Ethereum (ETH) Bullish Setup Points to 32% Potential Upside

Ethereum (ETH) price is currently showing some interesting patterns, especially after Bitcoin (BTC) recently reached a new all-time high, which lifted the entire crypto market. This surge helped ETH rise nearly 10% in a single day, suggesting potential for further gains.

The 7-day MVRV ratio and recent whale accumulation hint at growing confidence among investors. Historical trends indicate that Ethereum may face a correction at these levels. However, the ongoing bullish sentiment could push it even higher before that happens.

ETH 7D MVRV Shows An Interesting Pattern

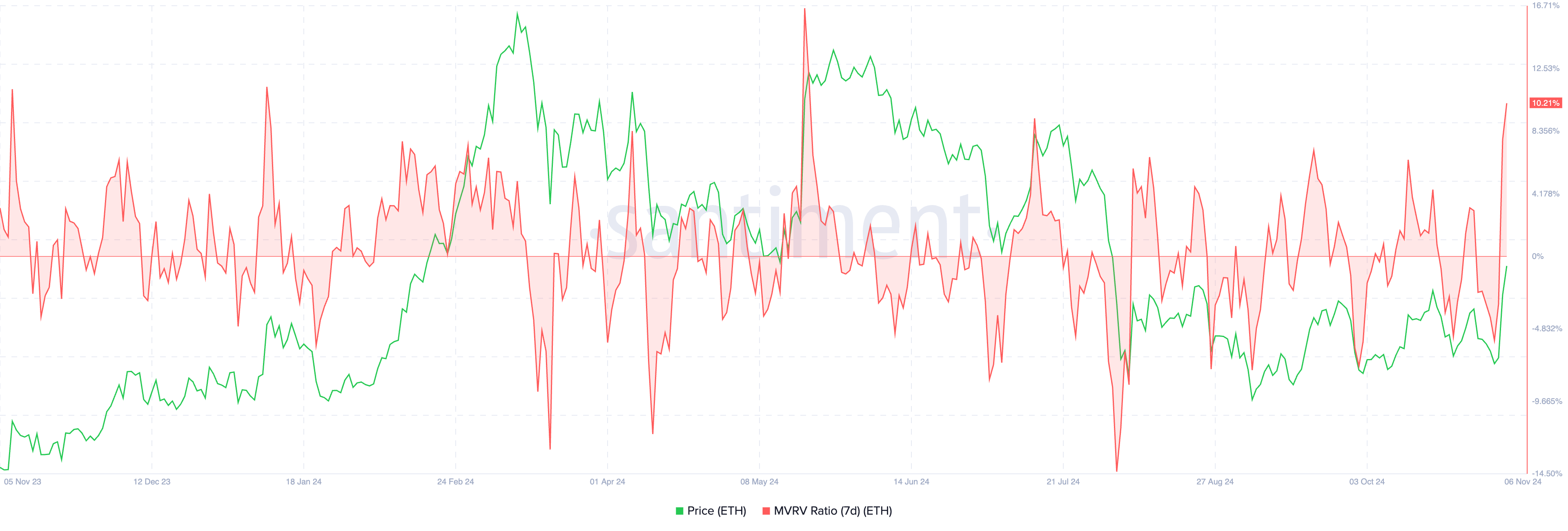

The 7-day MVRV (Market Value to Realized Value) ratio for Ethereum (ETH) is currently at 10.21%. This metric helps gauge whether an asset is overvalued or undervalued compared to its historical price basis.

Essentially, the 7D MVRV ratio measures the average profit or loss of holders who have acquired ETH in the past seven days.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

ETH 7D MVRV. Source: Santiment

ETH 7D MVRV. Source: Santiment

Historically, Ethereum’s price has tended to correct when the 7D MVRV ratio surpasses 8%, indicating that the asset might be overbought. However, there have also been cases where it needed to reach even higher levels before a correction took place—like in May, when it climbed to 16%.

Currently, with ETH’s MVRV ratio above 10%, there is a risk of a potential correction, but several factors could delay this outcome. Given ETH’s strong correlation with Bitcoin and the broader market’s bullish momentum, it’s possible that Ethereum could continue to rise before we see a significant pullback, allowing its MVRV ratio to increase further in the meantime.

