Crypto Today: ADA, AVAX, TON in profit as BTC stalls at $100K

- The cryptocurrency sector valuation opened at $3.27 trillion on Monday, holding all-time highs despite Bitcoin stagnating below $100,000.

- In the derivatives markets, long liquidation stood at $260.8 million, surpassing shorts at $163.4 million.

- Dominant long position liquidations amid rising market capitalization signals that traders are rotating profits within the crypto sector.

Altcoin market updates: ADA, AVAX, TON emerge as top gainers

While BTC has stagnated on Monday, traders are redirecting capital toward mid-cap assets, driving the likes of Cardano (ADA), Avalanche (AVAX) and Toncoin (TON) above key resistance levels.

- Cardano (ADA) bulls battling to hold $1 spot:

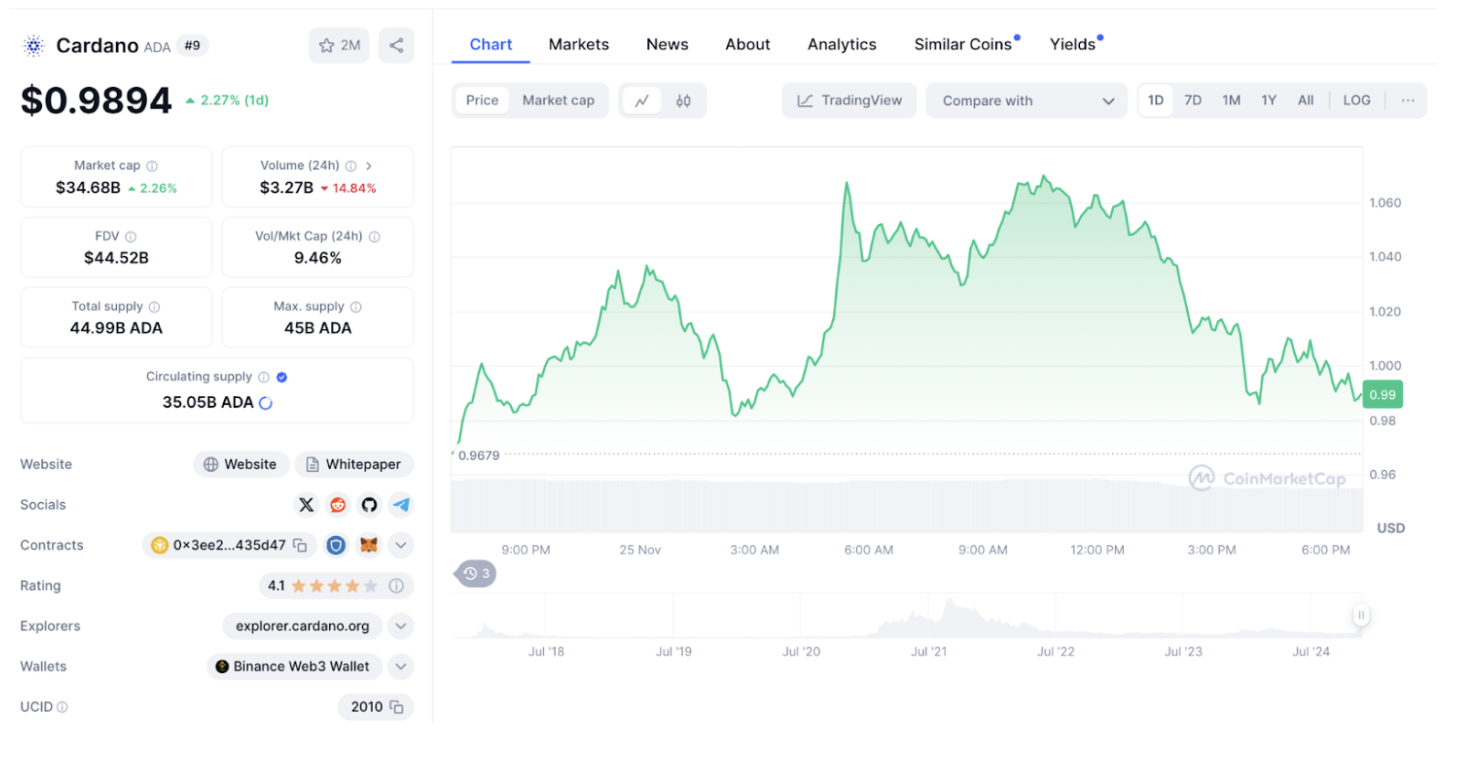

Cardano (ADA) price made headlines on Monday as it held firm above the $1 mark, having tested the new two-year peak around $1.20 last week.

