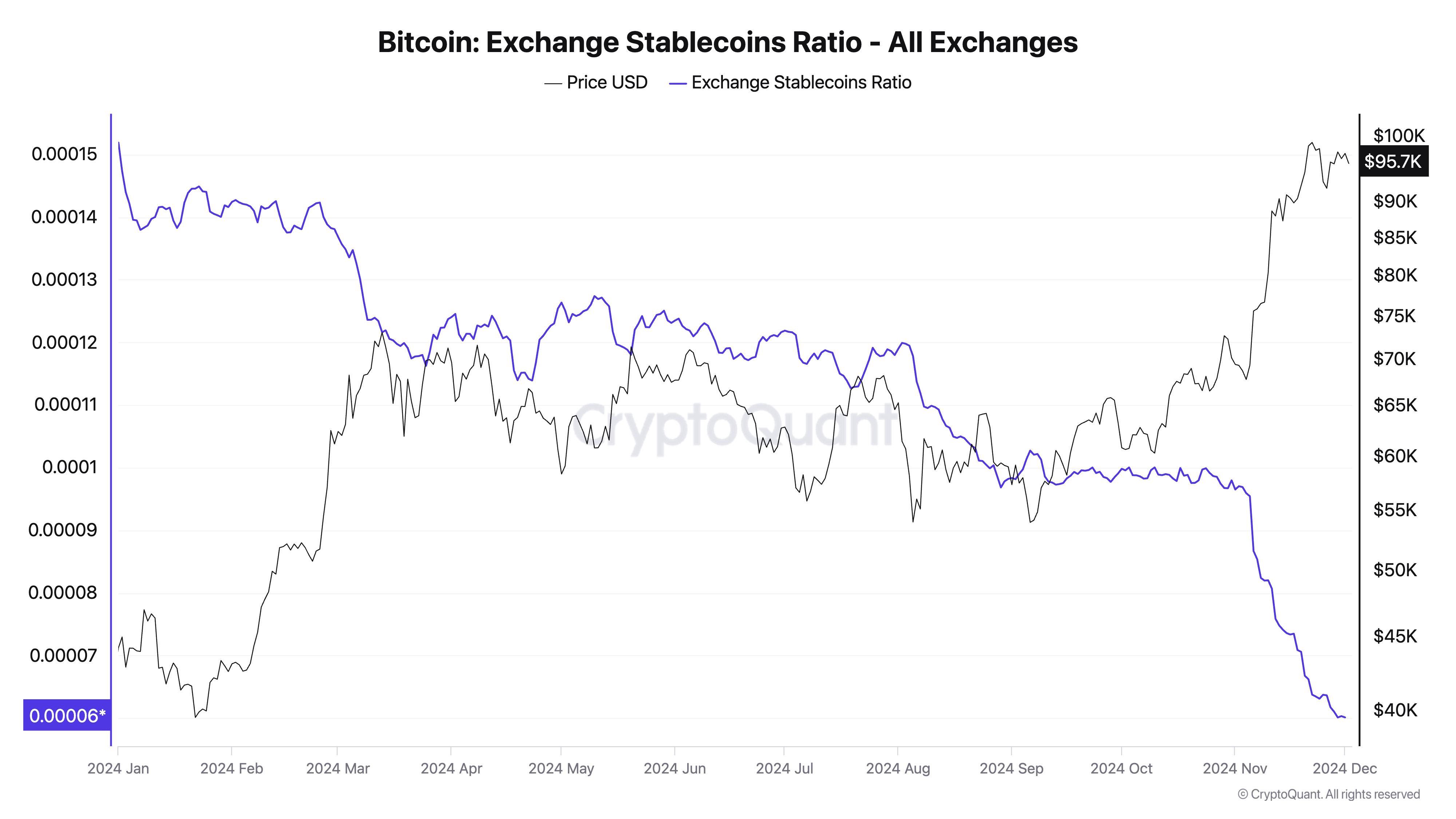

BeInCrypto’s assessment of BTC’s on-chain performance has revealed a steady fall in its Exchange Stablecoins Ratio. Per CryptoQuant’s data, this stands at 0.000060 as of this writing, its lowest level since the beginning of the year.

The Exchange Stablecoins Ratio measures the amount of stablecoins held on exchanges relative to the amount of Bitcoin. A lower ratio indicates more buying power in the market, as there are more stablecoins for purchasing Bitcoin on exchanges.

When this ratio dips, it often signals a higher demand for Bitcoin. As more investors seek to acquire Bitcoin, the coin’s price is likely to rise. This could potentially push it back toward the $100,000 psychological mark, which it has struggled to breach.

BTC Exchange Stablecoins Ratio. Source: CryptoQuant

BTC Exchange Stablecoins Ratio. Source: CryptoQuant

Further, the growing trend of short-term Bitcoin holders adopting a “HODL” strategy could fuel a rally toward the $100,000 mark. According to CryptoQuant, this group — typically those holding BTC for less than a month — has extended their holding period by 36% over the past month.

Longer holding periods reduce selling pressure, create scarcity in the market, and often signal confidence in the coin’s price growth. This can contribute to upward momentum for Bitcoin in the near term.

Bitcoin Address By Time Held. Source: IntoTheBlock

Bitcoin Address By Time Held. Source: IntoTheBlock

BTC Price Prediction: What to Expect?

BTC is currently trading at $96,882, just below its all-time high of $99,860, which remains a strong resistance level. If short-term holders continue their “HODL” strategy and new demand arises — supported by the influx of stablecoins on exchanges — Bitcoin could surpass this barrier and move toward the $100,000 milestone.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if selling pressure intensifies, BTC’s price might consolidate within its current range or dip further to $88,986 before attempting another upward move.