Ethereum Whales Are Modestly Accumulating

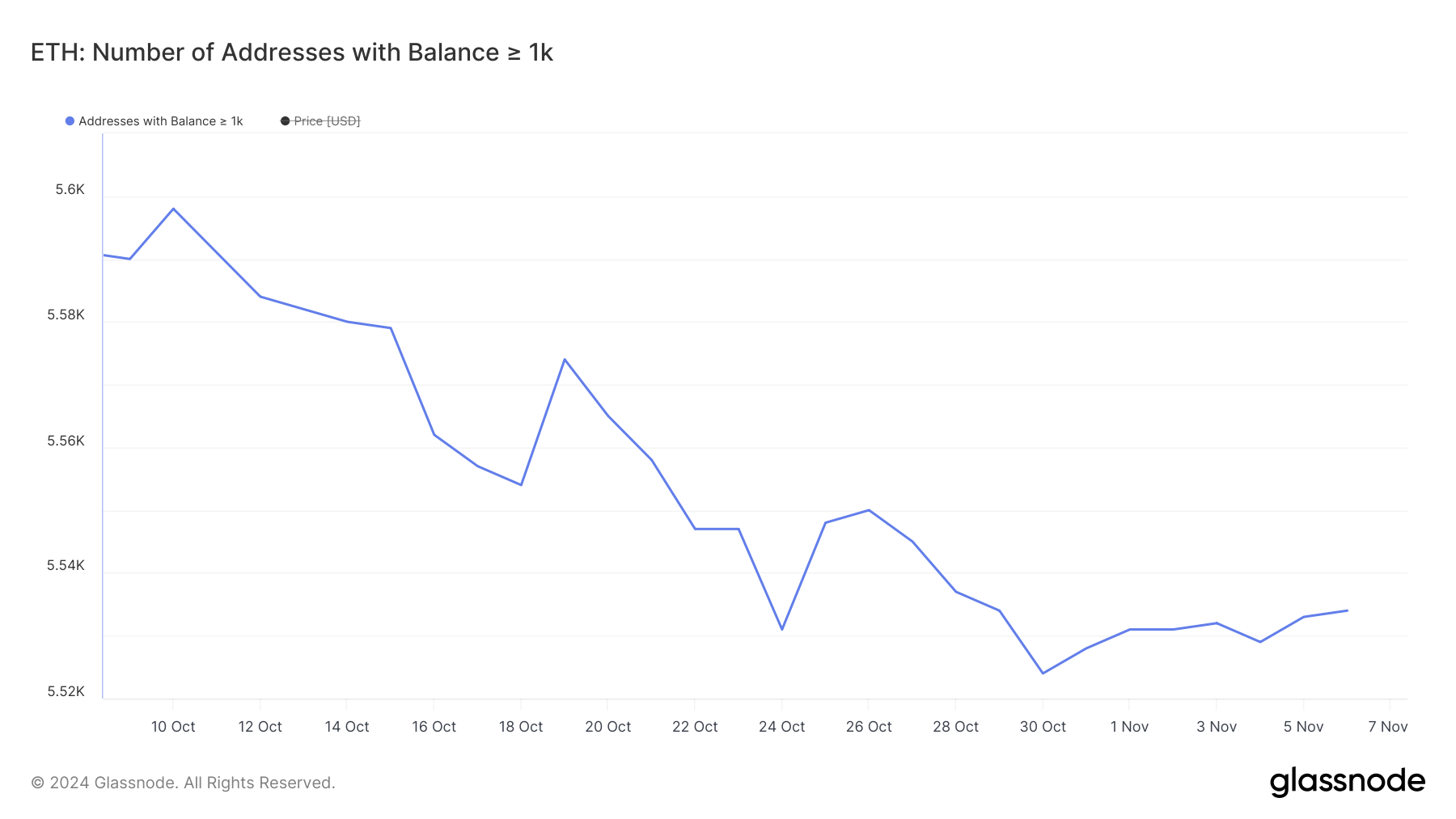

Since October 30, the number of addresses holding at least 1,000 ETH has been steadily increasing. From October 30 to November 6, this number grew from 5,524 to 5,534.

Although this might not seem like a significant jump, it is still noteworthy as it indicates renewed confidence among some Ethereum whales, who have started accumulating more ETH.

Addresses with Balance >= 1,000 ETH. Source: Glassnode

Addresses with Balance >= 1,000 ETH. Source: Glassnode

Tracking whale activity is crucial because these large holders often have the power to influence the market. When whales accumulate, it can signal that they expect the asset to rise in value, potentially driving bullish sentiment among smaller investors as well.

Although the current number of whale addresses is still far below what it was several months ago, the recent uptick could be an early indication that whales are gaining confidence in ETH again. This accumulation may suggest that they are anticipating further price increases in the near term, positioning themselves ahead of potential market movements.

ETH Price Prediction: A New 32% Surge?

Ethereum’s EMA lines currently indicate a bullish setup, driven by BTC’s new all-time highs. The short-term EMA line has crossed above the long-term one, forming a “golden cross.”

This crossover is generally seen as a positive sign by traders, suggesting that momentum is shifting towards the bulls.

Read more: How to Invest in Ethereum ETFs?

ETH EMA Lines and Support and Resistance. Source: TradingView

ETH EMA Lines and Support and Resistance. Source: TradingView

After rising almost 10% in a single day, if this momentum continues, ETH price could rise significantly, potentially testing the resistance level around $3,400. Such a move would represent a 32% increase from current levels.

However, if a downtrend emerges and a correction takes place before testing this resistance, ETH could first test support levels at $2,574 and $2,378.