This Week in Crypto: Bitcoin ETFs Hit 1 Million BTC, Tether Reports Record Q3 Profit, Polymarket Under Fire

This week, BeInCrypto noted strong investor interest in key events: Bitcoin ETFs crossing the 1 million BTC mark, insider trading allegations involving MrBeast, and suspected manipulation on Polymarket related to Trump.

Major Q3 earnings reports from industry giants also drew attention, alongside unexpected large-scale layoff announcements. Additionally, the GRASS token saw a significant price surge despite earlier airdrop controversies.

US Bitcoin ETFs Now Hold Over 1 Million BTC

This week, Bitcoin ETFs in the US surpassed the milestone of holding over 1 million BTC. This marks an important step, indicating strong growth and wide acceptance of Bitcoin in traditional investment funds.

Read more: What Is a Bitcoin ETF?

BTC Holdings in Publicly Traded And Private Companies, ETFs And Countries. Source: Treasuries Bitbo

BTC Holdings in Publicly Traded And Private Companies, ETFs And Countries. Source: Treasuries Bitbo

Currently, these Bitcoin ETFs hold over 1.18 million BTC, which is more than 5.6% of the total supply. BlackRock’s iShares Bitcoin Trust alone holds over 420,000 BTC, accounting for over 2% of the total supply. This positive signal reinforces Bitcoin’s status as a mainstream financial asset.

“US ETFs smash through the 1 million bitcoin under management after Blackrock alone purchases a staggering 12,053 in a single day. Reminder to the small guy to “get some / get yours” while you still can. Utterly enormous supply shock inbound,” Shaun Edmondson commented.

Notable Q3 Reports from Tether, MicroStrategy, and Robinhood

This week, notable Q3 reports from major companies grabbed attention with record figures.

- Tether, the world’s largest stablecoin issuer, reported a record profit of over $2.5 billion for Q3, with USDT’s market capitalization exceeding $120 billion. The report also revealed that Tether holds over $105 billion in cash and cash equivalents, including $102.5 billion in US Treasury bills.

- MicroStrategy announced a $42 billion capital-raising initiative to buy Bitcoin (BTC) over the next three years. Additionally, its stock hit a 24-year high, outperforming Bitcoin.

- Robinhood’s Q3 2024 report showed a trading volume of $14.4 billion, up 114% from Q3 2023. Robinhood’s stock surged 170% in 2024.

Investor enthusiasm for Bitcoin has not only driven it near its all-time high but also elevated the profits and share values of associated firms.

