Bitcoin (BTC) Powers Up for the Next Big Move, Fueled by US Demand

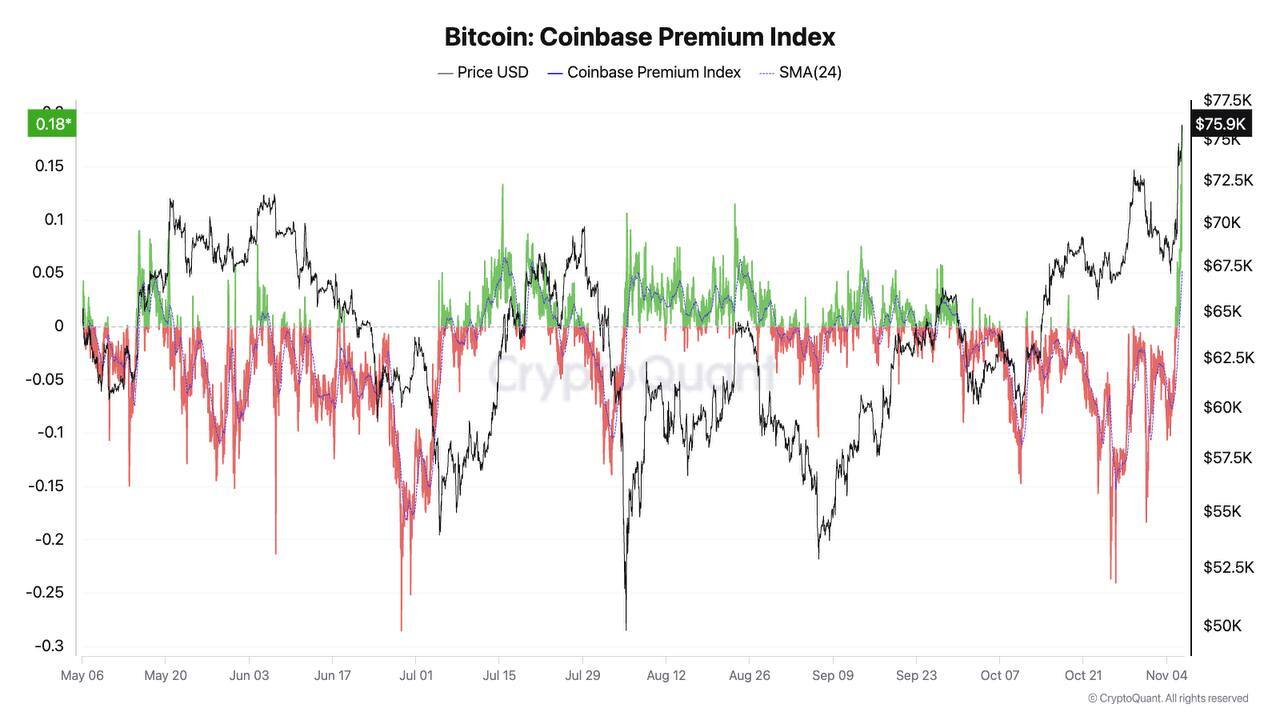

Bitcoin (BTC) price has recently reached a new all-time high following Donald Trump’s election as US President. This surge in demand appears to be driven by renewed interest from US investors, as seen by the significant spike in the Coinbase Bitcoin price premium.

Historically, a positive Coinbase premium often correlates with sustainable rallies in Bitcoin’s price, indicating that US-based traders are becoming more bullish. With the current uptrend gaining momentum, there is optimism that BTC could soon test even higher price levels.

BTC Coinbase Premium Index Is Hitting New Recent Highs

One of the most significant developments recently has been the noticeable resurgence in Bitcoin demand originating from US-based investors and traders. That’s even more relevant with the recent election of Donald Trump as the new president of the United States.

This increased interest is clearly reflected by the Coinbase Bitcoin price premium, which has spiked into positive territory for the first time since October 18.

