Donald Trump’s World Liberty Financial Cuts WLFI Presale Goals by 90%

World Liberty Financial (WLFI), a project endorsed by Donald Trump, recently reduced its presale goal from $300 million to $30 million.

After an initially strong first day, sales have since stagnated, with the project reaching nearly $15 million to date. However, WLFI faces significant behind-the-scenes issues, contributing to its slowed momentum.

WLFI’s Presale Flop

World Liberty Financial, a project endorsed by Donald Trump, has cut its fundraising goals by 90%. Presale for WLFI tokens launched on October 15, raising $5 million in the first hour before facing immediate technical difficulties. The goal for this presale was $300 million. However, an SEC filing from October 30 describes much lower expectations.

“$288,501,188 is the maximum inventory available for sale. The company currently only plans to sell tokens up to $30 million in the offering before terminating sale. $2,703,786 reflects assets received by the company, including assets whose fair market value is approximated,” it stated.

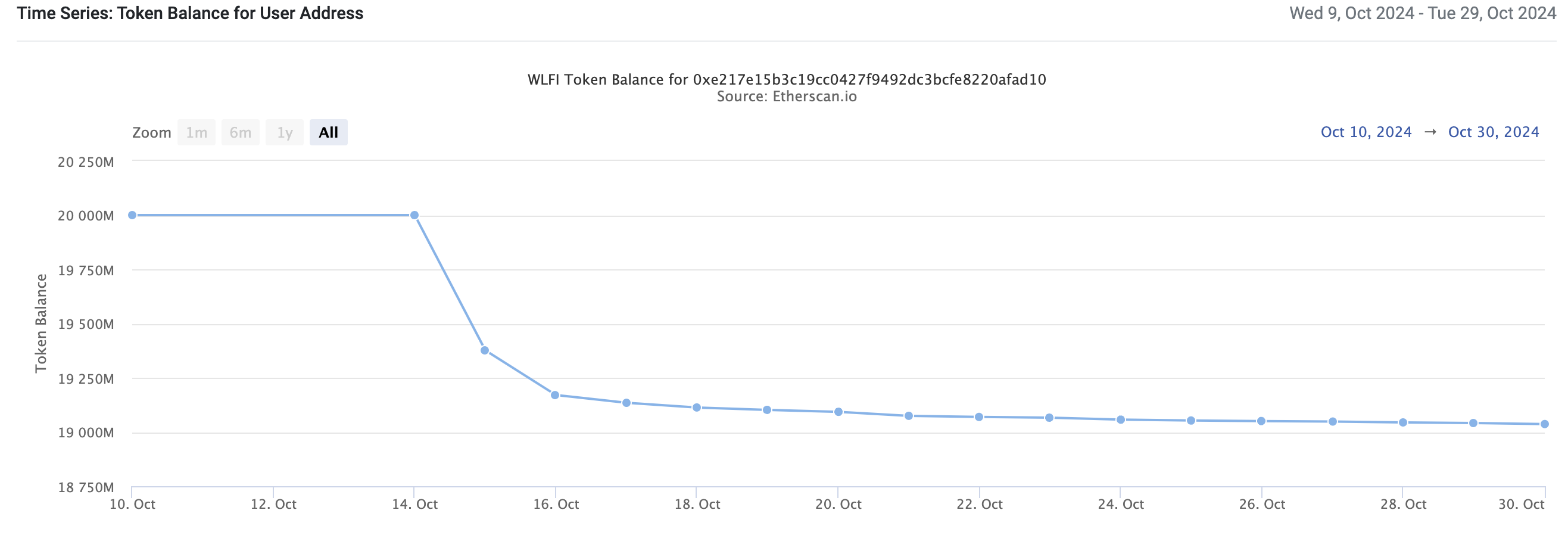

In other words, World Liberty plans to close this presale after reaching only 10% of its initial goal. Before launch, the project generated a good deal of hype that impacted Trump’s Polymarket odds. However, on-chain data reveals that token buys immediately plummeted. In total, WLFI holds over 19 billion of the 20 billion tokens it initially offered.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

WLFI Token Sale Decline. Source: Etherscan

WLFI Token Sale Decline. Source: Etherscan

The SEC’s mention of over $2.7 million in sales does seem to be a slight discrepancy. However, World Liberty’s official site claims that these tokens sell for $0.15, and that it sold just shy of a billion. The SEC document lists $285,797,402 as the value of remaining WLFI tokens, so they’ve sold a hair under $15 million so far. These figures, at least, all add up.

In other words, it’s presently unclear if World Liberty hopes to sell an additional $15 million or $28 million before canceling the sale. Whatever the case, crypto investors’ skepticism of the project seems well-founded. The purchased WLFI tokens are frozen for current holders, so holders can’t cash out for more fungible assets.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Indeed, current WLFI holders own nothing more than “a governance token for [an] as-yet unlaunched protocol,” as Galaxy Digital stated. World Liberty attempted a launch on Aave’s Ethereum mainnet, but there doesn’t seem to be any progress with the negotiations. With failed expectations and disappointing sales, WLFI might never get off the ground.