Crypto Today: BTC halts at $98K, Microstrategy buys again as XRP, XMR, DASH emerge top gainers

- The cryptocurrency sector valuation shrank hit a new all-time high of $3.5 trillion on Monday.

- Bitcoin Dominance (BTC.D) dropped to a 3-month low of 57%, signaling that investors are leaning towards the altcoins.

- Crypto market liquidations hit $647.46 million on Monday, with $428 million long liquidations representing 66% of the losses.

Altcoin market updates: TON emerges as top gainer as BTC rally squeezes altcoins

Bitcoin price failed another attempt at breaching the $100,000 mark on Monday, as investors’ attention remains skewed towards the altcoin markets. Despite another large purchase from Microstrategy, Ethereum (ETH), Ri

ple (XRP) and Litecoin (LTC) all outperformed BTC within the daily timeframe.

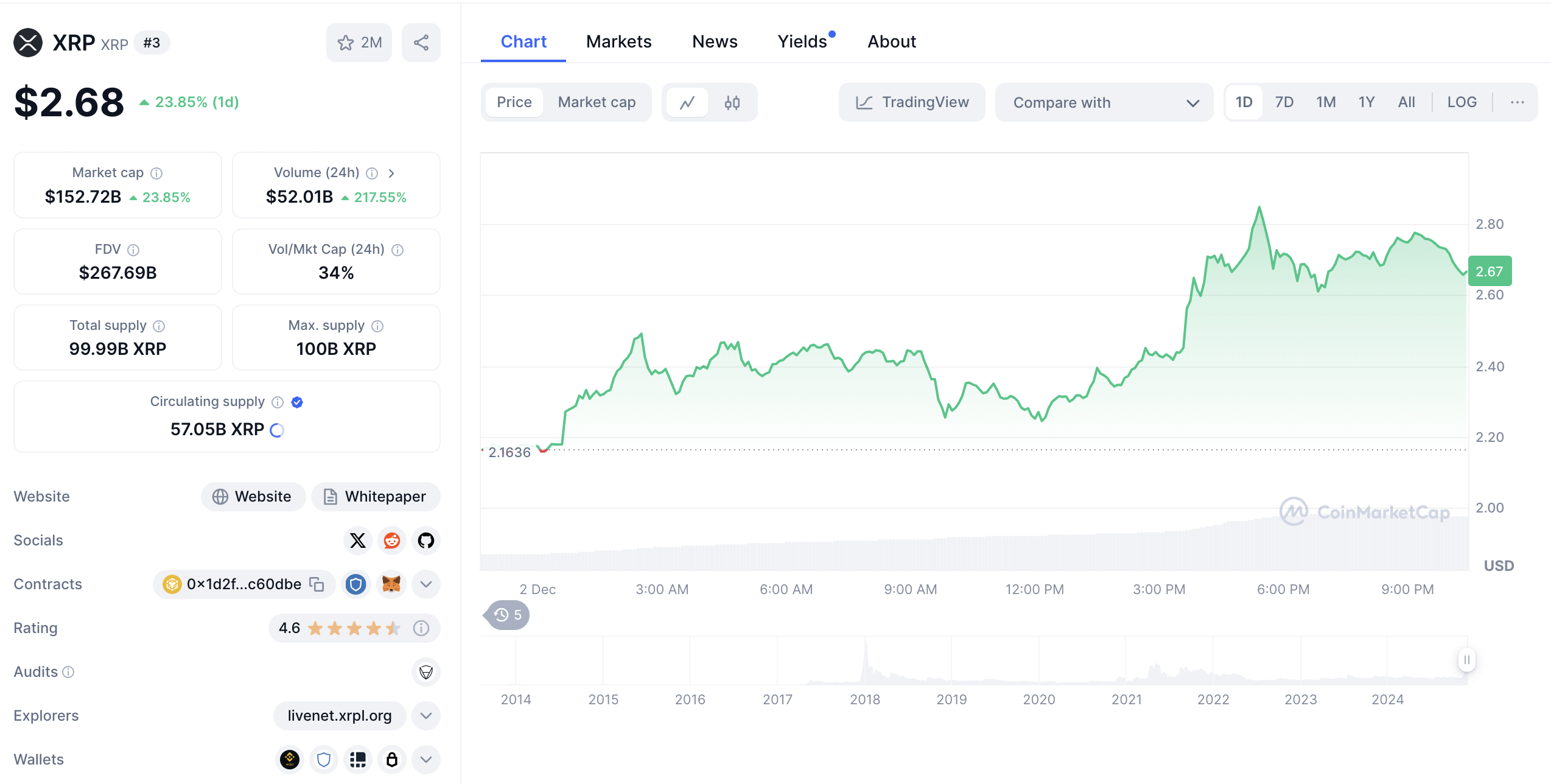

- Ripple (XRP) price hits three-year peak

On Monday, XRP price rose by more than 20%, crossing the $2.7 mark for the first time since 2021. The XRP price rally was driven by WisdomTree, a major asset management firm, which officially filed with the SEC for a spot XRP exchange-traded fund (ETF).

Ripple (XRP) price action December, 2 2024

Amid the rally, XRP’s market cap crossed $150 billion, flipping both Solana and USDT to become the third-largest cryptocurrency.

- Litecoin (LTC) price also recorded 16% gains on Monday, propelled by positive sentiment surrounding WisdomTrees XRP ETF application.

With Trump poised to replace Gensler with a crypto-friendly candidate, investors are placing long bets on assets with ongoing ETF filings, including XRP, LTC, and SOL.

- Ethereum (ETH) price fell 3% breaking below the $3,600 support, as investors rotated capital towards better performing altcoins.

Chart of the day: Privacy coins hit $7B market cap after TornadoCash ruling

The recent U.S. appeals court ruling overturning sanctions on Tornado Cash has reignited interest in privacy-focused cryptocurrencies. According to Reuters, the US appeals court declared that the U.S. Treasury Department exceeded its authority by sanctioning Tornado Cash, a cryptocurrency mixer accused of facilitating money laundering.

The ruling emphasized that Tornado Cash's immutable smart contracts do not qualify as "property" under federal law, setting a precedent for distinguishing decentralized protocols from traditional assets in regulatory frameworks. This decision was hailed as a win for advocates of decentralized finance and privacy rights in crypto.

