Solana Hits Record Fees Amid Meme Coin Surge, but Faces Long-Term Risks

The Solana blockchain is witnessing a surge in activity due to a growing frenzy around meme coins.

This wave of enthusiasm has boosted network usage and pushed transaction fees to their highest levels in over a year.

Solana Meme Coin Hype Drives Network Fees and Adoption

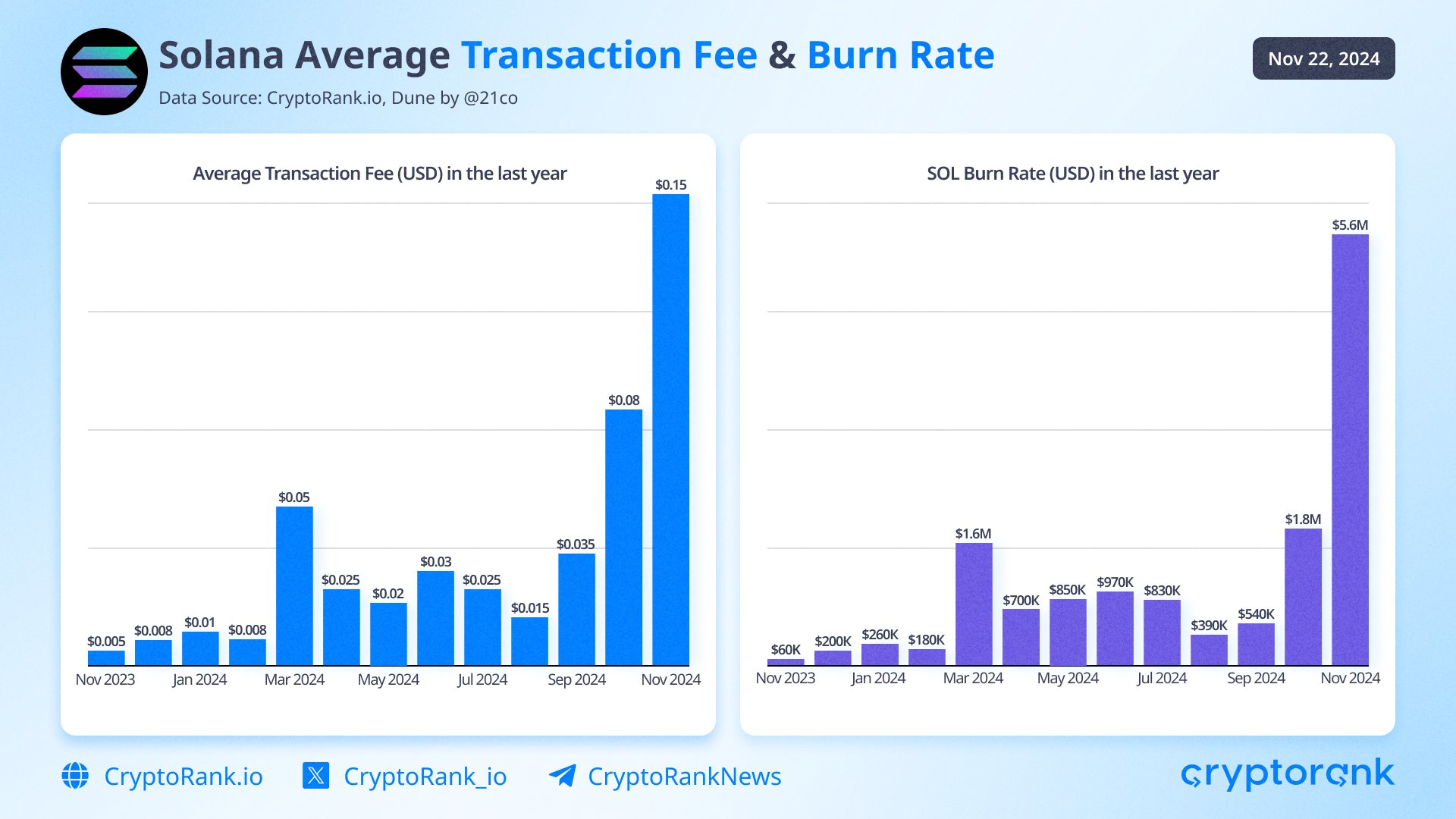

Recent weeks have seen meme coin activity rebound, fueled by a broader crypto rally led by major assets like Bitcoin. This resurgence has significantly increased transaction volumes on Solana, leading to higher fees. According to Cryptorank, Solana’s transaction fees reached $0.15 this month, doubling October’s $0.08 and marking the highest level in a year.

