5 Token Unlocks to Watch Next Week

Token unlocks release tokens previously restricted under fundraising agreements. Projects strategically schedule these releases to minimize market pressure and prevent token price declines.

Here are three major token unlocks to keep an eye on next week.

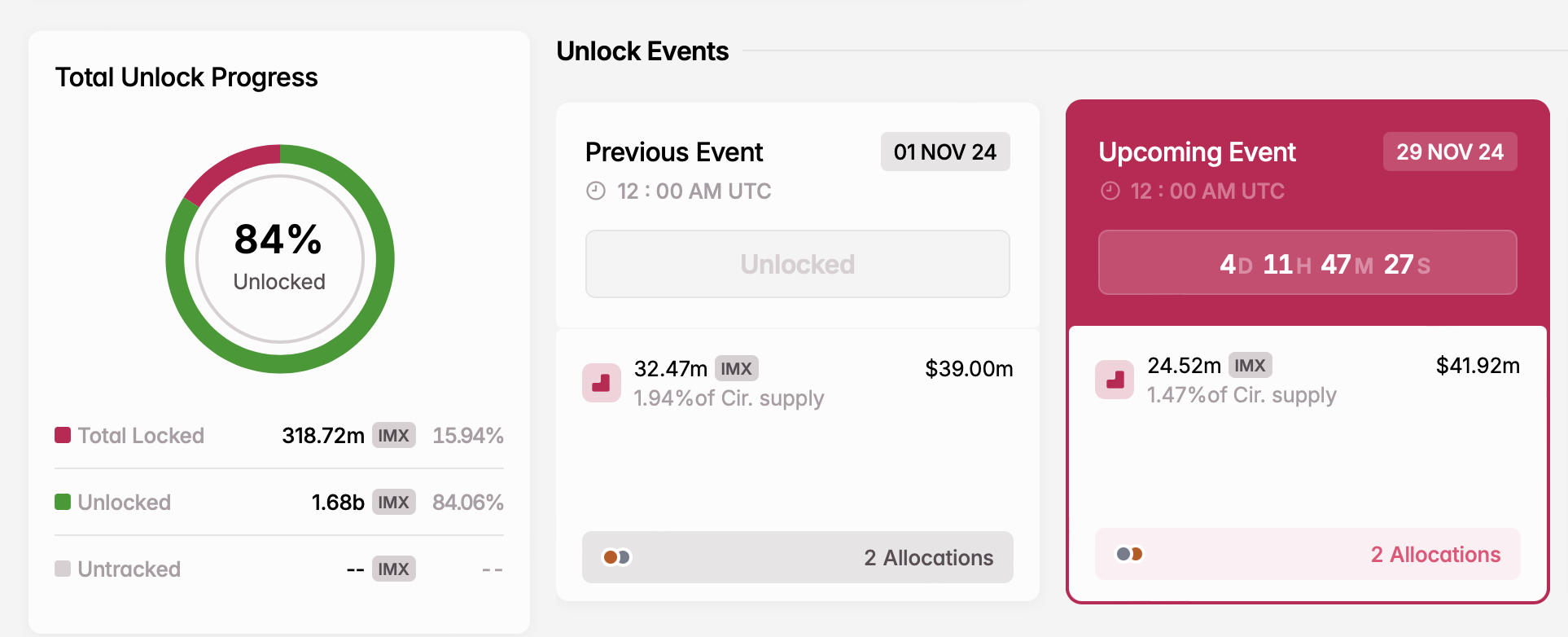

Immutable (IMX)

- Unlock date: November 29

- Number of tokens unlocked: 24.52 million IMX

- Current circulating supply: 1.67 billion IMX

Immutable, a Layer-2 solution for scaling NFTs on Ethereum, raised $12.5 million in just one hour during its IMX token sale on CoinList in September 2021. By March 2022, the project secured $60 million in an investment round, followed by an additional $200 million from investors such as ParaFi Capital, Declaration Partners, and Tencent Holdings.

On November 29, Immutable will release 24.52 million new IMX tokens into circulation. These tokens will support project development and growth within the broader Immutable ecosystem.

