Bitcoin remains short of $100K as long-term holders capitalize on recent price rise

- Bitcoin trades below $100K as long-term holders continue to hinder its price from reaching the psychological milestone.

- Glassnode data noted that long-term holders have been taking profit near $100K.

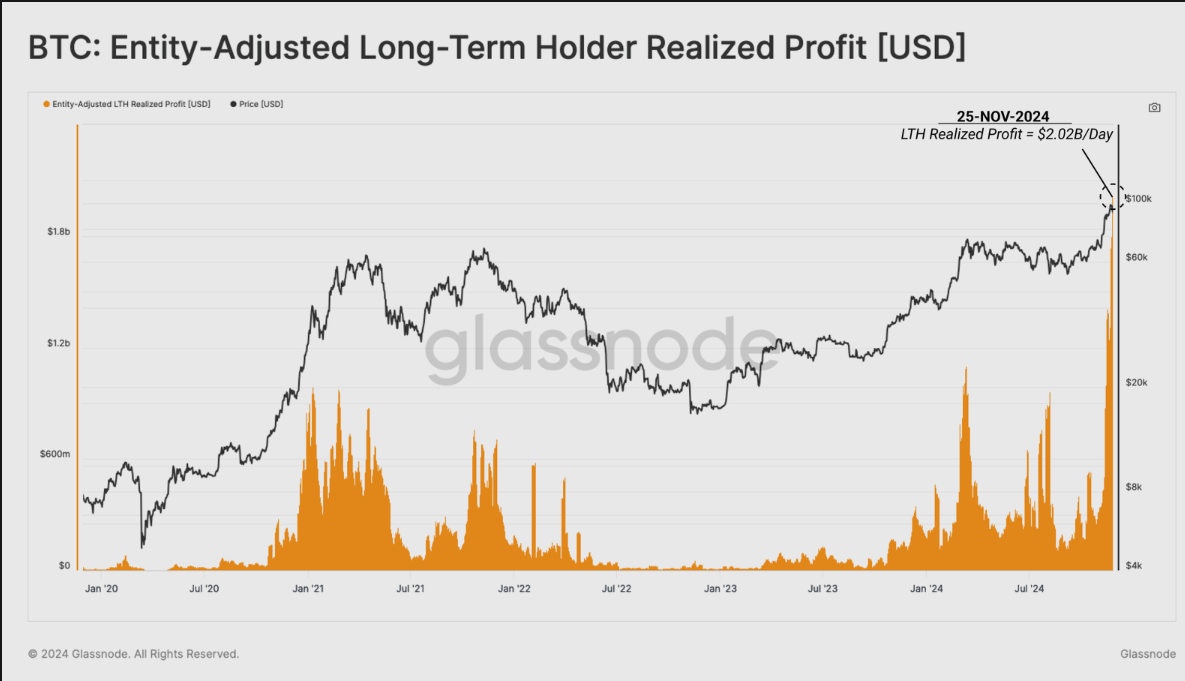

- Bitcoin's consecutive all-time highs have resulted in $2 billion daily profit for long-term holders.

Bitcoin (BTC) trades below $95K on Tuesday following increased selling pressure among long-term holders (LTH) after a series of new all-time highs (ATH).

BTC declines as long-term holders increase profit-taking

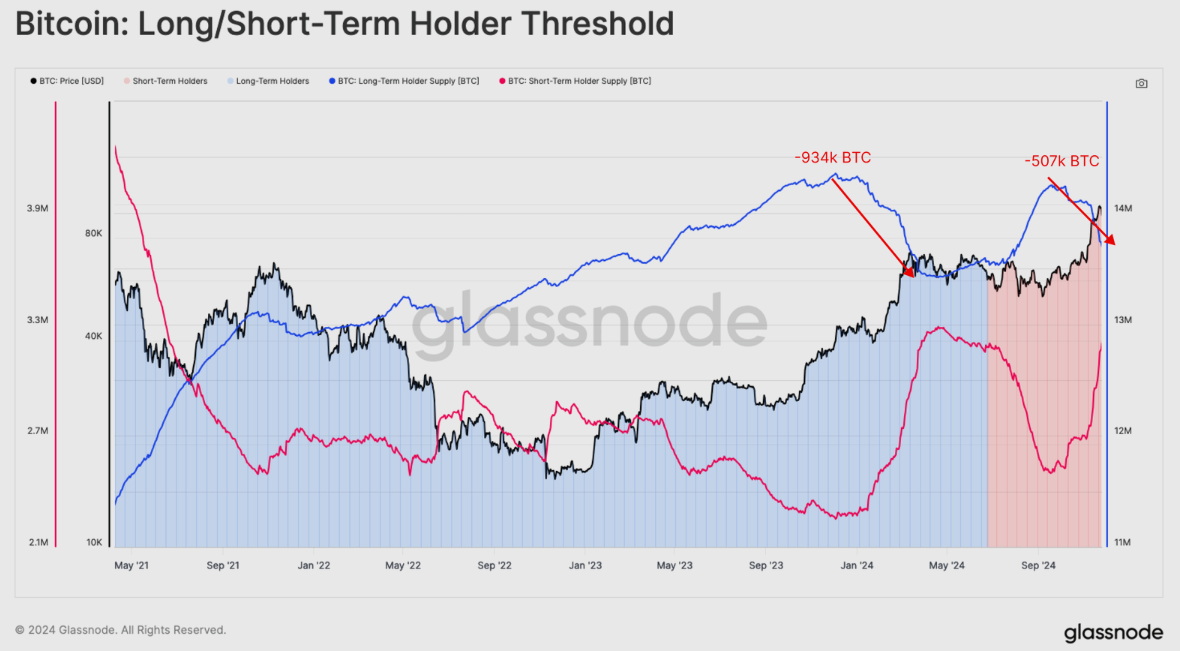

Bitcoin is trading at $92K as expectations for a $100K run meet sustained selling pressure from long-term holders. Glassnode's weekly crypto report suggests that LTHs have distributed 507K Bitcoin between September and November.

"Since the peak in LTH supply set in September, this cohort has now distributed a non-trivial 507K BTC," Glassnode noted.

This substantial volume, although noteworthy, is smaller than the 934K BTC that investors spent during the previous rally leading up to the March 2024 ATH.

BTC Long/Short-term Holder Threshold | Glassnode

Glassnode also highlights that "an average of 0.27% of the LTH supply is being distributed daily," with only 177 out of all trading days reflecting a heavier distribution rate. This trend suggests an increased willingness among long-term holders to conduct transactions.

It also indicates that the current distribution rate of LTH spending surpasses that seen during the March 2024 ATH, signaling a more aggressive approach to distribution as the market moves towards the $100,000 valuation.

Likewise, long-term holders are now realizing a staggering $2.02 billion in profits daily, marking an all-time high (ATH) and surpassing a previous record set in March. This surge in profit indicates an increasing confidence among long-term investors to capitalize on favorable market conditions.

BTC: Entity-Adjusted LTH Realized Profits (USD) | Glassnode

Also, the Sell-Side Risk Ratio — a tool used to calculate the total volume of realized profit and loss taken in by investors — is drawing near the high-value band. This signals that holders are taking profit close to the $100K level, resulting in a price decline every time prices approach the level.

Additionally, the amount of realized profit for tokens held between six months to a year also hit a record of $12.6 billion. In comparison, tokens held for one to two years and longer accounted for a smaller portion of sell-side pressure — specifically, the six-month-held tokens represented 35% of the total sell-side pressure.