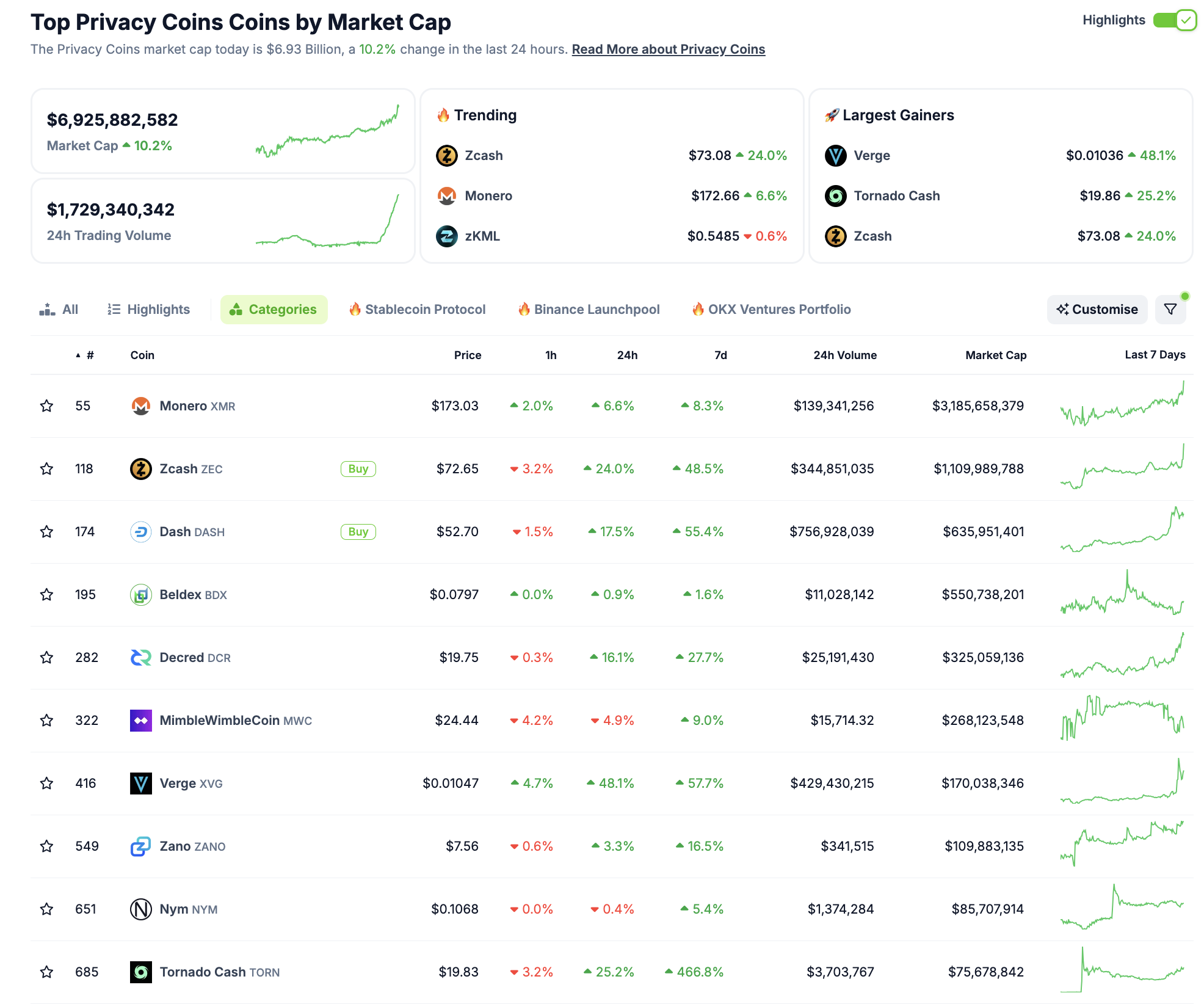

Privacy Coin Sector Performance | December 2, 2024 | Source: Coingecko

In the aftermath of the ruling, privacy-focused cryptocurrencies witnessed a sharp rally. The sector's market cap surged by 10.2% within 24 hours, surpassing $7 billion.

This indicates heightened investor interest in assets that prioritize anonymity and transactional privacy. Tornado Cash (TORN), led the charge with a 25.2% increase, signaling renewed confidence among privacy coin enthusiasts.

Among the top-performing privacy coins, Monero (XMR), Zcash (ZEC), and Dash (DASH) stood out. Monero, a pioneer in privacy-focused blockchain technology, rose by 6.6% in the last 24 hours, reflecting its robust use case and $3.18 billion market cap.

Zcash saw the highest surge among top coins, with a 24% jump, driven by its advanced privacy features like zero-knowledge proofs. Dash also impressed with a 17.5% increase, underpinned by strong trading volumes of $756 million. Together, these assets underscore the growing appetite for privacy-preserving cryptocurrencies in the wake of regulatory clarity.

Crypto news updates:

- European Central Bank (ECB) releases second progress report on digital Euro

The European Central Bank (ECB) has released its second progress report on the digital euro, highlighting advancements in the framework for a central bank digital currency (CBDC) and a unified payment system across the eurozone.

The report outlines updates to the digital euro scheme rulebook, emphasizing efforts to streamline CBDC payments for better interoperability within the euro area.

Additionally, the ECB is in the process of selecting potential providers for key components of the digital euro infrastructure, a crucial step toward operational readiness.