IMX Unlock. Source: Tokenomist

IMX Unlock. Source: Tokenomist

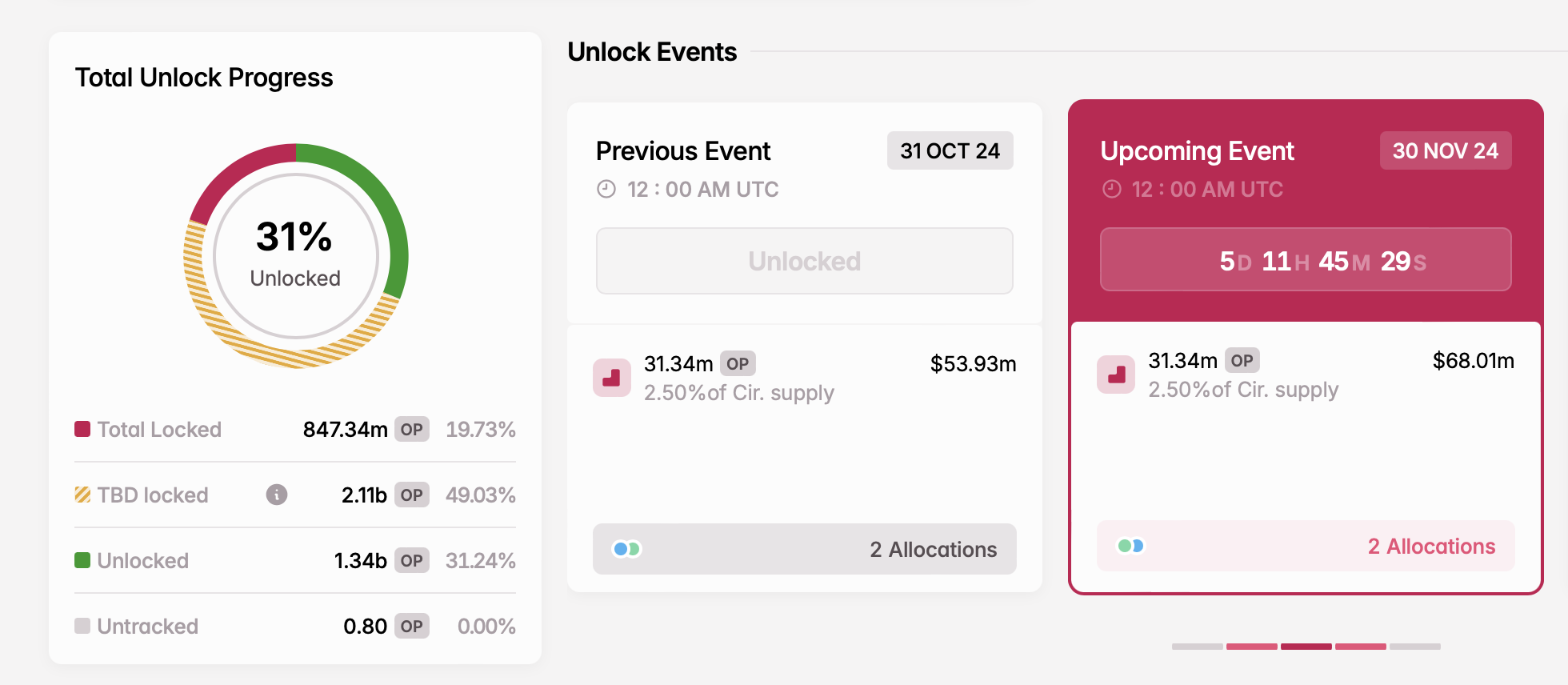

Optimism (OP)

- Unlock date: November 30

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.25 billion OP

Optimism, a Layer-2 scaling solution, enhances transaction speed and reduces costs on the Ethereum mainnet. Its OP token is vital for governance, enabling holders to vote on proposals and influence the network’s development and management.

On November 30, Optimism will release 31.34 million OP tokens into circulation. Tokenomist (formerly TokenUnlocks) reports that core contributors and investors will receive these tokens.

