Crypto Today: Poland to adopt BTC as Hedera, Tezos rally alongside Microstrategy investing another $4.6B

Crypto market analysis today:

- The aggregate cryptocurrency market capitalization increased by $45 billion on Monday, November 18.

- In the last 24 hours, Solana, Hedera and Stellar have emerged among the top gainers.

- In the derivatives markets, bears gained upper hand with $179 million long contracts closed out, accounting for 58% of the $305 million daily time frame liquidations.

Altcoin market updates: Solana, Hedera, Stellar are top gainers

- While Solana’s daily time frame gains were subdued at 2.2%, the SOL price action drew attention on Monday as traders brace for a potential breakout to new all-time highs.

Solana price action | November 18, 2024

Solana price action | November 18, 2024

Solana (SOL) came just 5% shy of reaching new all-time highs as prices rose as high at $248 on Monday. Solana has now increased by 60% since November.

Market reports have linked the Solana rally to increased capital inflows toward SOL derivatives markets amid positive speculation on Solana ETF approval.

Increased memecoin trading activity in the aftermath of BONK’s 1 trillion token burn announcement from November 15 has also played a pivotal role.

-

Stellar (XLM) also delivered a blistering price rally on Thursday, hitting new all-time highs of $0.000026.

The XLM price rally appears linked to a delayed reaction to HBAR ETF filing by Canary Capital.

