Fortnite Pro-Turned-Scammer Tied to $3.5 Million Theft via Meme Coin Fraud

Australian Fortnite YouTuber SerpentAU, once celebrated for his exceptional in-game skills, now finds himself at the center of a significant crypto fraud scandal.

Blockchain investigator ZachXBT revealed that SerpentAU, whose real name remains undisclosed, played a major role in a $3.5 million theft scheme executed through meme coin scams. This marks a dramatic fall from grace for the former esports talent who was dropped from Overtime Gaming in 2020 following cheating allegations.

From Gaming Scandal to Crypto Fraud

ZachXBT’s detailed investigation highlights SerpentAU’s involvement in multiple account takeovers (ATOs). The YouTuber targeted high-profile entities, including McDonald’s, Usher, and the creator of the Kabosu meme coin.

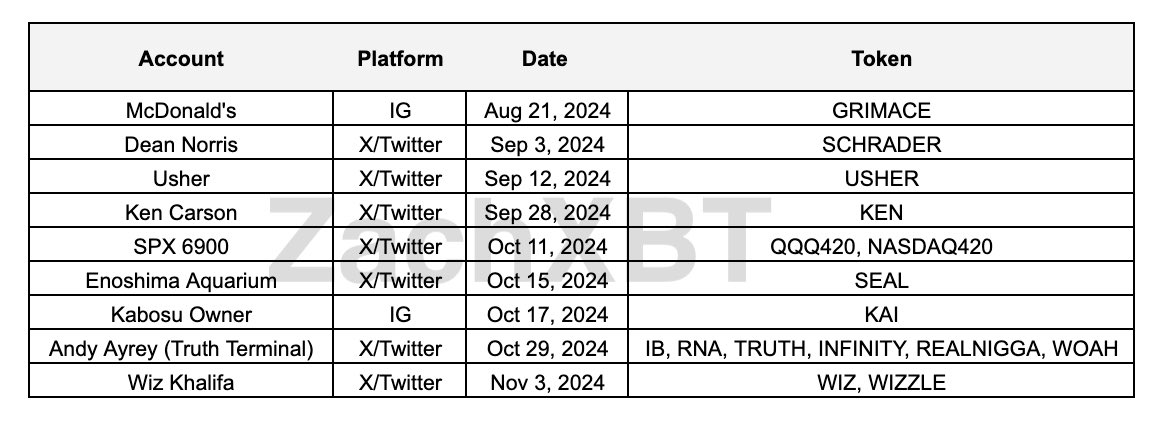

“Over the past few months, I have been tracking a series of related compromises for McDonald’s, Usher, Kabosu Owner, Andy Ayrey, Wiz Khalifa, SPX 6900, etc on X & IG which has resulted in an estimated $3.5M+ stolen via launching Pump Fun meme coins,” the blockchain sleuth said.

SerpentAU’s Victims. Source: ZachXBT

SerpentAU’s Victims. Source: ZachXBT

These compromised social media accounts served to promote fraudulent cryptocurrencies, leading unsuspecting followers to invest heavily. For instance, the McDonald’s Instagram hack alone netted over $690,000 for scammers. The bad actor funneled the funds through blockchain wallets connected to SerpentAU.

Using timing analysis and on-chain tracking, ZachXBT linked funds from these swindles to gambling platforms like Stake and Roobet. SerpentAU reportedly wagered millions on these platforms. In one instance, a leaked Discord screen share revealed Serpent making high-value deposits and withdrawals tied to wallets implicated in the scams.

SerpentAU first gained notoriety in 2020 after being exposed for using macros, software tools that enabled unfair advantages in Fortnite’s Creative mode. Despite expressing remorse and attributing his actions to a lack of understanding of their severity, his career trajectory took a darker turn.

By 2022, SerpentAU had co-founded NFT (non-fungible token) and cryptocurrency projects such as DAPE and ERROR. Both of these projects collapsed amid accusations of fraudulent activity. These ventures set the stage for his deeper entanglement in blockchain-based scams.

As the details of SerpentAU’s involvement emerge, the repercussions extend beyond crypto. Victims of the scams are left grappling with significant financial losses. The esports community must confront the ethical lapses of one of its former stars. In an ironic twist, Serpent’s early apology for cheating in Fortnite included a plea for understanding.

“My actions were blurred by the money, influence, and experiences I was having,” SerpentAU had said.

These words now echo as a grim foreshadowing of his trajectory into crypto fraud. The case serves as a stark reminder of the changing nature of online fraud.

The role of social media platforms as conduits for malicious actors also becomes apparent. As ZachXBT continues to unravel the full scope of these schemes, the crypto and gaming communities reckon with the cost of misplaced trust in influential figures.

Meanwhile, this is not ZachXBT’s first major investigation. The blockchain sleuth has previously exposed significant frauds, including phishing scams targeting Coinbase users. He also revealed meme coin manipulations involving prominent figures like influencer Murad.

His work also led to the arrest of hackers linked to Genesis Trading creditors. Some also prompted the resignations of key figures in OpSec Williams after allegations of fraud came to light. ZachXBT’s consistent focus on uncovering deceit within the crypto ecosystem reflects the broader risks investors face.