Cardano (ADA) price action | November 25, 2024 | Source: CoinmarketCap

While Bitcoin price tumbled 3%, Cardano price gained 2.24% within the daily time frame, confirming growing confidence in the altcoin market.

ADA’s prominent bullish price catalyst remains Securities & Exchange Commission (SEC) head Gary Gensler’s exit and rumors of Trump’s administration partnering with Cardano for a new blockchain voting system.

- Avalanche (AXAX): 5% price gains today:

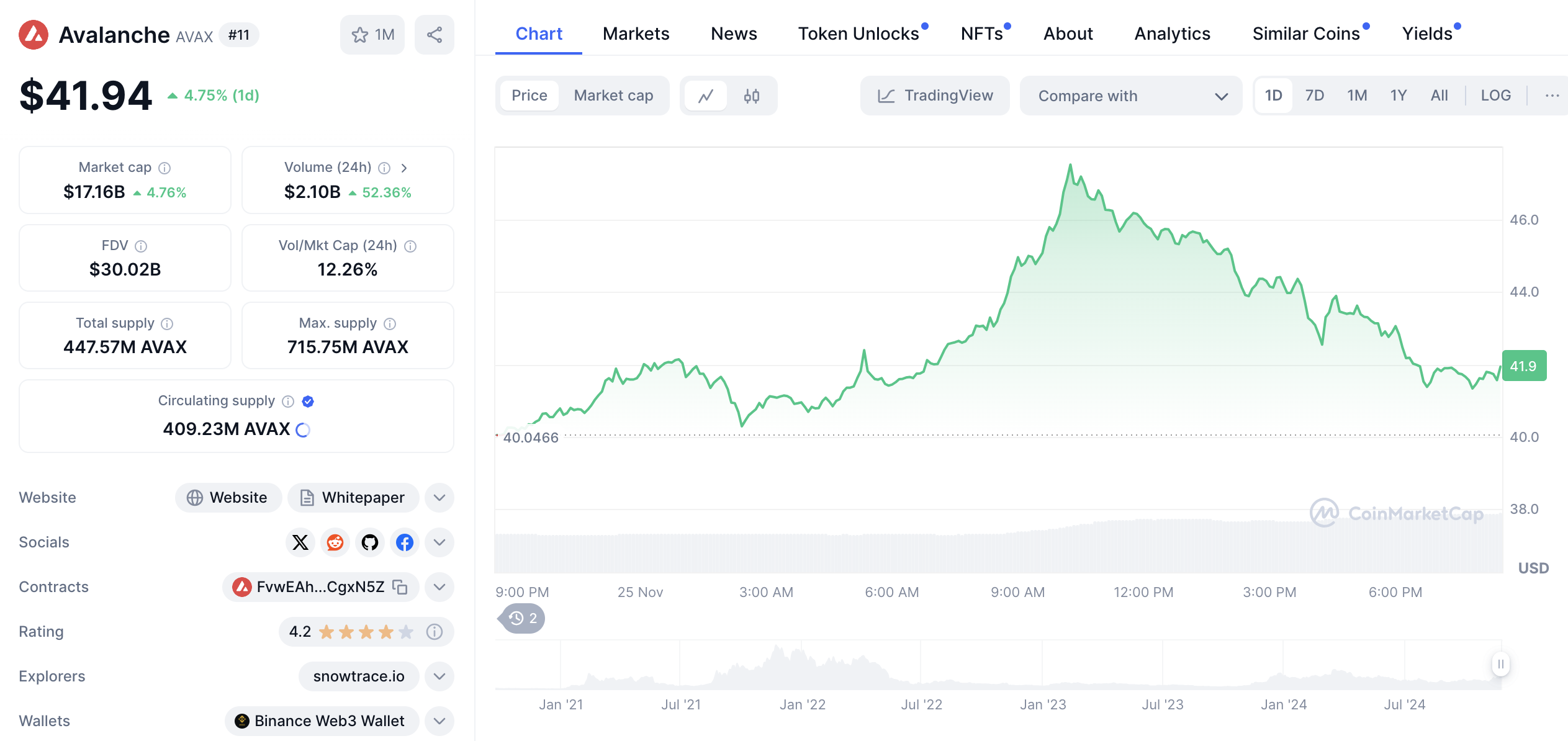

After weeks of underperforming, Avalanche raced up the top gainers chart with 5% gains on Monday, driving AVAX above the $40 resistance level for the first time since April.

Avalanche (AVAX) price action

With rival assets like Solana and Cardano trading at multi-year peaks, AVAX price still has ample room for more upside movement in the days ahead

- Toncoin (TON) gains momentum on Gensler exit:

