Crypto Today: XRP gains 10%, Cardano, XRP, and DOGE price rallies, delay Bitcoin’s $100K breakout

- The global cryptocurrency market capitalization grew by $230 billion on Friday crossing the $3.29 trillion mark.

- The cryptocurrency sector valuation has scored new all time highs in each of the last 5 trading days

- Bitcoin dominance (BTC.D) fell below the 60% mark within the daily timeframe.

Altcoin Market Updates: Cardano, XRP, and BCH price rallies, delaying Bitcoin’s $100K breakout

The global cryptocurrency sector pulled $230 million capital inflows on Friday, as markets reacted positively to news of SEC Chair Gary Gensler’s imminent exit. Price movements observed in the last 24 hours suggest traders are leaning heavily into altcoin, particularly those that have underperformed in recent years under intense regulatory scrutiny from Gensler-led SEC regime

- Cardano price surged 35% to graze the $1 mark on Friday, trading at its highest since November 2021. Markets reports link the ADA rally to Gary Gensler imminent exit and Caradano’s potential collaboration with the incoming Trump administration.

- Ripple (XRP) also tested new yearly peaks above $1.45 on Friday, rising 36% in the last 48 hours. Traders place long bets on XRP in hopes that the ongoing lawsuit between Ripple labs and the SEC could be dropped when Gensler exits on January 20.

- Dogecoin price also snapped out of a 10-day consolidation phase to book 13% gains within the daily timeframe

Chart of the day: Whales spotted buying $65M ADA after Gensler exit confirmation

While Bitcoin price failed to stage a decisive breakout above $100,000, Cardano price moved in a similar pattern, peaking just below the $1 mark, amid 35% daily timeframe rally.

However, while ADA price consolidates around the $0.97 level, on-chain data trends shows, crypto whales continue to pile on bullish pressure behind the scenes.

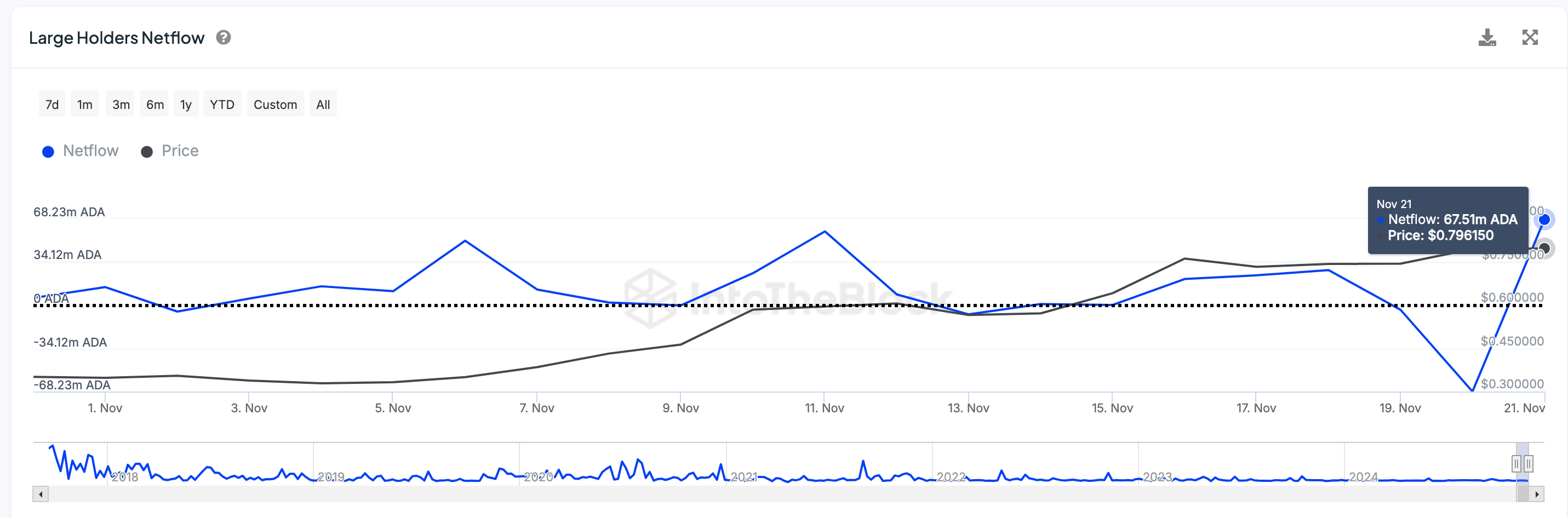

IntoTheBlock’s chart below tracks the netflow of deposits and withdrawals in wallets that control at least 0.1% of ADA supply in circulation, which works out to a minimum of 35 million ADA.

This serves as a proxy to measure whales buying or selling trends around key market events.

Cardano price vs. Large holders netflow | Source: IntoTheBlock

At first glance the chart shows how Cardano whales have acquired 67.51 million ADA, worth approximately $65 million on November 21.

More so, this represents the highest single-day whale inflows in 60-days dating back to September 23.

Such spikes in whale accumulation signals a positive sentiment shift among the Cardano network’s largest stakeholders.

If retail traders mirror this trend en-masse, ADA price could potentially advance above the $1 territory in the coming days.

Crypto news updates:

- Regulators in France have restricted access to crypto predictions platform, Polymarkets, amid gambling compliance review.

- Coinbase plans to list more memecoins after Trump inauguration,

In a recent interview with Bloomberg, Tom Duff Gordon, Coinbase’s Vice President of International Policy, stated that the exchange intends to broaden its offerings once comprehensive regulatory guidelines for the cryptocurrency sector are established.

“We’re talking more about some of the smaller tokens, some of the meme coin tokens,”

- Tom Duff Gordon, Coinbase’s Vice President.

Coinbase continues to face regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC), which alleges that the exchange offered trading services for 13 tokens considered unregistered securities.

Among the tokens cited by the SEC are Solana (SOL), Cardano (ADA), and Polygon (MATIC), with the Commission claiming the exchange failed to secure the necessary registrations for these assets.

- Robinhood executive Dan Gallagher has declined potential SEC chair position

Robinhood executive Dan Gallagher has announced he will not pursue the role of chair of the U.S. Securities and Exchange Commission (SEC). Gallagher affirmed his commitment to Robinhood, emphasizing his focus on collaborating with the incoming administration and the next SEC leadership.

His decision comes at a pivotal time for the SEC, as upcoming changes are expected to have a profound impact on cryptocurrency regulations and the broader financial landscape.