BlackRock, Bitwise poised to shake up crypto markets as Bitcoin ETF options start trading

- Trading options on BlackRock’s iShares Bitcoin Trust begins on Tuesday on Nasdaq, while Bitwise Bitcoin ETF options will start on Wednesday.

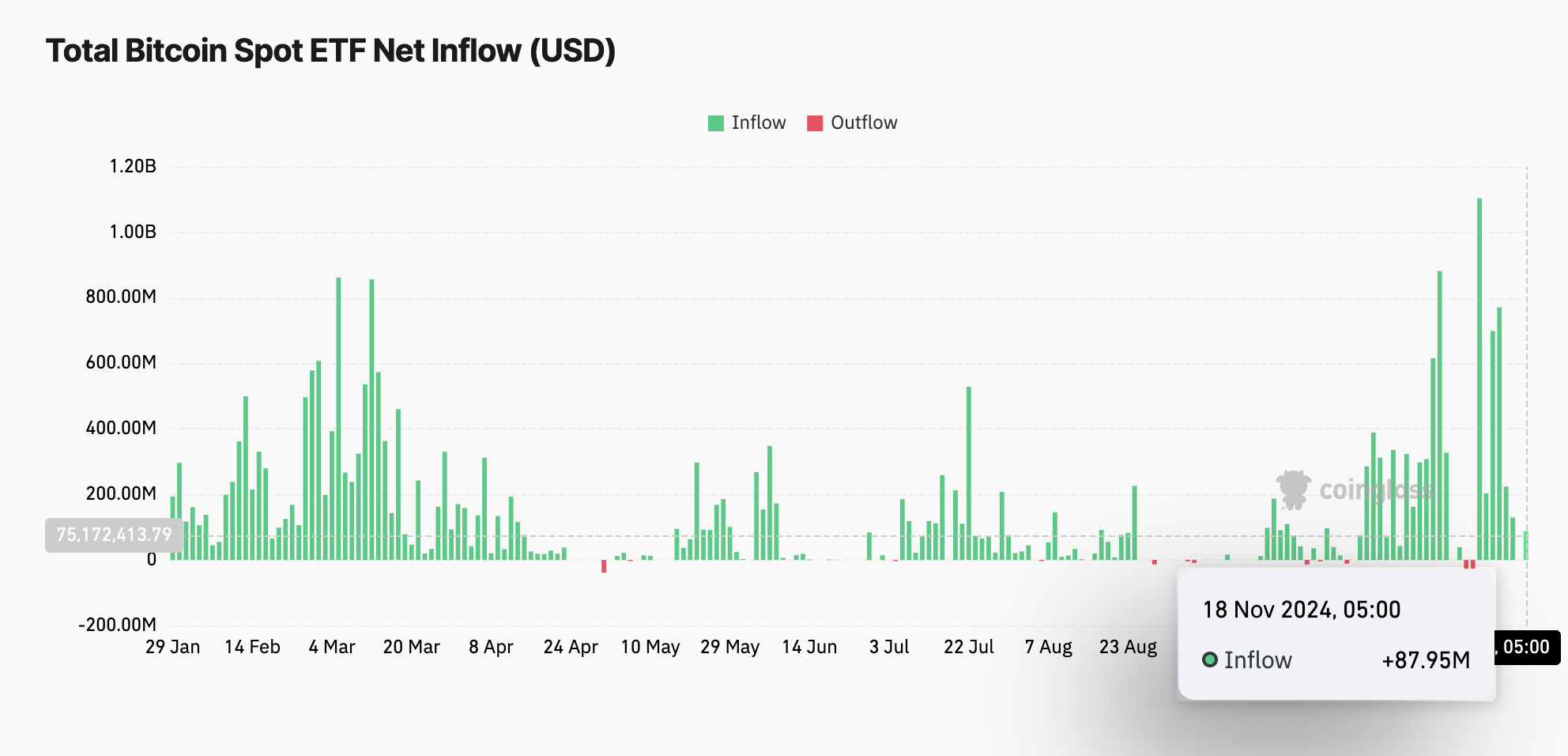

- BlackRock’s IBIT ETF led with around $88 million inflows on Monday, followed by Fidelity’s FBTC with $60 million.

- Bitcoin spot ETFs collectively hold a net asset value of $95.93 billion, representing 5.3% of Bitcoin’s market value.

Options trading for BlackRock's iShares Bitcoin Trust (IBIT) is expected to start on Nasdaq on Tuesday, and Bitwise Bitcoin ETF options will begin trading this Wednesday, Nasdaq head of ETP listings Alison Hennessy told Bloomberg on Monday.

In September, the US Securities and Exchange Commission (SEC) approved options for spot Bitcoin ETFs on various exchanges, enabling these launches.

Options trading is a key element of advanced financial markets. It involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. The contracts will concentrate on Bitcoin ETFs, providing new options for hedging and speculation.

Bitwise Invest CEO Hunter Horsley announced on X (formerly Twitter) that options for their BITB ETF will launch on Wednesday.

We expect options on the Bitwise Bitcoin ETF ( $BITB ) to begin trading Wednesday.

— Hunter Horsley (@HHorsley) November 19, 2024

BITB traded around $115M of volume today, with AUM near $4B.

As ever, the public addresses allowing investors to verify the Bitcoin holdings are published on the ETP website and 10% of gross…

Bitcoin ETFs see a surge in inflows

Bloomberg analyst James Seyffart has commented on the imminent launch of options trading for Bitcoin ETFs. “It appears that $BITB and likely other Bitcoin ETFs will begin options trading on Wednesday,” he stated.

Looks like $BITB and I’m assuming other Bitcoin ETFs are going to see options trading start on Wednesday. https://t.co/HWPRDieWjt

— James Seyffart (@JSeyff) November 19, 2024

The launch occurs alongside notable inflows into Bitcoin spot ETFs. On Monday, Coinglass data showed that BlackRock’s iShares Bitcoin Trust (IBIT) had a daily inflow of $87.95 million, the highest among all 11 US-listed spot ETFs that day.

Source: Total Bitcoin spot ETF net inflow (Coinglass)

Now that options trading for these ETFs have begun, people in the market are waiting for more institutions to get involved and for the crypto world to become more widely accepted.