Raydium (RAY) Price Soars 30% as Daily Fees Hit Record Highs

Raydium (RAY) price is up 30% in the last 24 hours, driven by Bitcoin’s new all-time highs and RAY’s growing dominance within the Solana ecosystem. The protocol’s impressive earnings are establishing it as a leader while contributing to renewed bullish sentiment around its token.

However, as with any rally, there remains the potential for a correction before any further price surges.

Raydium Is Making More Money Than Ever

Raydium is on track to achieve $350 million in revenue in 2024, which is a remarkable feat for a decentralized protocol.

This performance highlights Raydium’s dominance in the Solana ecosystem and demonstrates the strong product-market fit it has achieved.

Read more: 11 Top Solana Meme Coins to Watch in November 2024

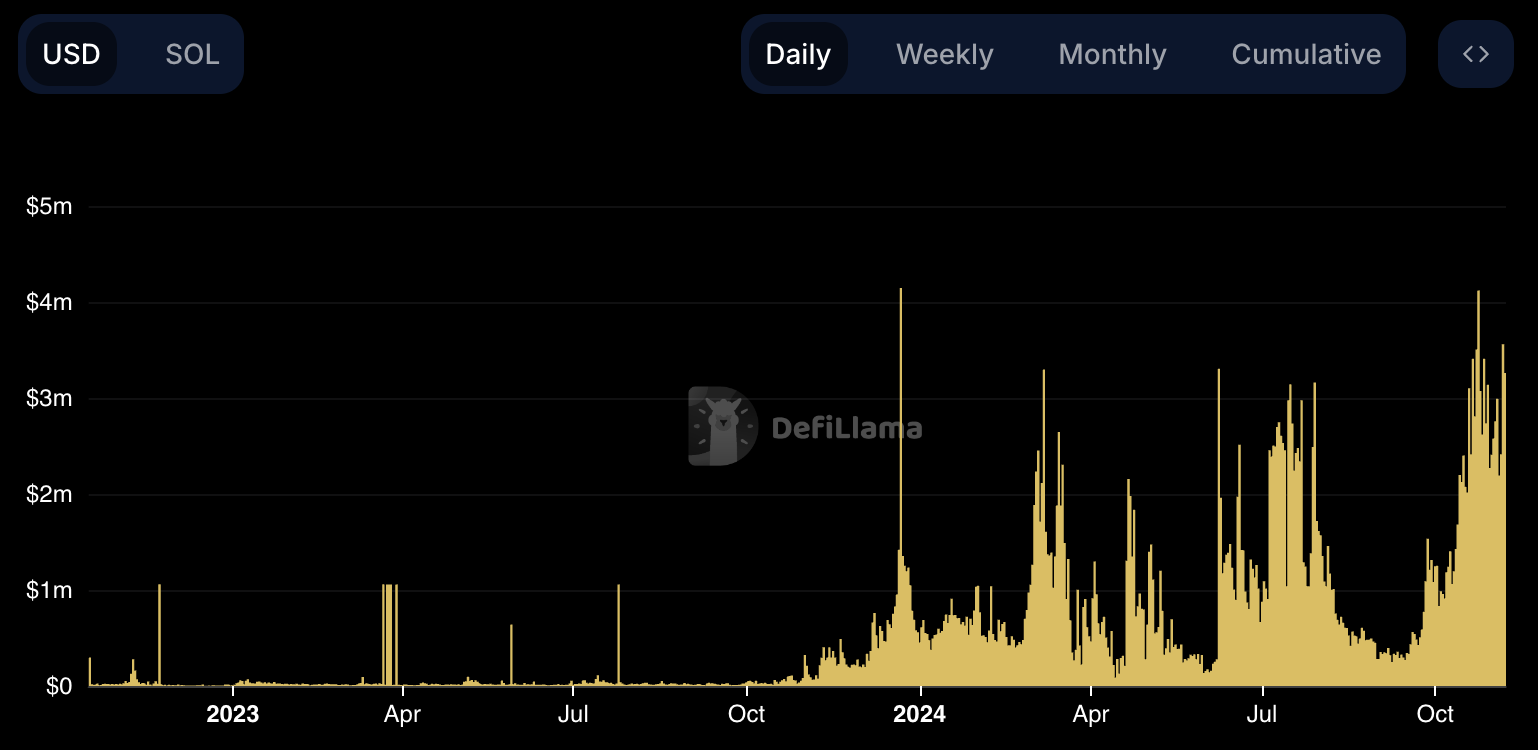

Raydium Daily Fees. Source: DeFiLlama

Raydium Daily Fees. Source: DeFiLlama

Currently, Raydium generates over $2 to $3 million per day in fees, positioning it ahead of many well-known blockchain platforms in terms of daily earnings.

