XRP Finds Stability at $0.52, Sets Sights on New Highs

Ripple’s XRP has witnessed a 5% price surge over the past 24 hours. This uptrend has propelled XRP’s price above the crucial $0.52 support level.

With strengthening investor support, the altcoin is now testing the $0.56 resistance level. It is attempting to flip it into a support floor as it targets a move above $0.60.

Ripple Bulls Consolidate Control

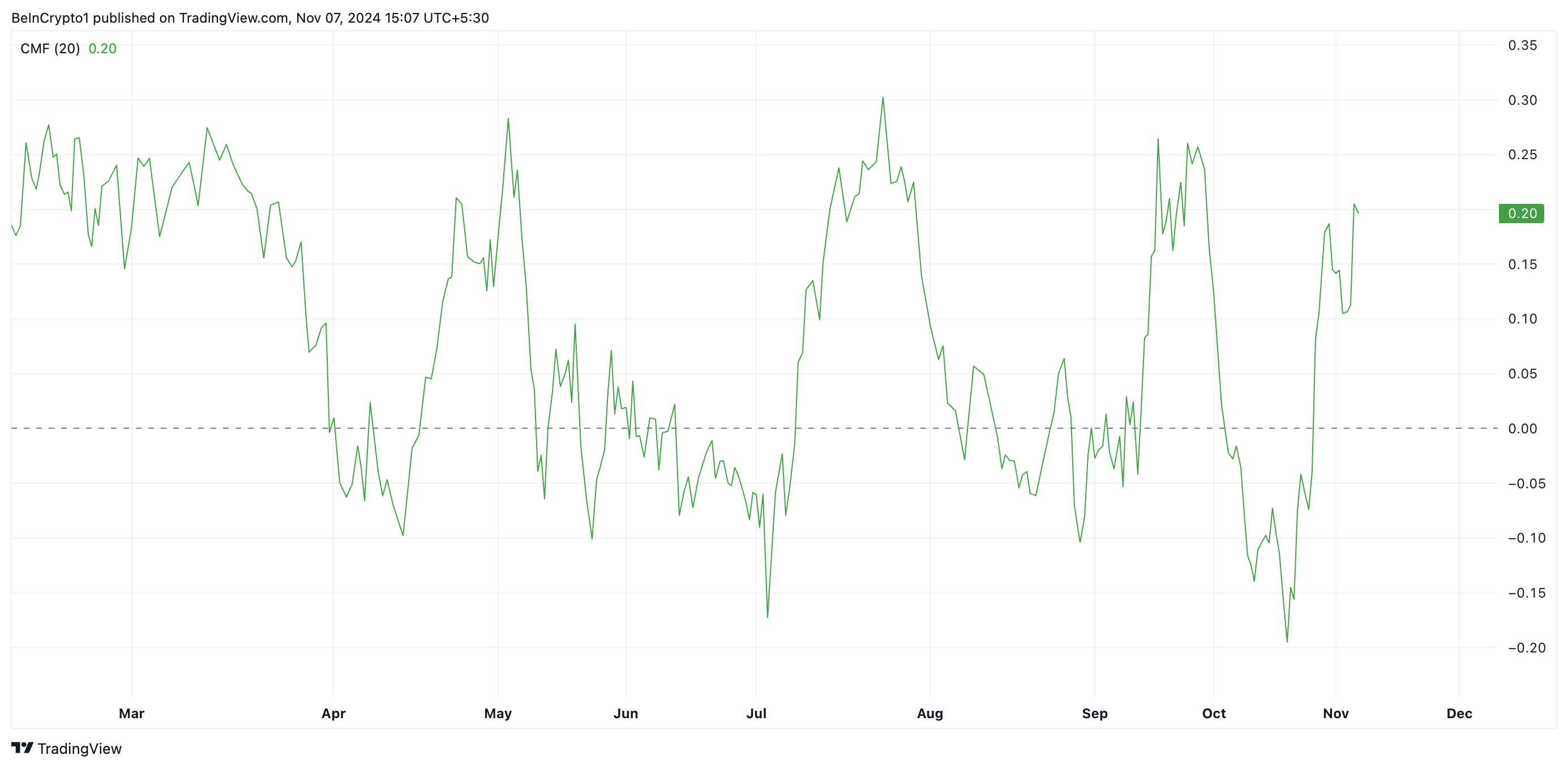

Market participants’ actual demand backs XRP’s 5% surge over the past 24 hours for the altcoin. This is reflected in the rise in the token’s Chaikin Money Flow (CMF), which measures money flows into and out of an asset. As of this writing, XRP’s CMF is in an upward trend at 0.20.

When an asset’s CMF climbs, there is increasing buying pressure in the market. This means that more investors are accumulating the asset than distributing it. As in XRP’s case, traders often look for a rising CMF with an asset’s price increase to confirm that the bullish trend is supported by strong investor interest and volume, giving more credibility to the rally.