OP Unlock. Source: Tokenomist

OP Unlock. Source: Tokenomist

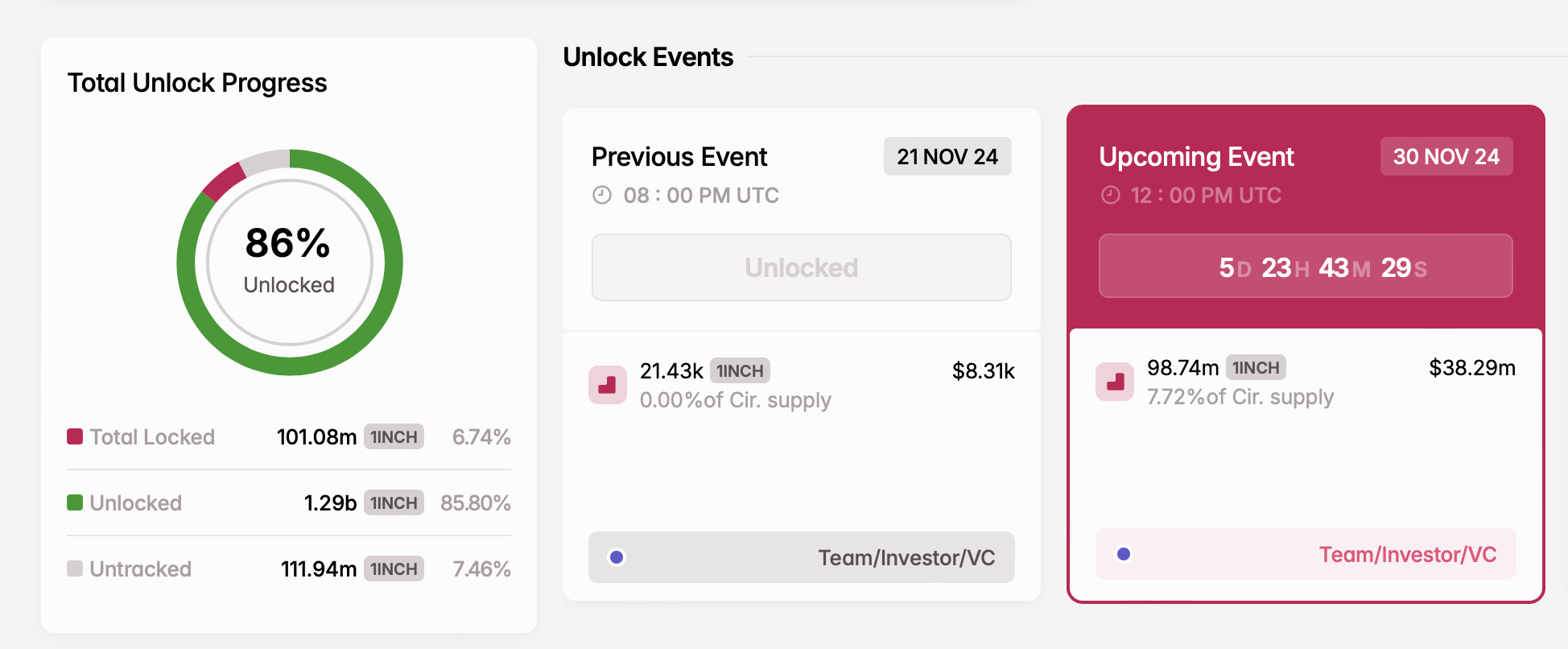

1Inch (1INCH)

- Unlock date: November 30

- Number of tokens unlocked: 98.74 million 1INCH

- Current circulating supply: 1.27 billion 1INCH

1inch is a decentralized exchange aggregator that pools liquidity from multiple DEXs to offer users the best trading rates. It streamlines trading by identifying the most efficient transaction routes, minimizing slippage, and lowering fees.

On November 30, 1inch will unlock nearly 100 million 1INCH tokens. These tokens are allocated for developers, early investors, and venture capital funds.