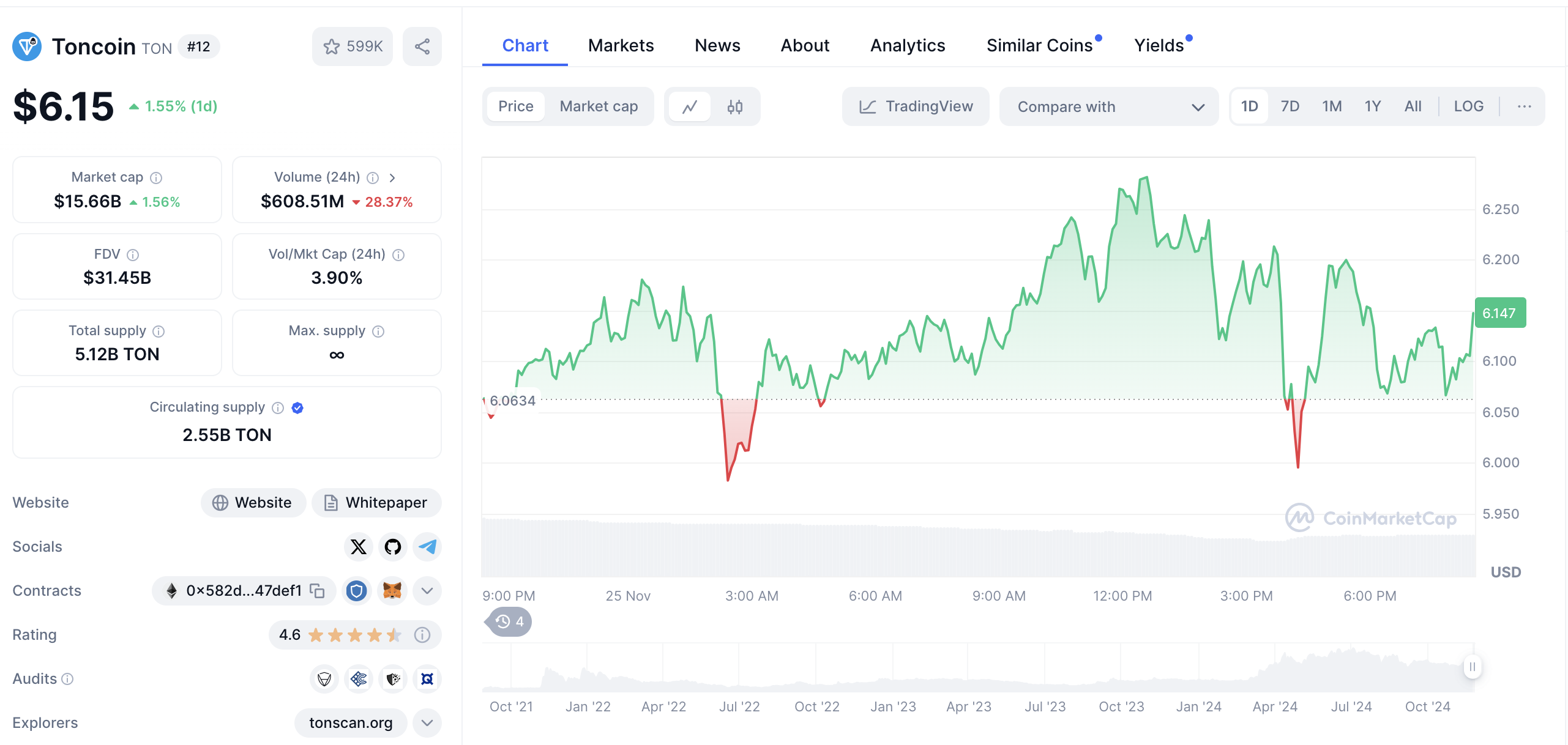

Toncoin price also flashed bullish signals as it gained 2% to reclaim the $6.15 level on Monday.

On November 23, barely 48 hours after Gensler’s exit was announced, TON price entered a major breakout to a new 90-day top of $6.60.

Toncoin price action (TONUSD) | November 2024

While weekend profit-taking saw Toncoin price dip below $5.90 in the early hours of November 25, bulls have promptly secured a rebound to reclaim the $6.15 level at the time of publication.

Chart of the day: How Gensler’s exit stopped Bitcoin’s $100K breakout

After weeks of speculation, the SEC confirmed that Chair Gary Gensler will exit the scene when the Trump administration is inaugurated January 20.

Rumors of a crypto-friendly replacement and positive shift in US regulatory stance toward cryptocurrencies has triggered positive sentiment across the crypto markets.

At first glance, market price charts show that assets like Ripple (XRP), Toncoin (TON), Cardano (ADA) and Binance coin (BNB) that have been encumbered by the legal run-ins with regulators all received a major boost.

However, unintended consequences of this market reaction appear to have prevented Bitcoin from staging a decisive breakout above $100,000.

The Bitcoin Dominance (BTC.D) chart tracks real-time value of BTC’s share of the global crypto market cap. This serves a critical metric for monitoring the directional flow of investments around key market events.

Bitcoin Dominance (BTC.D), November 2024 | TradingView

Bitcoin commanded 61.5% of the crypto market on November 21, with BTC price poised for the $100,000 breakout after Microstrategy announced its highest single-day purchase of 52,300 BTC at $4 billion earlier in the week. But since then things have taken a contrasting downturn.

After three consecutive days in decline out of four, the BTC.D metric now reads 58.7% at the time of publication on Monday, November 25.