Read more: How To Buy XRP and Everything You Need To Know

XRP CMF. Source: TradingView

XRP CMF. Source: TradingView

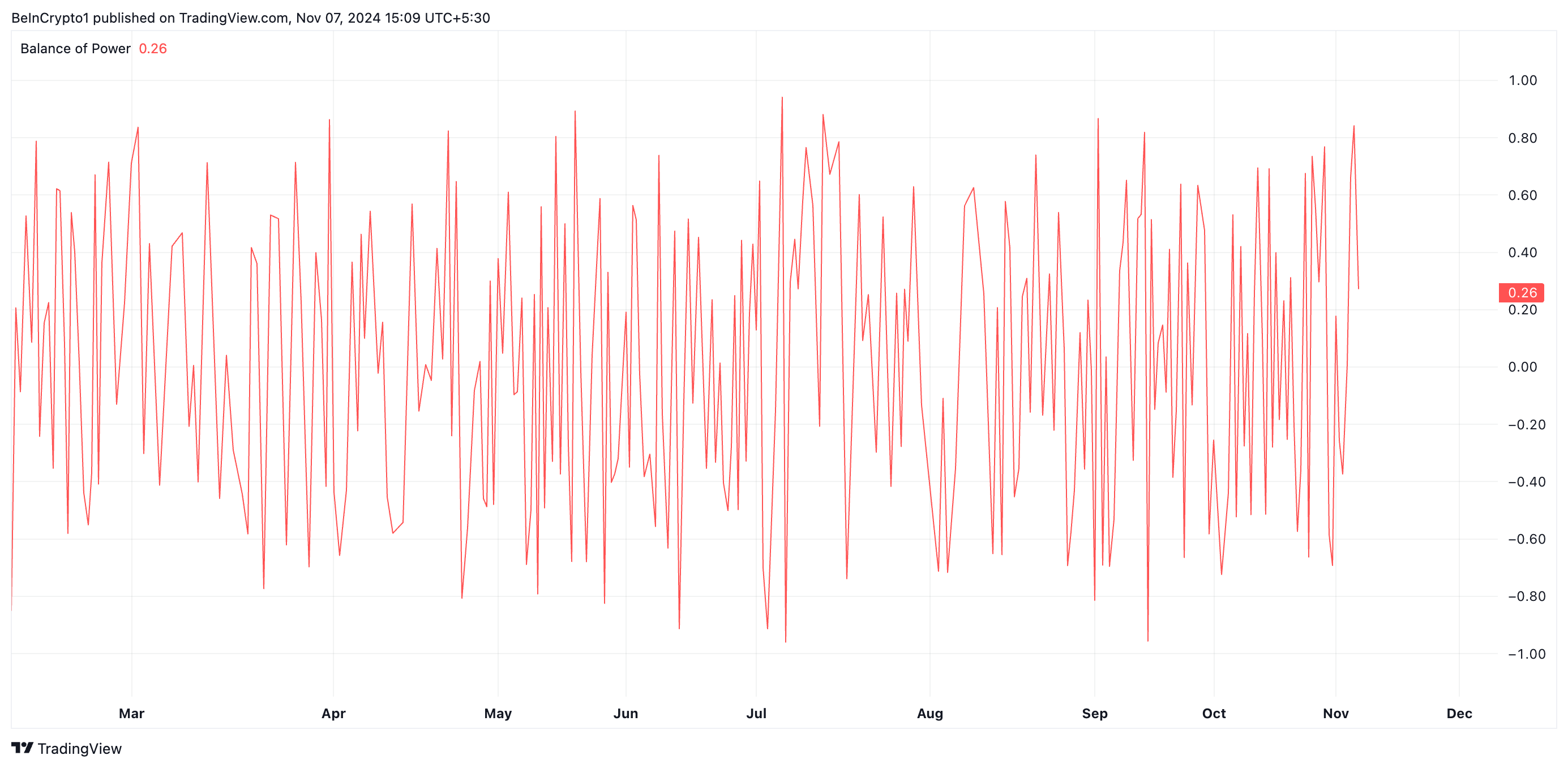

Further, its positive Balance of Power (BoP) indicates the bullish bias that XRP currently enjoys. This indicator, which measures the strength of buyers versus sellers in the market, is at 0.36 at press time. A positive BoP indicates buyers are in control and attempting to sustain the price rally.

XRP BoP. Source: TradingView

XRP BoP. Source: TradingView

XRP Price Prediction: One Of Two Ways

Notably, this bullish outlook also exists in XRP’s derivatives market, as reflected by its positive funding rate, which stands at 0.011% as of this writing. The funding rate is a mechanism used in perpetual futures contracts to ensure that the contract’s price stays aligned with the underlying spot price of an asset.

XRP Funding Rate. Source: Santiment

XRP Funding Rate. Source: Santiment

When an asset’s funding rate is positive, it indicates the price of the perpetual futures contract trades at a premium compared to the spot price. This signals that there is more buying (long) interest than selling (short) interest in the market. This occurs when traders are optimistic about the asset’s price increasing further.

If the current market momentum persists, XRP is poised to break through the $0.56 resistance in the near term. A successful breakout would position it toward targeting the $0.60 level, a price it last hit in early October.

Read more: XRP ETF Explained: What It Is and How It Works

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

Conversely, a failed attempt to surpass $0.56 could see the XRP price surge retracing its recent gains, potentially pulling back to the next support level at $0.52.