Ethereum price jump spurs most significant ETF inflows in six weeks

- US spot Ether ETFs gained $52.3 million in new inflows on Wednesday, a six-week high, with Fidelity and Grayscale leading.

- The value of all cryptocurrencies rose to $2.52 trillion as Ether price rose 12%.

- Spot Bitcoin ETFs also saw significant inflows, totalling $621.9 million, with Fidelity and others gaining and BlackRock seeing outflows.

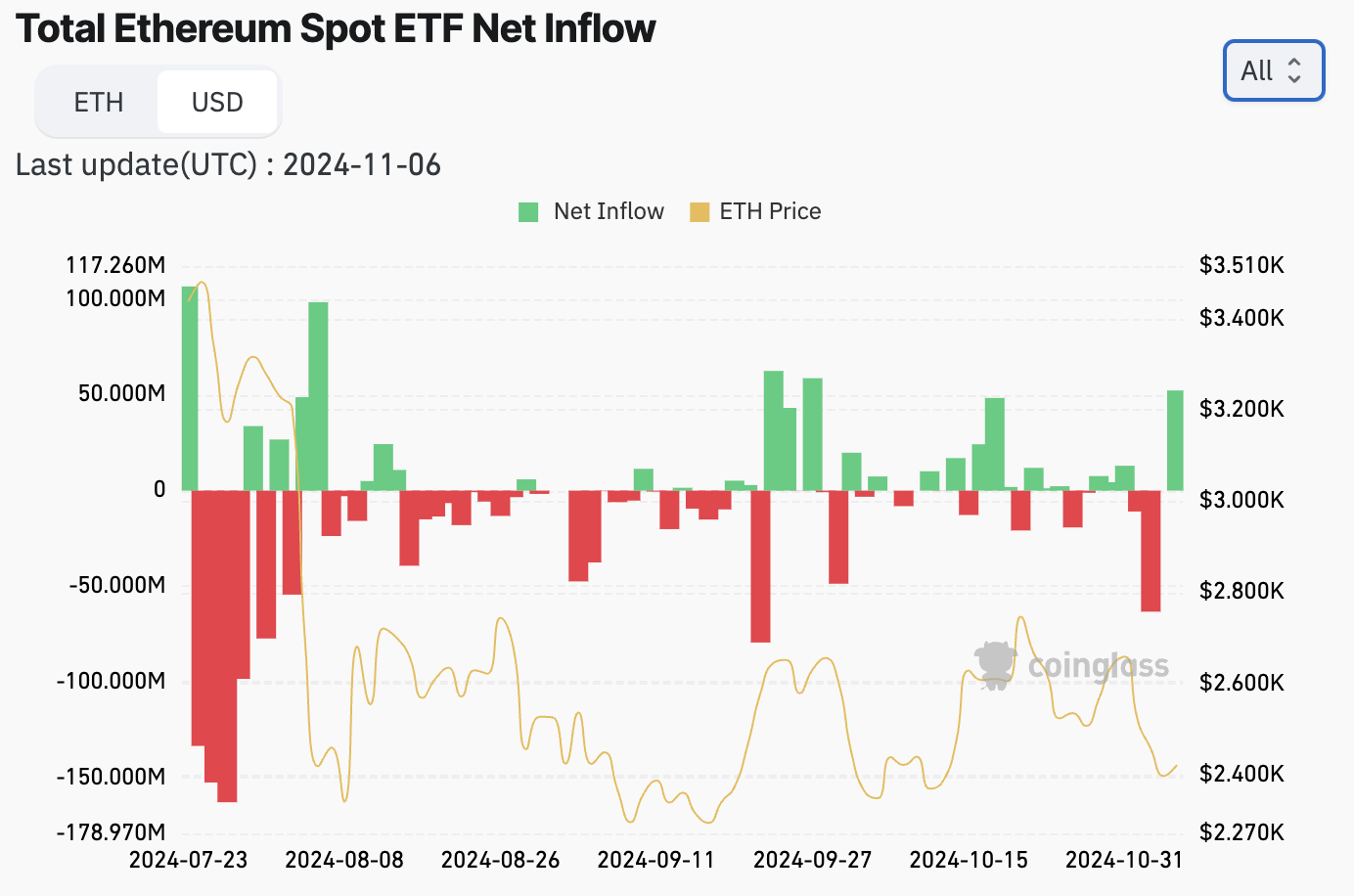

After a positive momentum in crypto markets following the outcome of the US presidential election, spot Ether exchange-traded funds (ETFs) in the United States saw their highest inflows in six weeks. Together, the nine newly-launched spot Ether ETFs saw a net inflow of $52.3 million on Wednesday.

