BlackRock, Securitize Likely to Launch BUIDL on Avalanche

BlackRock and Securitize may be gearing up to launch the BUIDL tokenized fund on the Avalanche blockchain. This would potentially expand the market for tokenized assets in the US and beyond.

It marks a significant step in integrating blockchain technology with traditional finance (TradFi). BlackRock’s BUIDL fund, which invests in US Treasury bonds, repurchase agreements, and cash, aims to reach a wider audience through the Avalanche network.

BlackRock’s BUIDL Eyes Possible Expansion to Avalanche

Running atop the Securitize protocol, BlackRock’s BUIDL fund has grown significantly, recording assets under management (AUM) above $500 million. According to on-chain data, the product may be expanding to the Avalanche blockchain after an initial deployment on Ethereum.

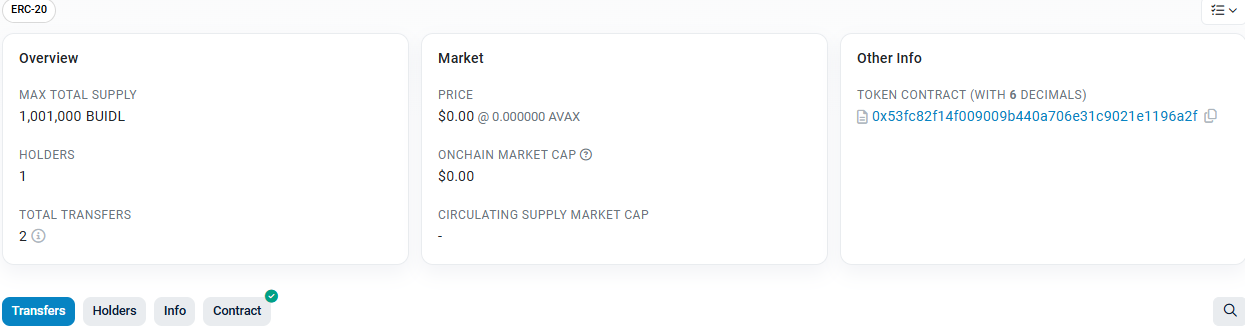

Data on SnowScan, a block explorer for the Avalanche network, the contract for the Avalanche-based BUIDL fund is already live. Further, early indicators show $1 million allocated to the Avalanche fund address.

“The owner of BUIDL on Ethereum is the same as BUIDL on Avalanche. This address was also funded today on Avalanche and has interacted with the newly deployed BUIDL contract,” CryptoNoddy shared on X.

Read more: RWA Tokenization: A Look at Security and Trust.

One million BUIDL has already been issued on Avalanche. Source: SnowScan

One million BUIDL has already been issued on Avalanche. Source: SnowScan

Of note, however, is that neither BlackRock nor Securitize have officially announced the expansion or launch. To some, the discretion may be a test phase strategy to determine Avalanche’s suitability for the fund. According to CryptoNoody, the deployment suggests strong potential for a broader rollout, though trading may not commence for months.

“As with all attempts to front-run announcements, this may not be final and could just be part of some tests or could be several months out. Around 6 months ago, Securitize and Arbitrum Foundation also signed an integration agreement, although I haven’t seen it deployed/discussed further,” Crypto Noddy added.

Avalanche Becomes a Hub for RWAs

Meanwhile, the possible addition of BlackRock’s BUIDL fund on Avalanche could mark the beginning of a new wave of tokenized funds joining the network. Over the past year, Avalanche has positioned itself as a hub for real-world asset (RWA) tokenization.

Specifically, it already hosts tokenized assets from Franklin Templeton, Grayscale, Backed Finance, and OpenEden. The network’s draw has been its strong infrastructure and its capability to support high volumes of on-chain transactions, a necessary feature for tokenized finance.

Similarly, Securitize recently collaborated with ParaFi Capital, a digital assets manager, to tokenize part of ParaFi’s $1.2 billion fund on Avalanche. It comes as the Securitize protocol establishes itself as a key player in the growing field of tokenized securities.

In addition to BlackRock, Securitize has previously collaborated with major asset managers such as Hamilton Lane, KKR, and Tradeweb Markets. As of now, tokenized government securities total around $2.34 billion in value, with a growth rate of 4% over the last 30 days, according to data from Dune Analytics.

Tokenized Government Securities Valuation. Source: Dune

Tokenized Government Securities Valuation. Source: Dune

Major financial institutions, including Goldman Sachs, JPMorgan, and Citi, are actively exploring and investing in tokenization technologies. Similarly, consulting firms like McKinsey and Boston Consulting Group predict the RWA market will reach multi-trillion dollars by 2030. This forecast and interest reflect the enormous potential and growing interest in tokenized assets.

However, not everyone is entirely optimistic. Binance founder and former CEO Changpeng Zhao (CZ) expressed concerns about the limited volatility of RWAs. Speaking at the Second Gulf Investment Forum in Bahrain, CZ explained that RWAs, due to their stable nature, lack the price swings seen in typical cryptocurrencies.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

This stability could dissuade active traders from seeking high-risk, high-reward trades, leading to lower trading volume and, in turn, reduced liquidity.