FTT Surges 36% as FTX Unveils Bold Reorganization Plan

FTT, the native token of the bankrupt cryptocurrency exchange FTX, has experienced a 36% price surge in the past 24 hours. It now trades at a monthly high of $2.61. It currently ranks as the top gainer among the top 100 crypto assets.

The double-digit rally in FTT’s price is fueled by the recent announcement of FTX’s reorganization plan, which is scheduled to begin in January 2025. With a growing bullish bias toward the altcoin, the FTT token price may reclaim its year-to-date high of $3.43 and rally past it.

FTX’s Reorganization Plans Boost Interest in FTT

In a November 21 press release, the now-defunct confirmed that it will soon implement its court-approved reorganization plan. According to the plan, FTX debtors anticipate finalizing arrangements with fund distributors in December, with claimant reimbursements set to begin in January 2025.

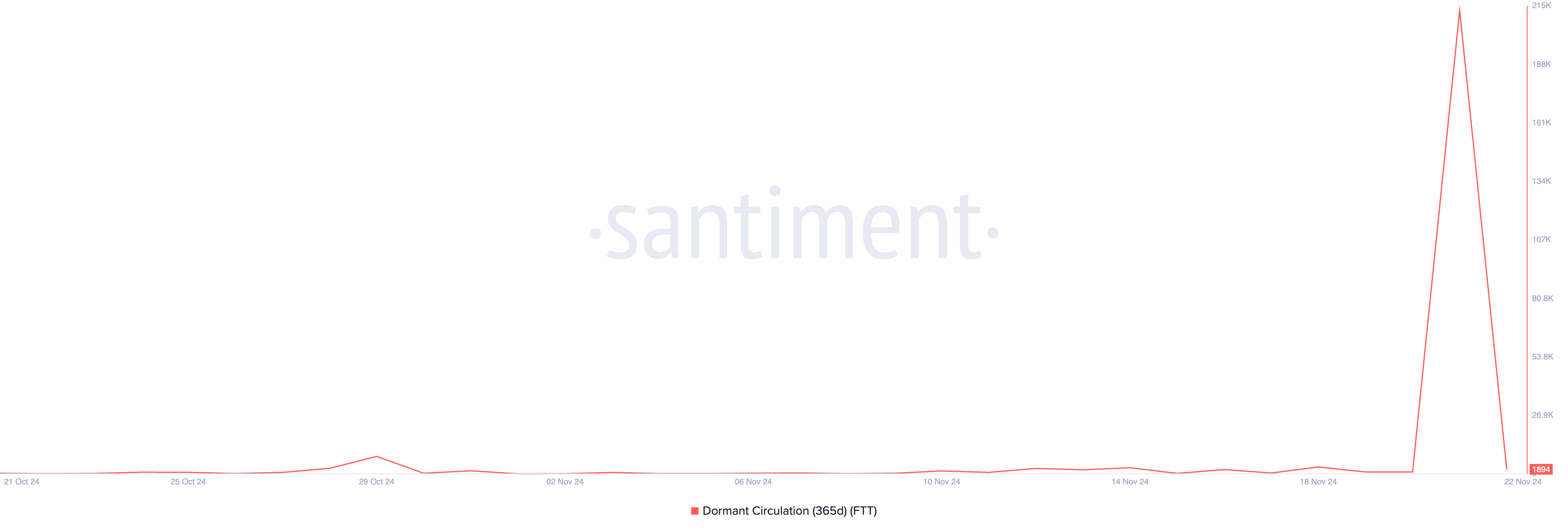

The announcement has triggered a surge in FTT trading activity, with previously inactive tokens now changing hands. BeInCrypto’s analysis of the altcoin’s on-chain performance has revealed an increase in FTT’s Dormant Circulation. Following FTX’s press release on Thursday, this metric—which measures the number of unique coins or tokens transacted after remaining unmoved for at least 365 days—climbed to a 30-day high of 213,350.