While the inflow to Ether funds had remained modest, this was the highest since September 27, according to data from CoinGlass.

Total Ethereum Spot ETF net inflow. Source: CoinGlass

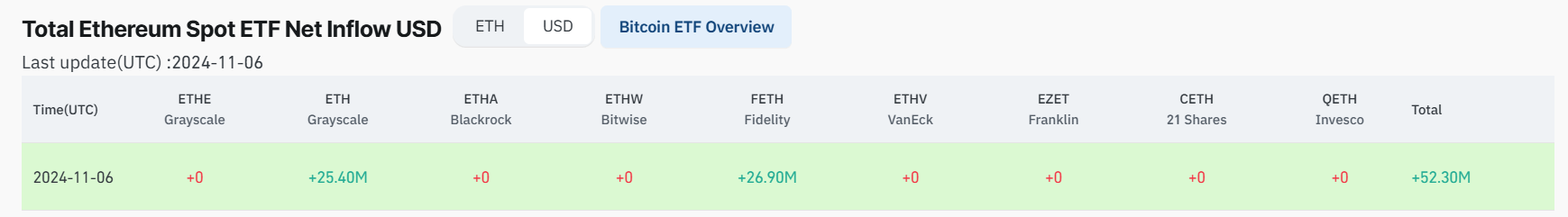

When dissecting the big figure, however, the data shows that just two ETFs recorded inflows: $26.9 million to the Fidelity Ethereum Fund and $25.4 million to Grayscale Ethereum Mini Trust. All the rest, including BlackRock’s iShares Ethereum Trust, didn’t register any inflows or outflows on Wednesday despite the price surge.

Ethereum Spot ETF net inflow by asset manager. Source: CoinGlass

Fidelity leads Bitcoin ETF inflows with record $308.8 million

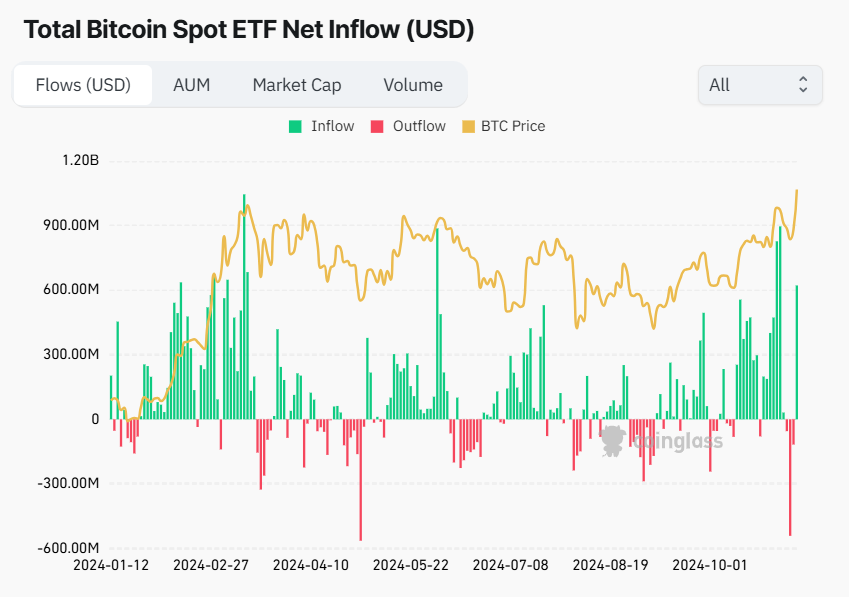

US-listed Bitcoin spot ETFs also registered inflows on Wednesday following BTC’s price surge. Net inflows of $621.9 million turned a page on three days of straight red, according to CoinGlass data.

Total Bitcoin Spot ETF net inflow. Source: CoinGlass

BlackRock's iShares Bitcoin Trust saw outflows for a second consecutive trading day, shedding $69.1 million. The fund also reported its highest trading volume, with $4.1 billion.

Bitcoin Spot ETF net inflow by asset manager. Source: CoinGlass

The most significant influx was $308.8 million into Fidelity’s Wise Origin Bitcoin Fund, which represented the fund’s most considerable inflow since June 4. Furthermore, Bitwise, Ark 21Shares, and Grayscale experienced more than $100 million in product inflows.

The crypto total market capitalization has reached $2.464 trillion, a 4% increase over the past 24 hours.

Total crypto market capitalization. Source: TradingView