Solana (SOL) Volume Falls From $12 Billion as Bears Look to Halt Potential $300 Run

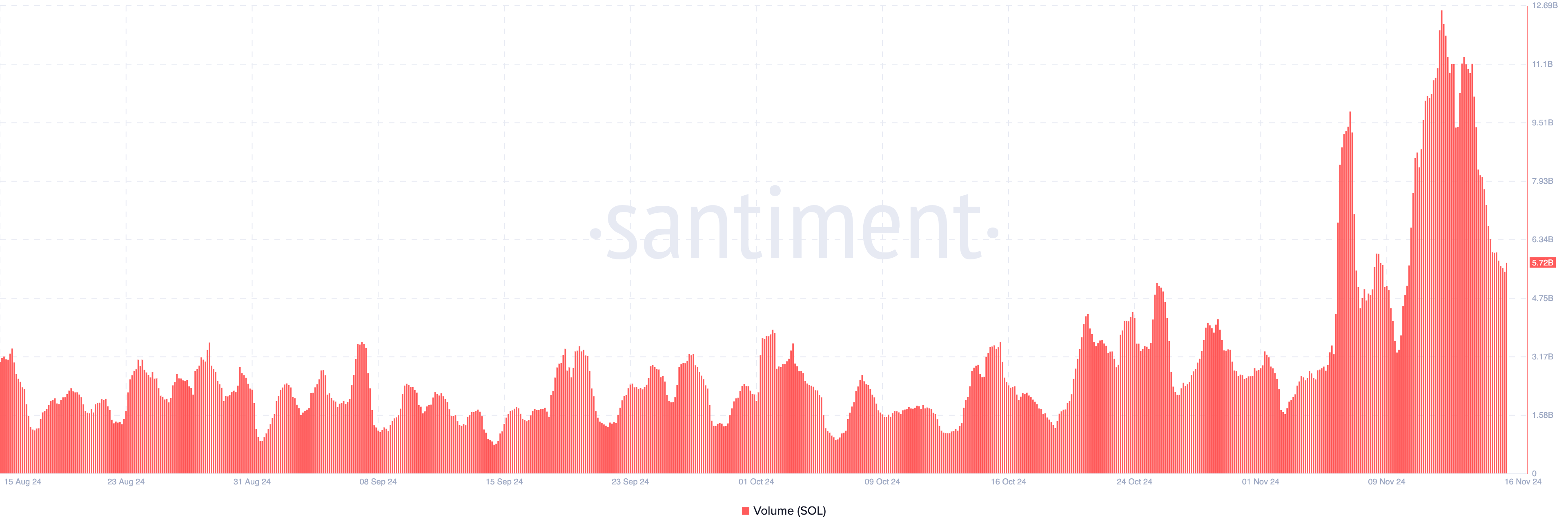

On November 12, Solana’s (SOL) trading volume hit a four-month high of $12.60 billion amid the altcoin’s rally above $200. However, the same volume is now less than half of that, suggesting that Solana bears are ensuring that the price fails to rally toward $300.

But the question remains: Is a SOL rally no longer on the cards? This analysis examines the chances.

Solana Sees Waning Interest, Low Activity

According to Santiment, Solana’s volume is down to $5.72 billion. In the crypto market, trading volume represents the total number of coins or tokens exchanged during a specific period. This key metric offers insights into market activity and liquidity, helping traders assess the strength of price movements and overall interest in a particular asset.

From a price perspective, the increase in volume alongside a rise in a crypto’s market value is a bullish sign.

However, in this case, the decline while the token trades at $216 suggests that Solana bears are restricting it from rousing higher. Thus, if the volume continues to decline, Solana’s price might also follow a downward trend.

