Algorand reaches fresh two-year high supported by bullish on-chain metrics

- Algorand’s price extends its rally by over 15% on Friday and reaches a fresh two-year high after surging more than double-dight the previous day.

- On-chain data paints a bullish picture as ALGO’s Open Interest and TVL are rising to record levels.

- A weekly candlestick close below $0.276 would invalidate the bullish thesis.

Algorand (ALGO) extends its gains and trades higher by more than 15% at the time of writing on Friday, breaking above the year-to-date high of $0.33 established in March and reaching levels not seen in over two years, after rallying 54% the previous week. On-chain data support for the bullish outlook is strong, as ALGO’s Open Interest (OI) and Total Value Locked (TVL) are rising to record levels, indicating a further rally in the upcoming days.

Algorand bulls eyes for $0.45 mark

Algorand price extends its ongoing rally, surging more than 30% so far this week after rallying 54% the previous one. At the time of writing on Friday, it trades higher by more than 15%, reaching levels not seen since November 8, 2022.

If ALGO continues its upward momentum, it could extend the rally to retest its October 2022 weekly high of $0.45.

However, the Relative Strength Index (RSI) momentum indicator on the weekly chart stands at 79, signaling overbought conditions and suggesting an increasing risk of a correction. An RSI’s move out of overbought territory could signify a pullback.

ALGO/USDT weekly chart

Crypto intelligence tracker DefiLlama data shows that Algorand’s TVL increased from $125.25 million on Tuesday to $157.97 million on Friday, constantly rising since early November.

This 26% increase in TVL indicates growing activity and interest within the Algorand ecosystem. It suggests that more users deposit or utilize assets within ALGO-based protocols, adding credence to the bullish outlook.

ALGO TVL chart. Source: DefiLlama

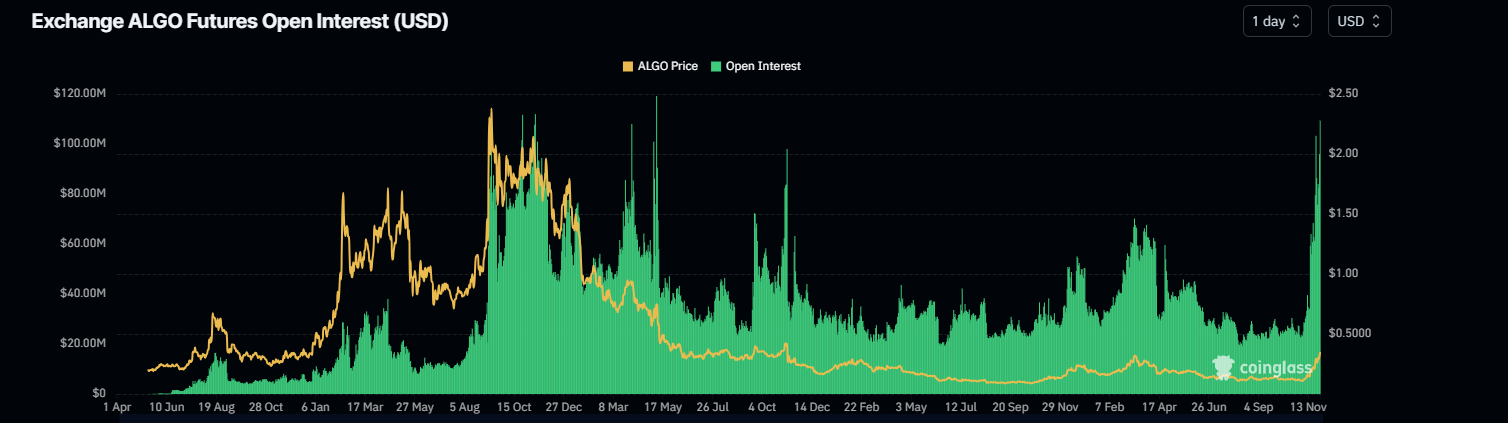

Algorand’s Open Interest (OI) is also supporting the bullish outlook. Coinglass’s data shows that the futures’ OI in ALGO at exchanges rose from $75.69 million on Tuesday to $95.87 million on Friday, the highest level since November 2022. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Algorand price.

ALGO Open Interest chart. Source: Coinglass

Lastly, the Annual Percentage Yield (APY) associated with ALGO investments has sparked interest, particularly during Thanksgiving, suggesting investors are keen to capitalize on lucrative returns.

Even though on-chain metrics and technical analysis support the bullish outlook, if the ALGO weekly candlestick closes below the $0.27 weekly support level, the bullish thesis will be invalidated, leading to a price decline to retest its weekly low of $0.25.