Read more: What Is a Bitcoin ETF?

BTC Coinbase Premium Index. Source: CryptoQuant

BTC Coinbase Premium Index. Source: CryptoQuant

Even more telling is that it has surged to the highest level witnessed since at least May, as illustrated by the green line.

“A positive Coinbase premium historically coincides with sustainable rallies in the price of Bitcoin,” Julio Moreno, Head of Research at CryptoQuant, noted.

Bitcoin Current Uptrend Is Strong

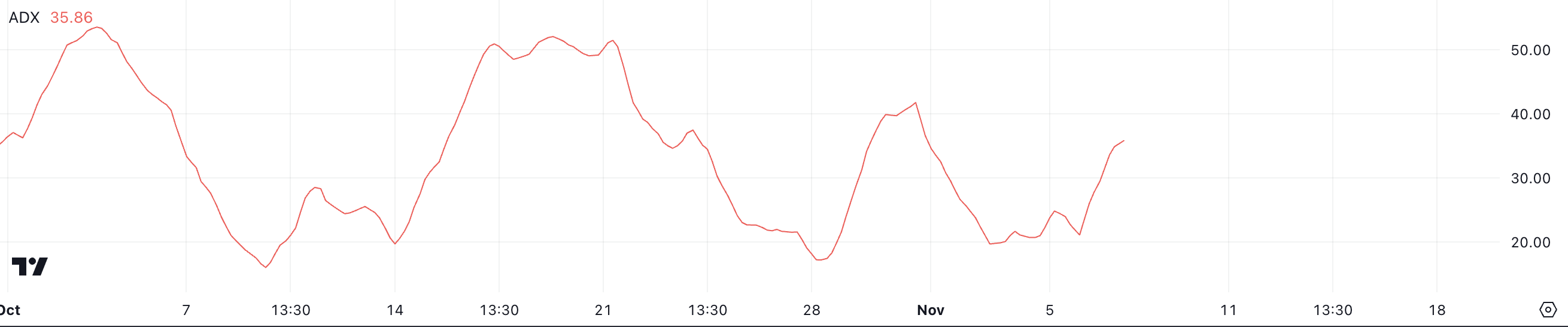

Bitcoin’s ADX is currently at 35.86, which is a notable increase from 20.98 just a day ago. This indicates that the trend is gaining strength. The ADX, or Average Directional Index, is used to measure the strength of a trend.

When the ADX rises sharply like this, it shows that the momentum behind the current trend—whether up or down—is increasing significantly.

BTC ADX. Source: TradingView.

BTC ADX. Source: TradingView.

The ADX helps traders determine whether a market is trending or moving sideways. Typically, an ADX below 20 signals a weak or nonexistent trend. When the ADX is between 20 and 40, the trend is moderate to strong.

If it goes above 40, the trend is very strong. Currently, Bitcoin’s ADX is at 35.86, signaling that Bitcoin is in a solid uptrend and could reach new all-time highs soon.

BTC Price Prediction: A New All-Time High Soon?

Bitcoin’s EMA lines are currently showing a bullish setup. Even after reaching a new all-time high, the price has retraced slightly but remains positive.

The EMA, or Exponential Moving Average, helps to smooth out price movements and identify trends. In this case, the positioning of these lines suggests continued optimism.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

BTC EMA Lines and Support and Resistance. Source: TradingView

BTC EMA Lines and Support and Resistance. Source: TradingView

Bitcoin’s price is well above the EMA lines. All short-term EMA lines are above the longer-term ones, indicating a strong uptrend. If this momentum keeps up, Bitcoin could continue its rally and reach new all-time highs, possibly aiming for the $76,000 zone.

However, after a new high, it’s normal for the price to correct a bit as investors capitalize on their profits or consider other coins to invest in. If the trend reverses, Bitcoin may test its strong support levels, around $65,500 and $62,000.