Solana volume. Source: Santiment

Solana volume. Source: Santiment

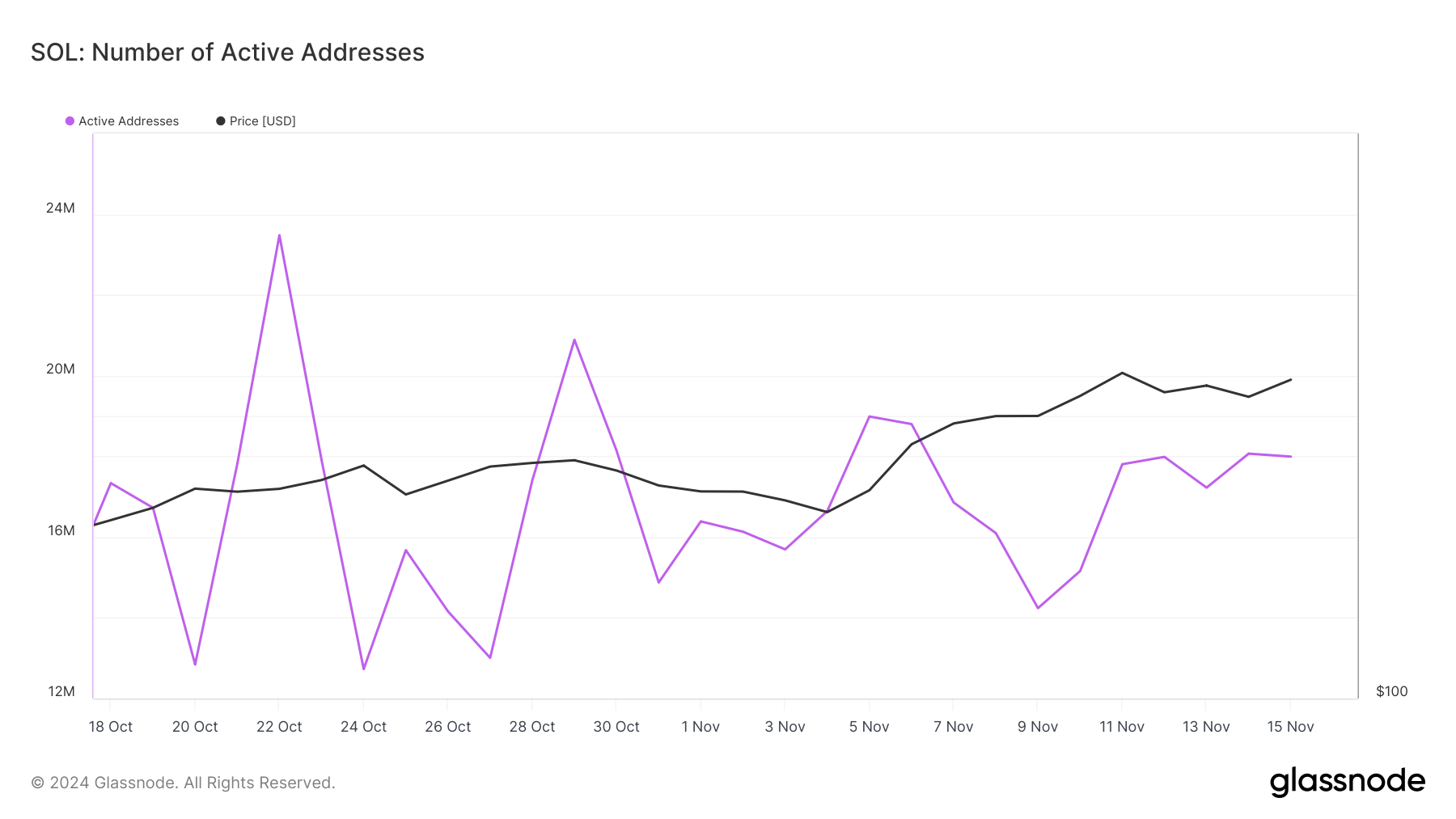

Another metric that affects this is Solana’s active addresses. Active addresses measure the unique wallet addresses involved in sending or receiving funds within a specific timeframe. This metric reflects network activity and user engagement.

A rise in active addresses often signals increased adoption and usage, which can positively influence a cryptocurrency’s price. Conversely, a decline may indicate waning interest in the network, potentially exerting downward pressure on the price.

According to Glassnode, Solana’s active addresses declined from over 20 million during the last days of October to 17.98 million. If this decrease continues, SOL might not have enough user engagement to support the uptrend.

Solana Active Addresses. Source: Glassnode

Solana Active Addresses. Source: Glassnode

SOL Price Prediction: Drop Below $200?

On the daily chart, Solana bears pushed the price back as soon as it hit $222.49. This pullback ensures that the altcoin’s hopes of reaching $300 have diminished. As mentioned above, the volume has decreased, which is also validated on the chart.

If that is the case, Solana’s price could decrease toward the $190.30 level. This will happen if selling pressure increases and SOL bears continue to control the price direction.

Solana Daily Analysis. Source: TradingView

Solana Daily Analysis. Source: TradingView

On the other hand, an increase in volume accompanied by buying pressure could invalidate this thesis. If that happens, Solana’s price might cross above $225 into the $300 level.