FTT Dormant Circulation. Source: Santiment

FTT Dormant Circulation. Source: Santiment

A spike in Dormant Circulation often signals that large amounts of previously untouched tokens are being moved. It could indicate that holders are preparing to sell, which might create downward pressure on the price. In FTT’s case, it could also mean that its long-term holders are repositioning in anticipation of further gains.

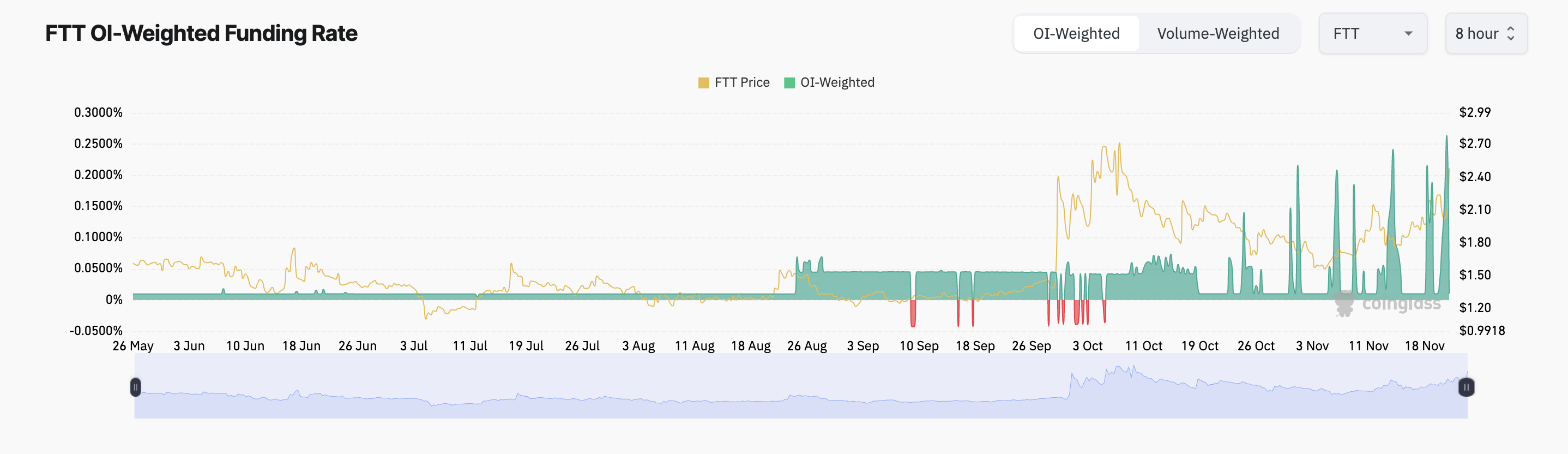

Notably, FTT’s positive funding rate indicates that its futures traders expect its price to continue growing. As of this writing, it stands at 0.010%. For context, following FTX’s announcement on Thursday, it climbed to a multi-month high of 0.26% before retracing.

FTT Funding Rate. Source: Coinglass

FTT Funding Rate. Source: Coinglass

The funding rate is a periodic payment exchanged between long and short positions in perpetual futures contracts to ensure their prices align with the spot market. When its value is positive, long positions pay shorts, indicating bullish market sentiment. Therefore, in the FTT futures market, more traders are betting on a sustained price rally than those anticipating a price decline.

FTT Price Prediction: What Way Now?

As of this writing, FTT trades at $2.61. If the uptrend persists, the token will break above resistance at $2.69, reclaim the $3 price mark, and rally toward its year-to-date high of $3.43.

FTT Price Analysis. Source: TradingView

FTT Price Analysis. Source: TradingView

However, if the previously dormant coins that are changing hands are sent to exchanges, it will put downward pressure on FTT’s price. In that case, its price may fall to support at $2.47. Should this level fail to hold, the FTT token’s price may plunge further to $2.24.