1INCH Unlock. Source: Tokenomist

1INCH Unlock. Source: Tokenomist

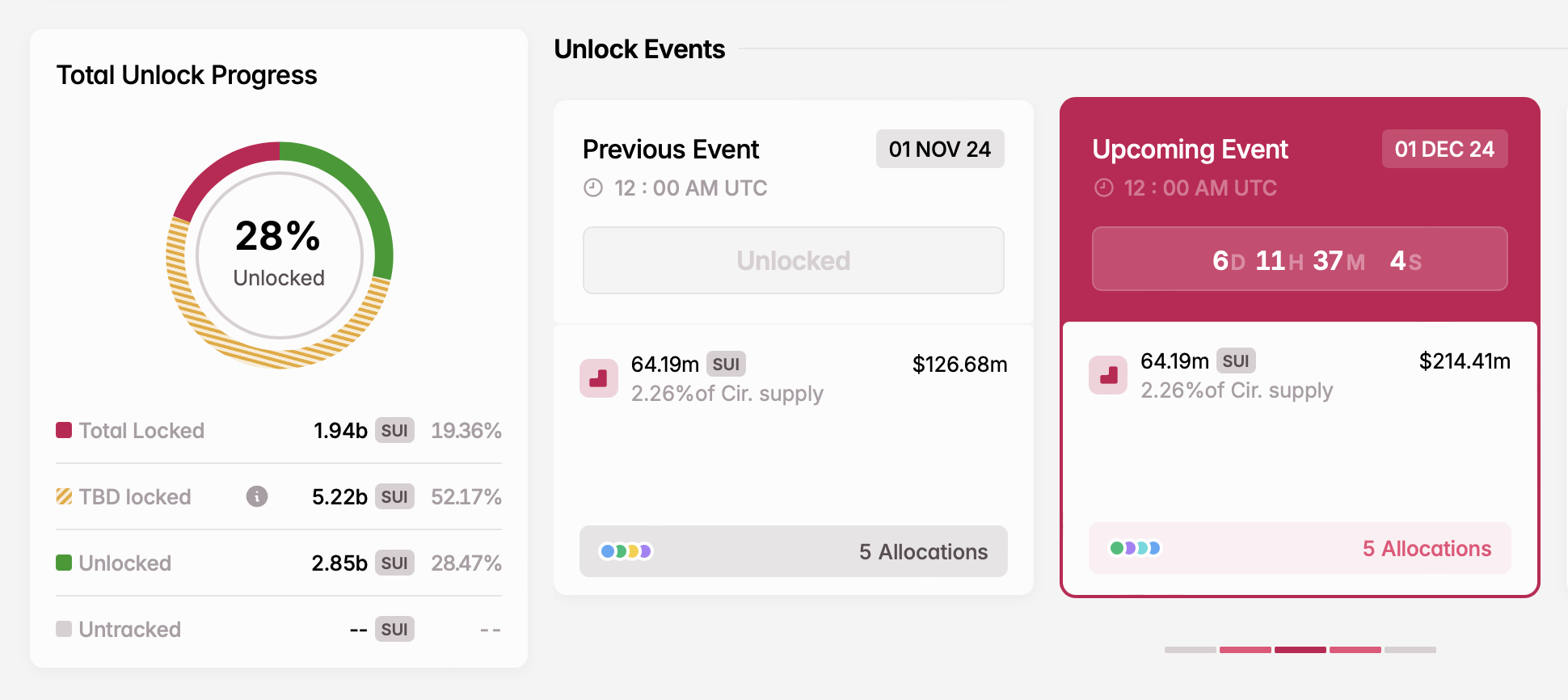

Sui (SUI)

- Unlock date: December 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 2.84 billion SUI

Sui is a high-performance Layer-1 blockchain designed to enhance network operations and security using a Proof-of-Stake consensus mechanism. Developed by Mysten Labs, the project was founded in 2021 by former Novi Research employees who were instrumental in creating the Diem blockchain and the Move programming language.