In fact, it currently outpaces Uniswap, Solana, and Tron in daily fees, trailing only behind major players like Ethereum, Tether, and Circle.

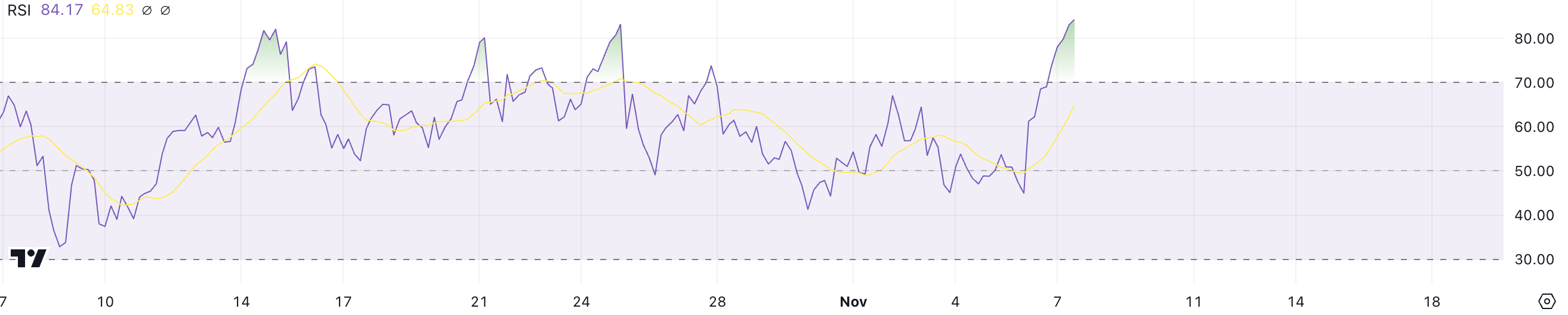

RAY RSI Now Shows an Overbought Stage

With a recent 30% price surge in just one day, Raydium (RAY) saw its RSI jump from 45 to over 84. This sharp increase indicates that the buying momentum has been intense, pushing the asset into an overbought zone.

Such a high RSI level often suggests that the price might have risen too quickly, potentially setting the stage for a short-term pullback.

RAY RSI. Source: TradingView

RAY RSI. Source: TradingView

RSI, or Relative Strength Index, is a momentum indicator used to evaluate whether an asset is overbought or oversold. Typically, an RSI below 30 indicates that an asset is oversold, suggesting it may be undervalued. An RSI above 70, on the other hand, signals an overbought condition, implying the asset could be overvalued.

With RAY’s RSI now above 84, it suggests that the token could be facing a correction soon, as the current levels indicate an overbought stage. Before attempting to make new recent highs, RAY may need to cool off and establish more stable support.

RAY Price Prediction: Is a 44% Correction Imminent?

RAY price is approaching its highest level since 2022, and it may soon break the $5 barrier. However, a strong correction may also occur before that.

Market conditions often fluctuate, and the current levels of optimism may be tested if the buying momentum slows down.

Read more: What Is Raydium (RAY)?

RAY EMA Lines and Support and Resistance. Source: TradingView

RAY EMA Lines and Support and Resistance. Source: TradingView

The EMA lines for RAY are showing a bullish setting, with the short-term EMAs positioned above the long-term ones and maintaining a healthy distance between them. This suggests a strong uptrend is currently in play. If the uptrend persists and RSI remains stable without a pullback, RAY could surpass the $5 level and continue higher.

On the other hand, if bearish pressure sets in, the price could retrace to its strong support zones at $3.11 or even $2.6, representing a potential 44% correction from current levels.