Crypto Today: BTC climbs to $97K, SHIB demand dips, TON lifted by Tornado Cash verdict

- The cryptocurrency sector’s valuation shrank $60 billion to hit $3.2 trillion on Thursday.

- Bitcoin Dominance (BTC.D) increased by 0.40% on the daily timeframe, signaling that BTC demand surpassed altcoins.

- Crypto market liquidations hit $263 million on Thursday, with $145 million in long liquidations representing 55% of the losses.

Altcoin market updates: TON emerges top gains as BTC rally squeezes altcoins

Bitcoin price rose 4% on Thursday, breaching the $97,000 mark after opening at $91,947 on Wednesday.

Amid the BTC rally, privacy-inclined projects like Monero (XMR) and Toncoin (TON) received a major boost alongside crypto AI coins such as Render (RNDR) and Artificial Super Intelligence Alliance, (FET).

- Monero (XMR) price surges 2% amid Tornado Cash ruling:

On Wednesday, a United States (US) court ruled that immutable smart contracts, like those used by Tornado Cash, cannot be sanctioned as property.

This decision challenges previous Treasury Department sanctions and supports the autonomy of blockchain protocols.

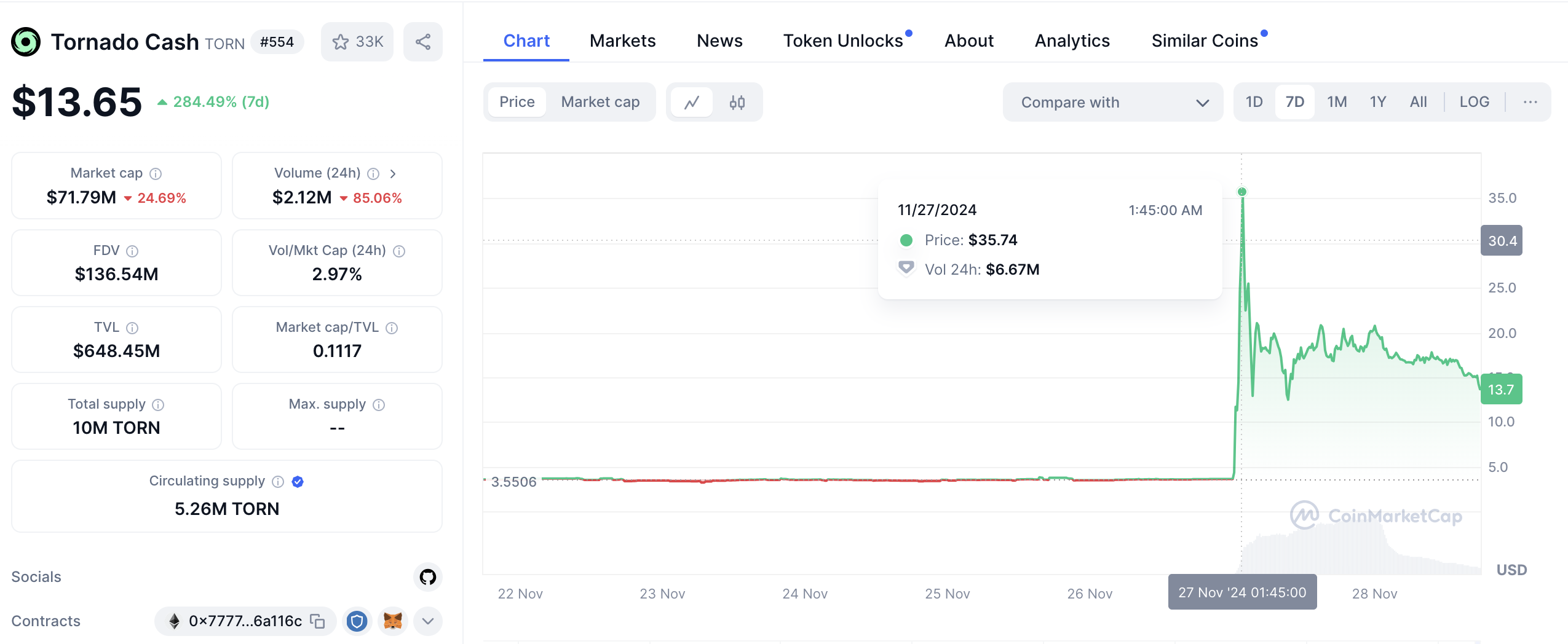

Tornado Cash (TORN) token price action | Source: Coinmarketcap

The ruling led to a massive market reaction, with Tornado Cash’s (TORN) token surging over 380% to reach $35.7, before retracing towards $13.7 on Thursday.