The SUI token supports governance, allowing holders to vote on key proposals and influence the platform’s direction. On December 1, the next token unlock will release a significant portion of tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

SUI Unlock. Source: Tokenomist

SUI Unlock. Source: Tokenomist

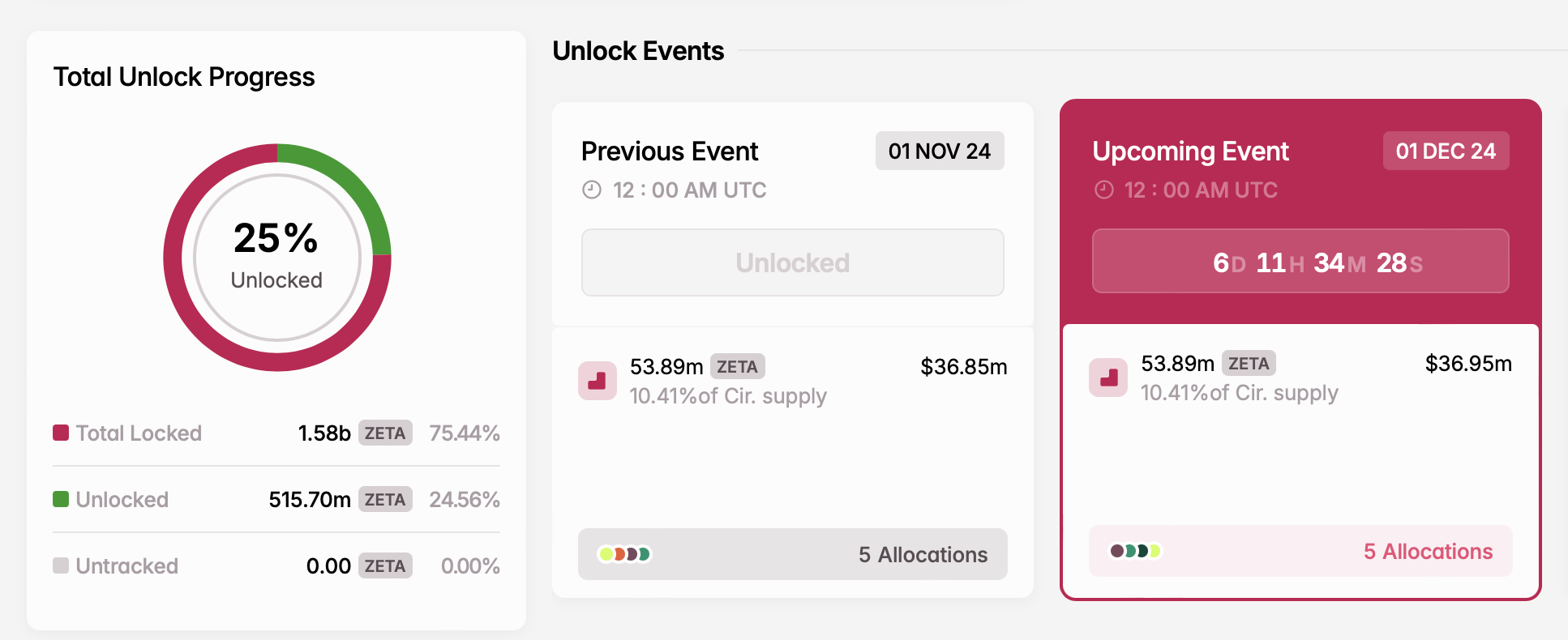

ZetaChain (ZETA)

- Unlock date: December 1

- Number of tokens unlocked: 53.89 million ZETA

- Current circulating supply: 517.85 million ZETA

ZetaChain is a decentralized blockchain platform designed to enable seamless interoperability between different blockchain networks. The platform’s standout feature enables cross-chain communication, allowing the exchange of tokens and data across blockchains like Ethereum and Binance Smart Chain.

On December 1, ZetaChain will release nearly 54 million ZETA tokens. These tokens will support various initiatives, including a user growth pool, an ecosystem growth fund, rewards for core contributors, advisory roles, and liquidity incentives.

ZETA Unlock. Source: Tokenomist

ZETA Unlock. Source: Tokenomist

Next week’s cliff token unlocks will also include Cardano (ADA), Ethena (ENA), and dYdX (DYDX), among others, with a total combined value exceeding $540 million.