YouTube Mogul MrBeast Accused of Insider Trading

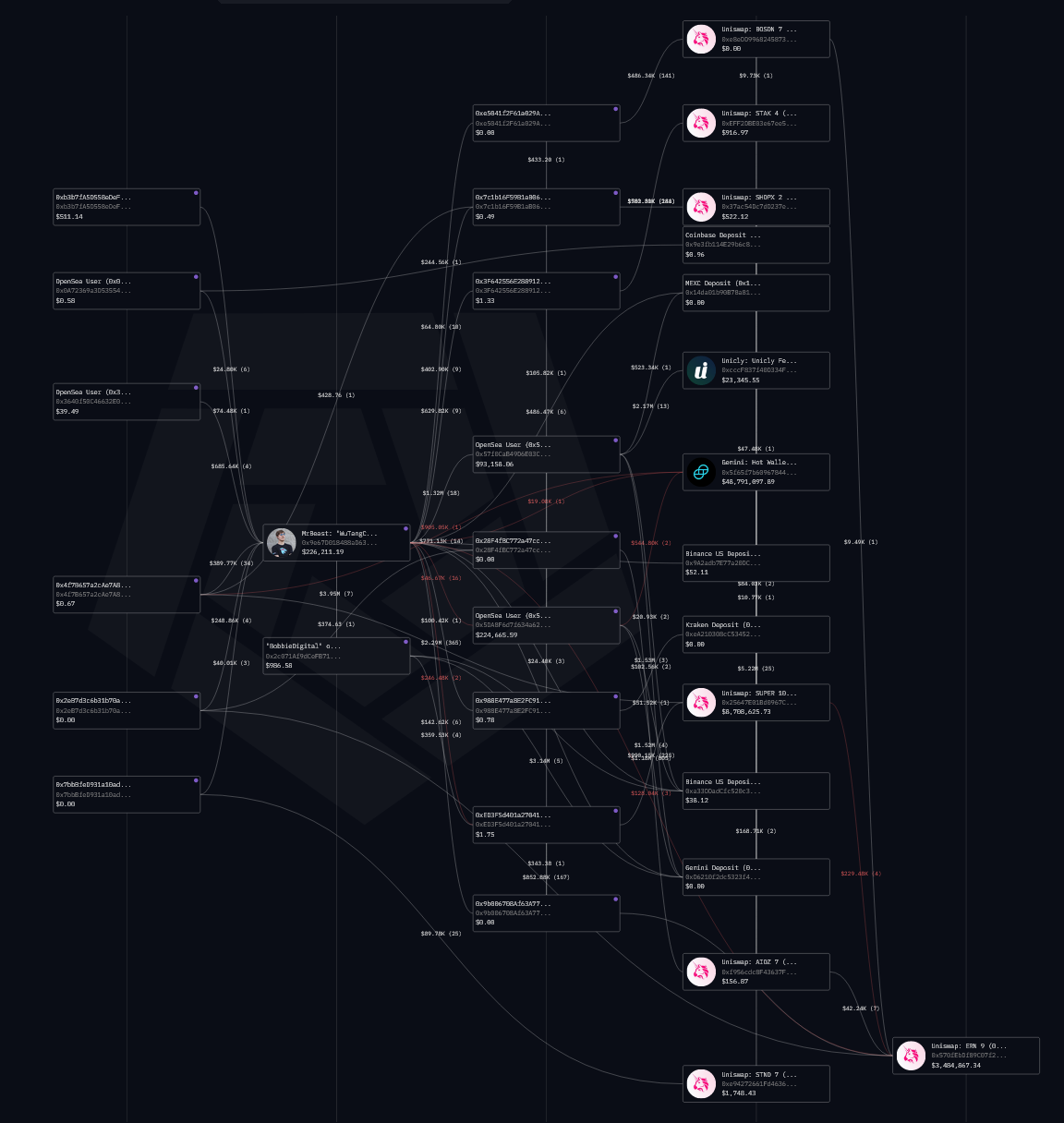

The crypto investment community was abuzz with insider trading allegations against MrBeast. A new investigation by Loock Advising mapped a network revealing numerous hidden transactions.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

MrBeast’s Secret Wallets. Source: Loock Advising

MrBeast’s Secret Wallets. Source: Loock Advising

Kasper Vandeloock, an analyst at Loock Advising, accused MrBeast of earning at least $23 million from insider trading. However, MrBeast has yet to respond to these allegations.

“We believe this is a result of insider trading because MrBeast has most of his focus set on his social media empire. Cryptocurrency investing takes time and focus, sorting out hundreds of potential investment opportunities. Rather than actively trading, MrBeast made several investments that paid off massively,” the investigation claimed.

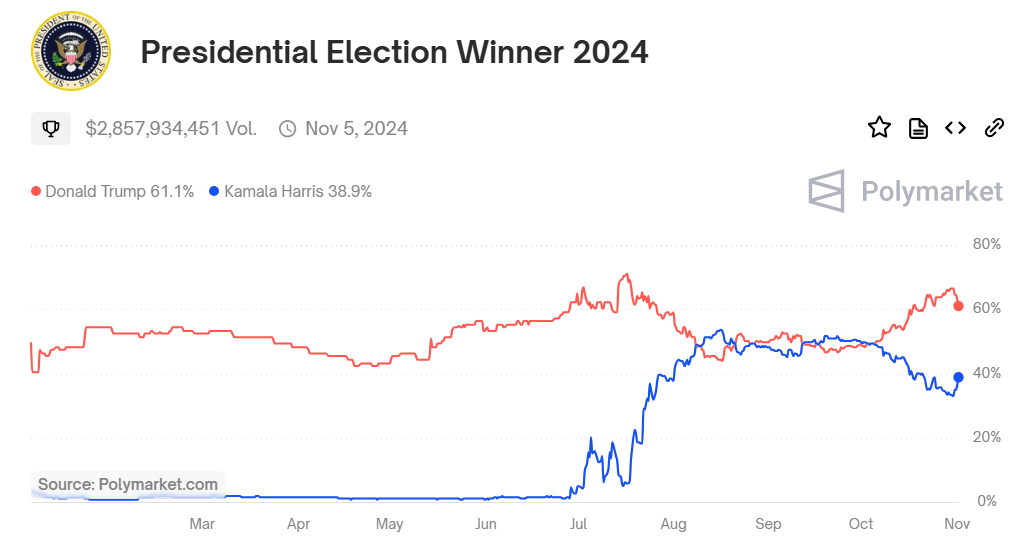

Suspicion Over Polymarket Betting Odds Related to Trump

This week, some analyses suggested that betting odds on Polymarket related to former President Donald Trump might be fake. These suspicions point to potential manipulation through wash trading, a fraudulent activity to create artificial trading volume.