This shows that Bitcoin has lost 4.5% market share over the last four days, coinciding with Gensler’s exit confirmation.

Meanwhile, during that period the TOTAL3 metric that captures the global crypto market capitalization excluding BTC and ETH, increased by 16.4%.

Evidently, following Gensler’s exit announcement, the improved regulatory sentiment around key altcoins saw investors re-direct capital away from Bitcoin.

This may have contributed to Bitcoin’s prolonged consolidation below the $100,000 mark despite dominant bullish sentiment for crypto assets.

Crypto news updates:

- Sui to enable Bitcoin staking from December 2024

Sui blockchain is set to tap into the $1.8 trillion Bitcoin market by partnering with Babylon Labs and Lombard Protocol to introduce BTC staking to Sui's DeFi ecosystem, integrating Bitcoin’s liquidity.

Starting in December, users can stake Bitcoin via Babylon’s protocol and receive LBTC, Lombard Protocol's liquid staking token, minted directly on Sui.

- MicroStrategy could own 4% of Bitcoin supply in ten years, says Bernstein

Bernstein analysts forecast that MicroStrategy will increase its Bitcoin holdings from 1.7% to 4% of the circulating supply within the next ten years.

This projection comes alongside an updated price target of $600 for MSTR by 2025, driven by the company’s aggressive capital scaling and unique Bitcoin treasury model.

- WisdomTree takes first step toward XRP ETF with Delaware Trust filing

WisdomTree, a global asset manager overseeing $113 billion AUM, filed to establish a Delaware trust for a potential XRP exchange-traded fund (ETF) on Monday.

This move makes WisdomTree the third digital asset manager to apply for XRP derivatives, behind Bitwise and Canary Capital.

With Gensler reportedly stepping down in January from the SEC, optimism is building around the approval of such funds in the near future.