Hedera (HBAR) Breaks Two-Year Price Barrier, Pushing Open Interest Past $220 Million

HBAR, the native cryptocurrency of the Hedera Hashgraph network, has rocketed by 41% over the past 24 hours. It currently exchanges hands at $0.24, trading above the $0.20 psychological barrier for the first time in two years.

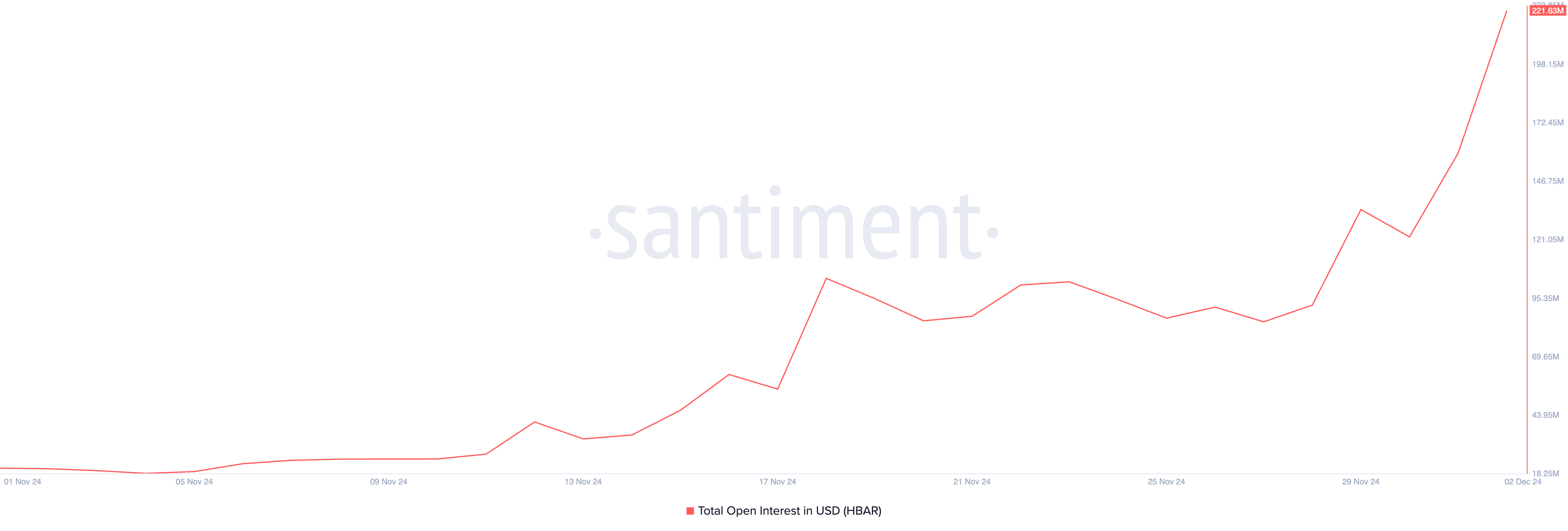

This double-digit price surge has led to an uptick in activity in its derivatives market, evidenced by its soaring open interest, which is now at an all-time high.

Hedera Is the Talk of the Town

Hedera has been generating significant buzz recently, attracting attention to its token. The current HBAR token price surge can largely be attributed to growing rumors surrounding a potential collaboration between Ripple and Hedera on a global settlement standard, as the former plans to expand its RLUSD stablecoin to the network.

In addition, crypto investment firm Canary Capital has submitted a proposal to the SEC for the first-ever Hedera HBAR spot exchange-traded fund (ETF). This would provide institutional investors with direct exposure to the HBAR token if approved.

These developments have captured the market’s attention, as reflected in the surge in HBAR’s open interest. At press time, it is $222 million, having risen by over 1000% in the past 30 days.

HBAR Open Interest. Source: Santiment

HBAR Open Interest. Source: Santiment

Open interest refers to the total number of outstanding contracts or positions in a particular asset, such as futures or options, that have not been settled. When open interest climbs during a price rally, new positions are being opened, suggesting strong market participation and confidence in the continued price movement.

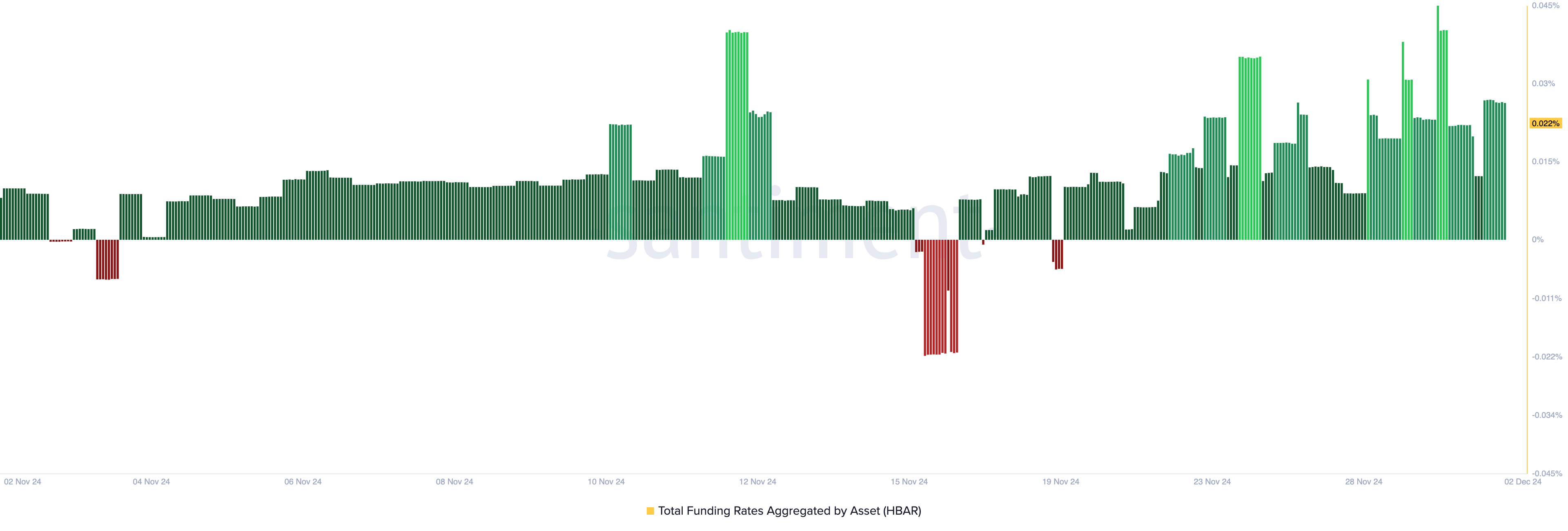

HBAR’s positive funding rate further supports its bullish outlook, currently standing at 0.022%.

The funding rate is a periodic fee exchanged between long and short positions in perpetual contracts, helping keep the contract’s price aligned with the asset’s spot price. A positive funding rate indicates that long positions are paying short positions, reflecting bullish sentiment as more traders expect the price to increase.

HBAR Funding Rate. Source: Santiment

HBAR Funding Rate. Source: Santiment

HBAR Price Prediction: There Is Room for More Growth

HBAR’s Super Trend indicator on the one-day chart signals the potential for an extended rally. The price currently sits above the green line of the indicator, reflecting bullish pressure.

The Super Trend indicator tracks the direction and strength of a price trend, appearing as a line on the chart. Green denotes an uptrend, while red indicates a downtrend. If the uptrend continues, HBAR’s price could reach $0.30.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView

However, a decline in positive momentum may result in a decline to $0.15, invalidating this bullish projection.