Meanwhile, Tornado Cash developer Alexey Pertsev remains detained, and the ruling does not endorse illegal activities like money laundering.

This case sets a critical precedent for regulatory boundaries in blockchain innovation.

- Monero (XMR) price surged 2.2%, while Toncoin (TON) gained 4% on Thursday as the Tornado Cash ruling spread bullish tailwinds toward privacy-focused assets.

- Crypto AI tokens Render Network (RNDR) and Artificial Super Intelligence Alliance (FET) also received considerable demand scoring 7% and 8% gains, respectively.

Chart of the day: Shiba Inu whale demand drops 85% after Trump’s DOGE announcement

Trump’s re-election on November 5 has had a significant impact on the cryptocurrency market.

While prices of top-ranked assets like BTC and ETH rose more than 30% within the monthly time frame, Trump’s impact also triggered a major shift in sentiment within the memecoin markets.

On November 12, Dogecoin price hit a 3-year peak of $0.47 after Trump confirmed Elon Musk’s involvement in the proposed Department of Government Efficiency (DOGE).

However, on-chain data shows that while the Dogecoin rally hogged the media spotlight, rival meme token Shiba Inu (SHIB) has ceded considerable investor mindshare, especially among whales.

IntoTheBlock’s Whale Transactions count below, lends credence to this narrative. The metric tracks the daily number of individual transactions that exceed $100,000 in value, serving as a proxy for measuring the activity of whale investors around key market events.

Shiba Inu Whale Transaction count | Source: IntoTheBlock

The chart above shows that the Shiba Inu network recorded 1,500 whale transactions as of November 12. Since then, whale demand for SHIB has entered a steep decline.

The latest data shows the Shiba Inu blockchain saw only 229 large transactions on the SHIB network on November 27, reflecting an 85% drop-off in whale demand since Trump announced the DOGE on X.

Whale transactions provide crucial liquidity, absorbing sell pressure and enabling retail traders to execute high volumes of transactions with minimal price impact.

Unsurprisingly, Shiba Inu price entered a 17% pullback during that period, moving from $0.000030 to $0.000025 at the time of writing on Thursday.

If it persists, Shiba Inu’s 85% dip in whale demand amid Dogecoin’s dominance and the growing popularity of Solana memes exposes SHIB price to major correction risks.

Crypto news updates:

- Russia awaiting Putin’s signature after crypto tax bill approval

Russia's Federation Council has approved a new legislation imposing taxes on cryptocurrency transactions and mining.

The bill exempts crypto transactions from value-added tax (VAT), treating digital currencies as property and aligning crypto income tax rates with those of securities.

The proposed law mandates crypto miners to report client data to tax authorities and calculate mining income taxes based on the market value at receipt.

Awaiting President Vladimir Putin's signature, the bill aims to establish a clearer regulatory framework for Russia's growing crypto industry.

- Hong Kong moots crypto tax exemptions for hedge funds

Hong Kong is proposing tax exemptions for hedge funds, private equity firms and high-net-worth investors on crypto gains to bolster its standing as a global financial hub.

The plan also includes expanded exemptions for assets like private credit, overseas property and carbon credits, aiming to attract top asset managers.

According to a Financial Times report, Hong Kong’s crypto-friendly initiative put the nation in stiff competition with the likes of Singapore, Luxembourg and Switzerland to attract billionaires and asset managers.

- Paul Atkins emerged favorite to replace Gary Gensler as SEC chair

According to a Bloomberg report, President-elect Donald Trump’s transition team has interviewed Paul Atkins as a candidate to replace Gary Gensler as the US Securities and Exchange Commission (SEC) chair.

Paul Atkins is a pro-digital asset advocate who served as a former SEC commissioner under President George W. Bush.

Following Gary Gensler's tenure marked by aggressive crypto crackdowns, Trump is widely expected to lean towards pro-Bitcoin candidates, having pledged to appoint regulators supportive of digital assets.

Other candidates being considered by the presidential transition team include current SEC Commissioner Mark Uyeda, securities lawyer Teresa Goody Guillén and Willkie Farr & Gallagher LLP partner Robert Stebbins.