Ethereum Price Forecast: Could ETH see new all-time high after 30% rise and record ETF inflows?

Ethereum price today: $3,300

- Ethereum ETFs posted a record $154.7 million net inflow last week.

- Justin Drake plans to unveil a new Ethereum consensus layer proposal at Devcon on Tuesday.

- Ethereum open interest climbed to an all-time high of $17.93 billion.

- Ethereum could rally to $3,732 if it overcomes $3,300 resistance amid quest for a new all-time high.

Ethereum (ETH) is up nearly 3% on Monday as it tackles the resistance near $3,300 for the first time since July. After soaring nearly 30% in the past week and seeing record ETH exchange-traded funds (ETF) inflows and open interest growth, the top altcoin could continue its bullish momentum and aim for a new all-time high.

Ethereum sets new ETH ETF inflows and open interest record

Ethereum ETFs witnessed their highest weekly inflows last week after recording net inflows of $154.7 million, per Coinglass data.

The inflows follow increased demand from institutional investors for the top altcoin after an impressive 30% run in the past week. If the Ethereum ETF inflows continue with a similar trend this week, it could propel ETH to a new all-time high.

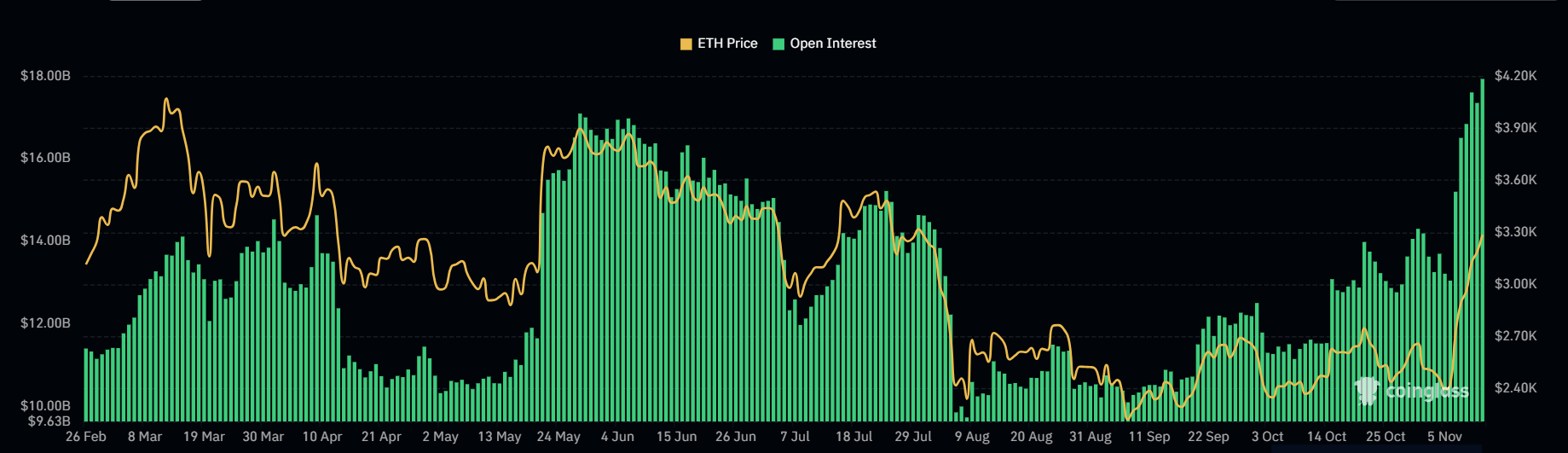

ETH derivatives investors expect a continuation of the bullish momentum as Ethereum's futures open interest surged to an all-time high of $17.93 billion on Monday.

Open interest is the total amount of outstanding contracts in a derivatives market. When OI grows alongside prices, it indicates increased bullish momentum.

Ethereum Open Interest | Coinglass

Meanwhile, Ethereum developer Justin Drake announced in an X post on Monday that he would reveal a new "from-scratch" redesigned framework for the Ethereum consensus layer at the Ethereum Devcon conference on November 12.

"The goal is to suggest a credible strategy to ship what is an extremely ambitious and exciting beacon chain roadmap, all on a reasonable timeframe," wrote Drake.

He revealed that the new framework had passed through a gestation period involving researchers and consensus developers.

"It's early days[,] and your participation is key should this new approach to tackling the consensus layer roadmap ever achieve rough consensus," Drake concluded.

The current Ethereum consensus layer features a Proof-of-Stake mechanism in which thousands of geographically-distributed validators worldwide use their coins in the process of validating transactions.

Ethereum Price Forecast: ETH eyes $3,732 in quest for new all-time high

Ethereum sustained over $102.89 million in futures liquidations in the past 24 hours, with long and short liquidated positions accounting for $58.18 million and $44.71 million, respectively.

Ethereum surged above the 100-day Simple Moving Average (SMA) and $3,000 psychological level over the weekend after reclaiming the $2,817 key support level.

ETH/USDT daily chart

The top altcoin is tackling the resistance level near $3,300. A sustained move above this resistance could see ETH rally toward $3,732. If the buying momentum sustains, ETH could test its yearly high resistance of $4,093 and aim for a new all-time high.

On the downside, the 100-day SMA could serve as a support. If it fails, ETH could likely bounce off the $2,817 key level, which held as a key support for nearly four months — April to July 2024.

The Relative Strength Index (RSI) is in the oversold region, signaling a potential correction.

A daily candlestick close below $2,817 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.