Polymarket consistently showed Trump’s chances of victory at over 60%, with trading volume for the “Presidential Election Winner 2024” market unusually high, exceeding $2.8 billion.

Read more: What is Polymarket? A Guide to The Popular Prediction Market

Chances of victory for Donald Trump vs. Kamala Harris. Source: Polymarket

Chances of victory for Donald Trump vs. Kamala Harris. Source: Polymarket

Chaos Labs’ analysis estimated that about one-third (33.33%) of Polymarket’s trading volume in the presidential election market was due to wash trading.

Additionally, Polymarket has taken steps to limit manipulation. As reported by BeInCrypto, the platform has begun tightening user verification protocols, especially for high-volume traders.

Wave of Layoffs in Crypto Companies

This week, numerous layoff announcements were also made by companies like ConsenSys, Kraken, and dYdX. Early in the week, ConsenSys, the blockchain company behind MetaMask, announced a 20% workforce reduction, affecting about 160 employees. CEO Joe Lubin cited macroeconomic challenges and legal costs associated with SEC disputes as primary reasons.

The next day, decentralized derivatives exchange dYdX announced a 35% cut in key personnel. Founder Antonio Juliano stated that dYdX was built differently from the vision it needed to pursue, leading to this difficult decision.

Kraken also announced layoffs affecting 15% of its workforce, approximately 400 positions. This announcement came as Arjun Sethi stepped in as co-CEO alongside Dave Ripley, with Kraken planning an organizational overhaul.

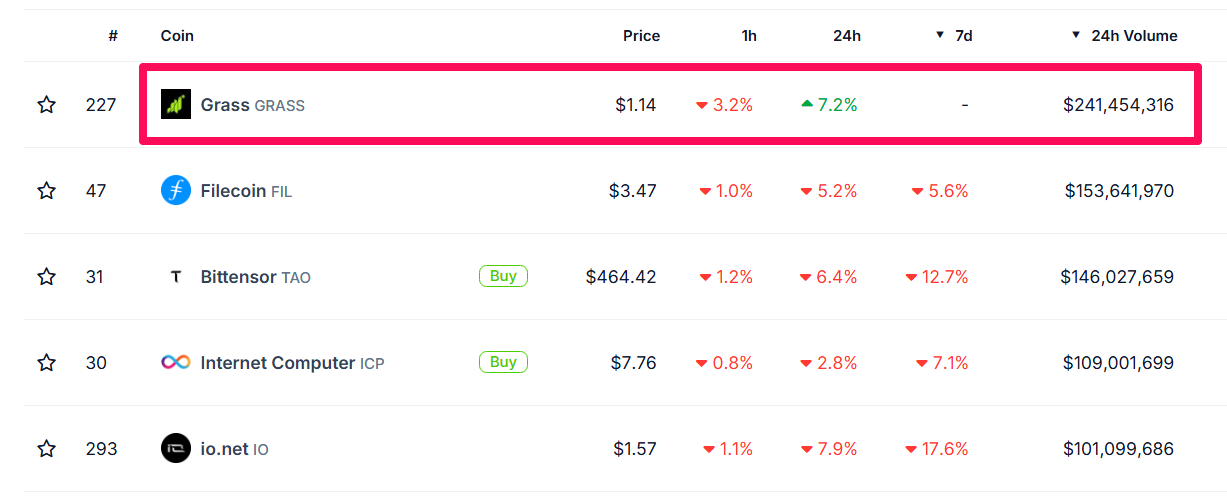

GRASS Airdrop Draws Attention

This week in crypto, the DePin Grass project’s airdrop event attracted community attention. After listing, the GRASS token on Solana surged to over $1.25, leading the DePin sector in trading volume.

Despite earlier controversies surrounding the GRASS token distribution, its price has continued to rise. Concerns were raised about the initial circulating supply of GRASS being too low, while its Fully Diluted Valuation (FDV) exceeded $1 billion. Additionally, 0.01% of the total supply, equivalent to 146,200 GRASS, will be unlocked daily.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Top DePIN Coins by 24h Volume. Source: CoinGecko

Top DePIN Coins by 24h Volume. Source: CoinGecko

However, at the time of writing, GRASS is the only token in the TOP5 DePin projects to remain in the green over the past 24 hours.