Solana Transaction Fee. Source: Cryptorank

Solana Transaction Fee. Source: Cryptorank

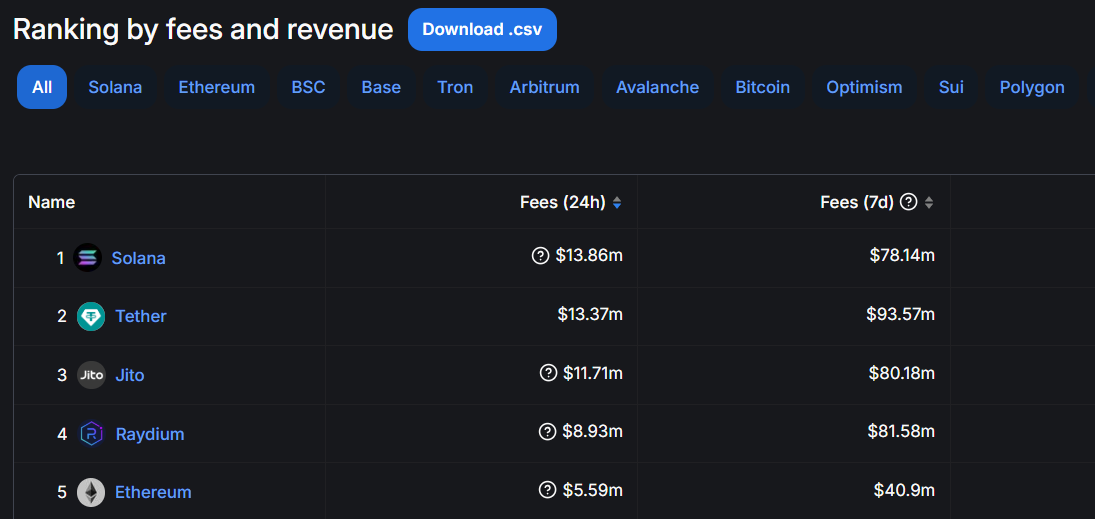

Data from DeFiLlama suggest that these rising network fees have contributed significantly to Solana earning approximately $78.14 million in fees over the past week, placing it among the most profitable networks. It ranked just below Tether’s $93.57 million but far outpaced Ethereum, which earned $40.9 million in the same period.

Beyond the core network, Solana-based decentralized applications (dApps) have also seen a surge in activity and fees. Platforms like Raydium, Jito, Pump.fun, and Photon have played key roles in this upswing, with Pump.fun and Photon leveraging the meme coin buzz for significant traction.

Top 5 Crypto Platforms by Fees. Source: DeFillama

Top 5 Crypto Platforms by Fees. Source: DeFillama

However, a crypto researcher at 1kx Network, Wei Dai cautioned that Solana’s rising activity could lead to congestion. He noted that prolonged congestion often leads to higher minimum fees, potentially pushing dApps and users away — a scenario Ethereum experienced during the DeFi boom four years ago.

Nevertheless, Dai conceded that Solana’s current congestion is mostly limited to short-term spikes, allowing patient users to process low-cost transactions still. Yet, he warned this balance might shift unless the network’s infrastructure evolves to handle growing demand effectively.

“Congestion on Solana is ‘bursty.’ Right now, users can still get payment transactions through with minimal fees with a short delay. However, this could change as demand increases, unless Solana tech stack improves to stay ahead of demand,” Dai added.

Meanwhile, this activity spike coincides with Solana achieving new price milestones. Over the past week, SOL’s price rose by nearly 20% to a new all-time high of $263, making it one of the best-performing digital assets since Donald Trump’s election victory on November 5.