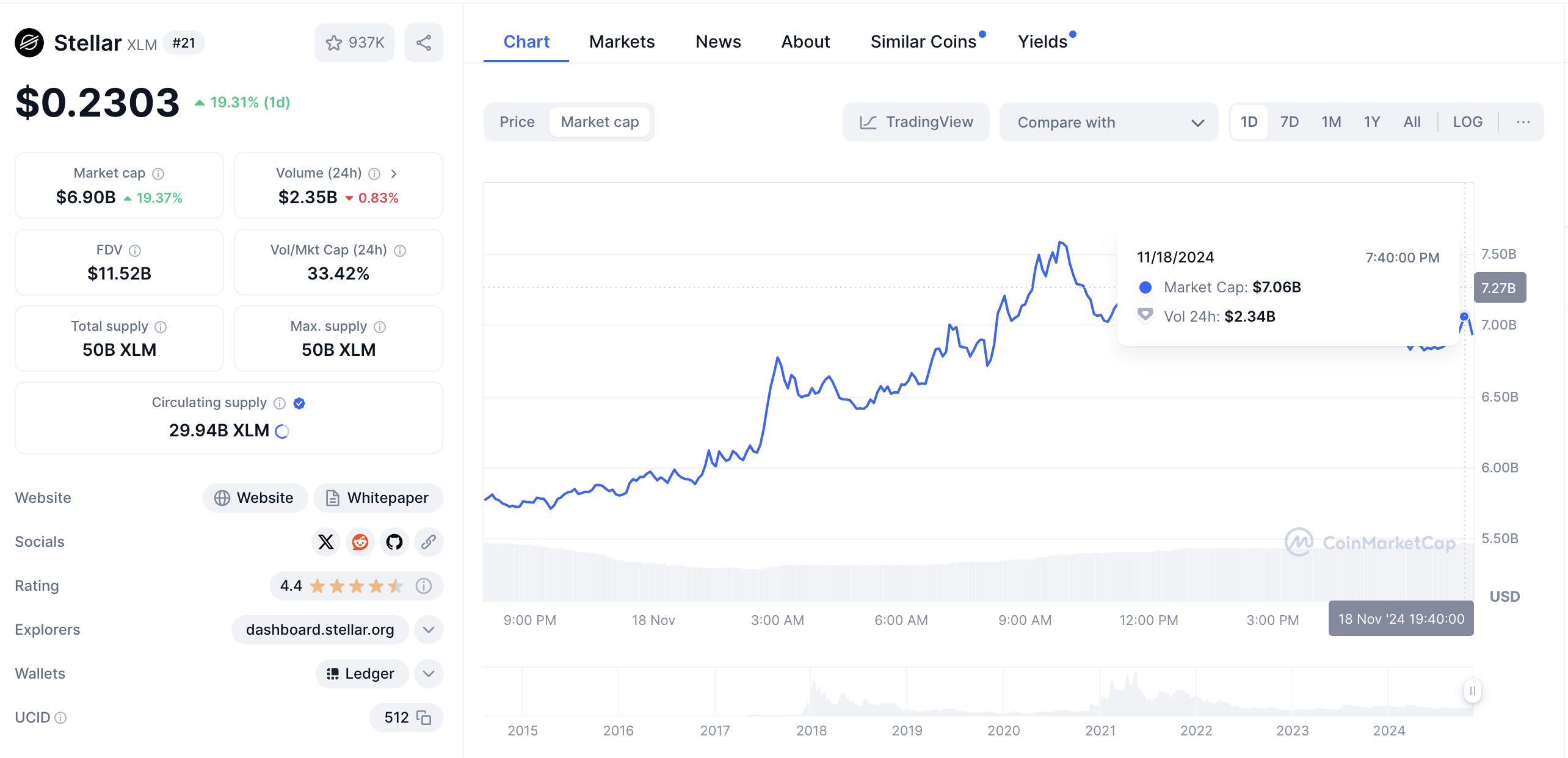

XLM price action | XLMUSD

Over the last 24 hours, XLM price rose 20%, adding over $ 1.3 billion to its market capitalization in the process.

- Hedera (HBAR) price also recorded 40% gains on Monday, rallying on news of impending ETF filing by US-based fund manager, Canary Capital.

Canary’s S-1 registration for a Hedera (HBAR) exchange-traded fund (ETF) on November 15 comes weeks after the firm had also filed for a Litecoin ETF.

After initial pessimism, Securities & Exchange Commission (SEC) Chair Gary Gensler’s rumored parting statements on November 14 have sparked hopes that Trump is set to appoint a more crypto-friendly replacement for Gensler, increasing the likelihood of more crypto ETFs approval in 2025.

Confirming this narrative, HBAR’s daily trading volume reached $2.34 billion on Monday, hinting at potential for more upside in the days ahead.

- Tezos (XTZ) is another major layer 1 altcoin that has witnessed a major breakout on Monday.

The XTZ coin rose by 57% within the daily time frame after staking platform Everstake announced support for Tezos.

In terms of bullish catalysts, Everstake’s announcement comes just days after analytics platform Messari released a Q3 2024 report highlighting growth signals for Tezos across key on-chain metrics including transaction count, decentralized applications deployed, upgrade proposals, and active validator count.

More so, the ongoing partnership with football powerhouse Manchester United has also boosted Tezos’ popularity globally.

Chart of the day: Michael Saylor announces another $4.6B BTC acquisition

US-based IT firm Microstrategy has made another giant stride in executing its $42 billion BTC acquisition plan. On November 18, CEO Micheal Saylor announced the purchase of another 57,160 BTC for $4.6 billion.

After initially purchasing 27,000 BTC for $2.03 billion on November 10, Microstrategy has now acquired $6.03 billion worth of Bitcoin since Trump’s reelection.

MicroStrategy Bitcoin holdings as of November 18, 2024 | SaylorTracker

This latest purchase beams the limelight on Microstrategy’s $42 billion Bitcoin acquisition plan.

“Our focus remains to increase value generated to our shareholders by leveraging the digital transformation of capital. Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprising $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan.

As a Bitcoin Treasury Company, we plan to use the additional capital to buy more bitcoin as a treasury reserve asset in a manner that will allow us to achieve higher BTC Yield,”

Phong Le, President and Chief Executive Officer, MicroStrategy. | October 30, 2024

If Microstrategy is to reach the goal of $42 billion Bitcoin acquisition in three years, the firm is now expected to acquire an average of $1.2 billion every month over the next 36 months. This could significantly impact Bitcoin’s short-term supply and demand dynamics.

Crypto news updates:

- A presidential candidate in Poland, Sławomir Mentzen, has promised to include Bitcoin in the nation’s strategic reserves if elected.

“Poland should create a Strategic Bitcoin Reserve. If I become the President of Poland, our country will become a cryptocurrency haven, with very friendly regulations, low taxes, and a supportive approach from banks and regulators. BTC to the Moon!”

- Sławomir Mentzen, November 18, 2024.

Poland's next presidential elections are slated for May 2025. The 37-year old Mentzen has emerged a prominent contender, positioning his New Hope party as the leading conservative force.

- Marathon digital (MARA) has announced a proposal to raise $700M debt in convertible notes to bolster its Bitcoin holdings.

- According to a Coindesk report, Cyber Fund, a venture firm headed by Lido co-founders, Konstantin Lomashuk and Vasiliy Shapovalov, have launched a new blockchain-based identity platform that to compete with Sam Altman’s World network (formerly Worldcoin)

Notably, Cyber Fund's project aims to sidestep World’s iris-scanning orb, which has faced heavy criticisms ranging from privacy concerns to exploitative user recruitment practices.