To enhance user adoption and functionality, the ECB is actively conducting user research and forming innovation partnerships.

These initiatives aim to explore advanced features such as conditional payments, which could expand the use cases for the digital euro.

The ECB plans to release key insights from these studies by mid-2025, signaling a continued commitment to ensuring the digital euro meets the needs of consumers and businesses alike.

-

Marathon Digital (MARA) issues $700M debt note buy more BTC

MARA Holdings has announced plans to issue $700 million in zero-coupon convertible senior notes set to mature in 2031.

Targeted at qualified institutional investors, the offering aims to fund strategic expansions, including the repurchase of existing convertible notes and the acquisition of additional Bitcoin.

The company has also provided initial purchasers with an option to acquire up to $105 million in additional notes, reflecting confidence in demand for the offering.

Of the net proceeds, MARA Holdings intends to allocate up to $50 million to repurchase a portion of its outstanding notes, while the remaining funds will be directed toward expanding its Bitcoin reserves and supporting general corporate initiatives.

DMM Bitcoin, a Japanese Crypto exchange, set to liquidate following $320 million hack

Japanese cryptocurrency exchange DMM Bitcoin has announced its decision to liquidate following a devastating $320 million loss resulting from a private key hack in May.

The breach, which resulted in the theft of over 4,500 bitcoins, left the exchange unable to recover the stolen funds despite extensive efforts.

As a result, DMM Bitcoin has decided to shut down operations and wind up its business.