Analyst Predicts 80% Rally for DePIN Token NAVI on Key Breakout

Atlas Navi (NAVI) has been attempting to break through a major resistance level at $0.150, but it has yet to succeed. This resistance has held NAVI back in recent price attempts, keeping it within a narrow range.

Despite these setbacks, NAVI still has a strong potential for significant growth, with some analysts predicting an 80% rise.

NAVI Is Eyeing a Massive Rally

Crypto analyst Michael Van de Poppe recently highlighted the DePIN (Decentralized Physical Infrastructure Networks) sector as a major opportunity in the crypto space, naming NAVI as one of its top contenders. According to Van de Poppe, NAVI is well-positioned to capitalize on the growing interest in DePIN.

He further highlighted that there is a massive potential for growth in the altcoin.

“From the TA perspective, heavy accumulation is going on, ready for a breakout upwards, potentially leading to $0.25,” Van de Poppe noted.

Read More: What Is DePIN (Decentralized Physical Infrastructure Networks)?

NAVI Potential Breakout. Source: Michael Van de Poppe

NAVI Potential Breakout. Source: Michael Van de Poppe

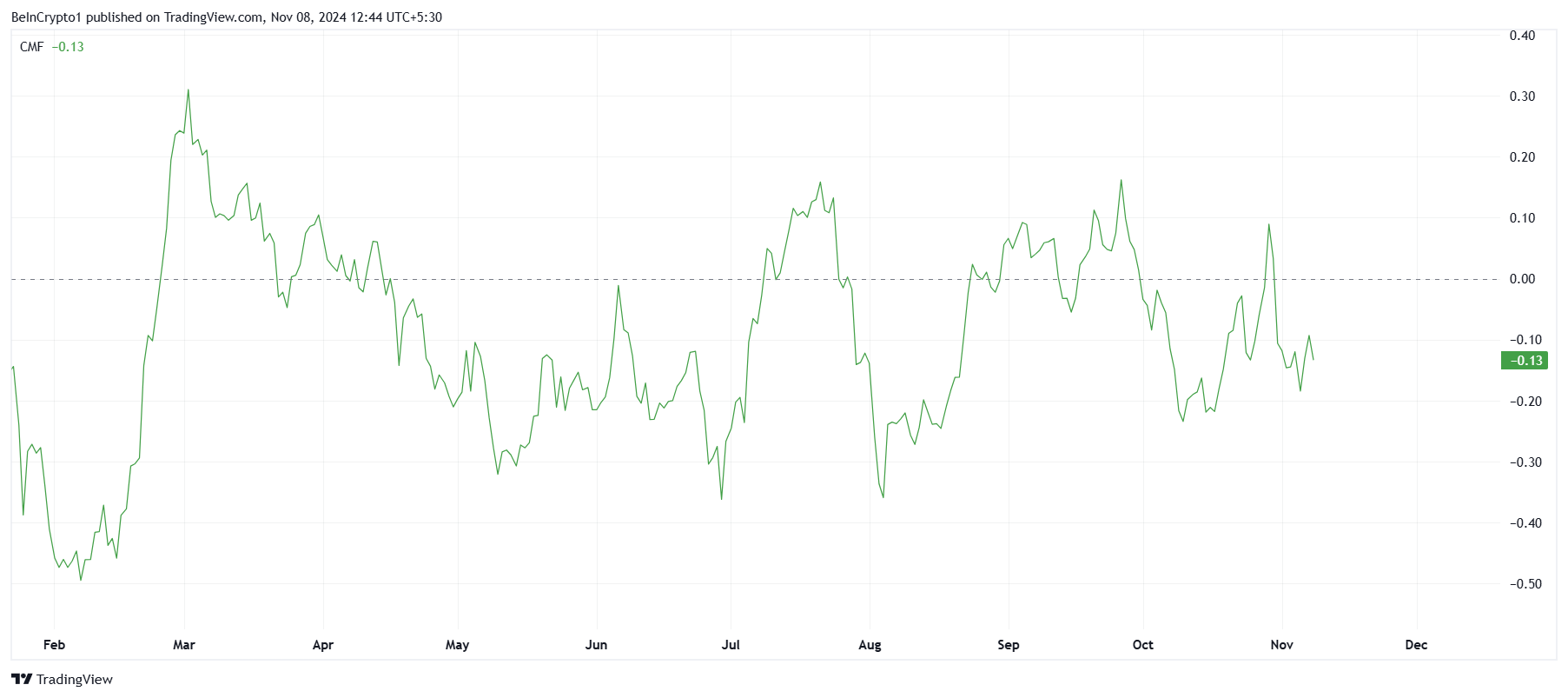

In terms of macro momentum, NAVI faces challenges. The Chaikin Money Flow (CMF) indicator, which tracks buying and selling pressure, reveals weak inflows into NAVI since mid-July.

This lack of buying pressure signals investor hesitation, as market participants appear wary of the DePIN token’s ability to break out. With these reduced inflows, NAVI may struggle to generate enough momentum to push past key resistance levels.

Investors’ cautious stance reflects broader skepticism in the market, as they prefer to avoid risk until NAVI shows a sustained uptrend. If the weak inflows continue, it could dampen NAVI’s potential for a rally. For NAVI to initiate a breakout, it will need more substantial investor interest to counterbalance the recent selling pressure.

NAVI CMF. Source: TradingView

NAVI CMF. Source: TradingView

NAVI Price Prediction: Breaking Consolidation

Currently, NAVI trades at $0.133 and is aiming to break its three-month consolidation phase by surpassing the $0.150 resistance level. A close above this level would signal a potential trend shift, possibly leading to gains. Although this may not immediately push NAVI to $0.250, it would indicate growing bullish momentum.

For the DePIN token to fulfill Van de Poppe’s optimistic outlook, investor confidence must strengthen, with increased inflows supporting its price. Additional capital inflows could validate the bullish thesis, enabling NAVI to leverage the DePIN sector’s momentum and attract more buyers to its market.

Read more: 10 Best Altcoin Exchanges In 2024

NAVI Price Analysis. Source: TradingView

NAVI Price Analysis. Source: TradingView

However, if the DePIN token fails to breach the $0.150 resistance, it risks remaining in consolidation, undermining the bullish expectations. Losing support at $0.098 is unlikely, but if it occurs, NAVI could drop further to $0.076.