Bitcoin Price Forecast: BTC recovers as BlackRock ETF sees over $1 billion in inflows for two weeks running

Bitcoin price today: $68,500

- US spot Bitcoin ETFs recorded net inflows of $997.2 million last week, with BlackRock IBIT funds contributing by $1.15 billion.

- Santiment data indicates that major stakeholders are accumulating more coins from retail traders, historically pointing to bullish outcomes.

- Reports that the US government investigates the Tether stablecoin and rising tensions between Israel and Iran weigh on the BTC’s outlook.

Bitcoin (BTC) continues to recover and trades above $68,000 on Monday after declining and finding support around $66,000 on Friday. Despite BTC dipping to $65,260 last week, US spot Bitcoin Exchange Traded Funds (ETFs) recorded net inflows of $997.2 million, with BlackRock IBIT funds contributing by $1.15 billion. However, reports that the US government is investigating the Tether stablecoin and rising tensions between Israel and Iran weigh on BTC’s outlook.

Institutional demand shows strength despite Bitcoin’s recent dip

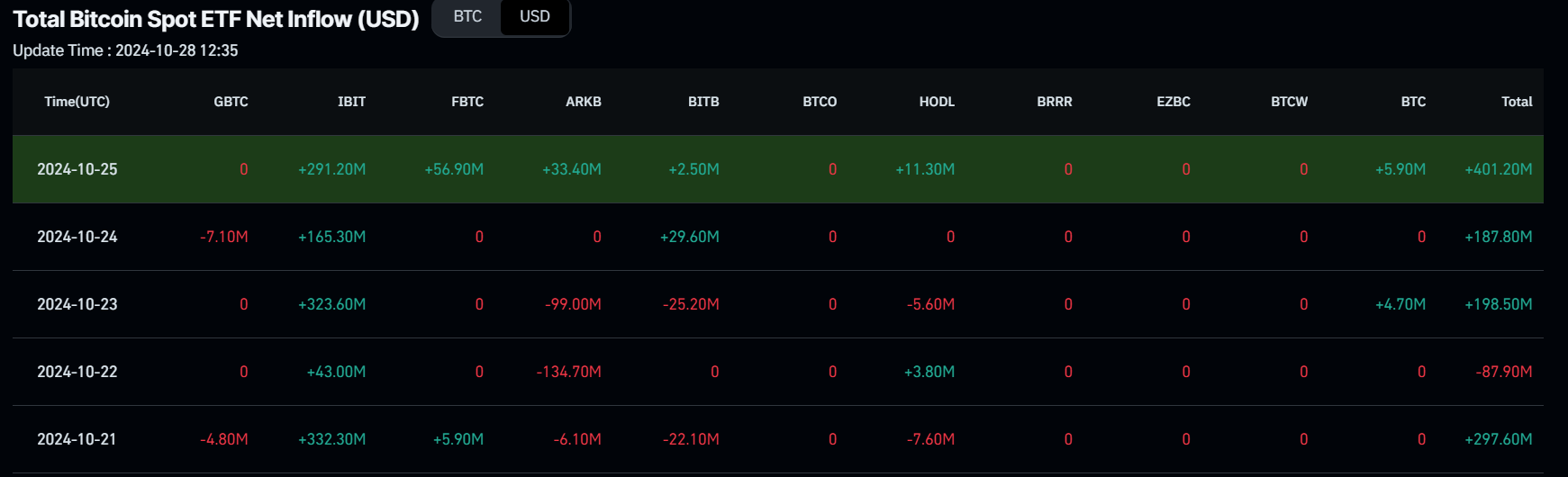

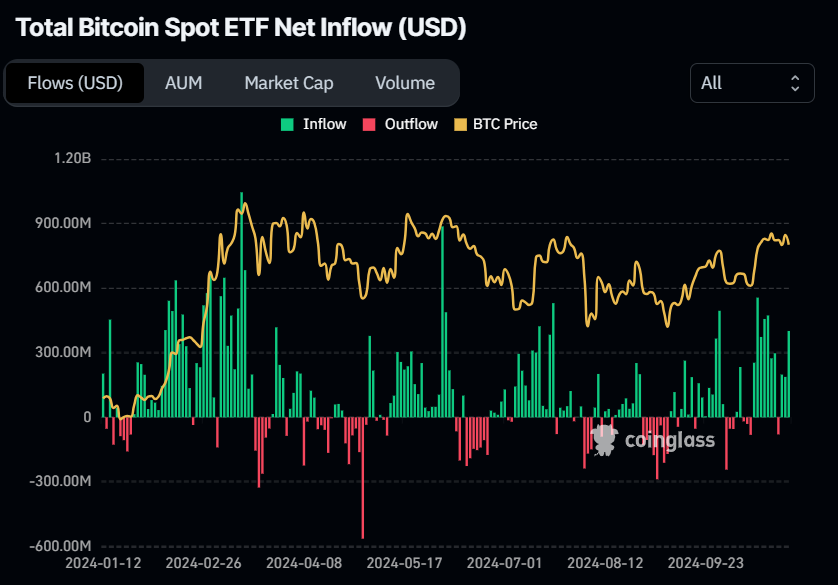

Institutional flows continued accumulating Bitcoin despite its dip to $65,260 last week. According to Coinglass ETF data, the US spot Bitcoin ETFs saw a total net inflow of $997.2 million, largely fueled by BlackRock IBIT funds, contributing $1.15 billion. This marks over $1 billion in inflows for the second consecutive week. If this magnitude of inflows persists or increases further, it could contribute to Bitcoin’s price rally.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

According to Santiment data, the number of Bitcoin whale wallets holding 100 or more BTC has increased by 297 (+1.9%) over the past two weeks, while wallets with under 100 BTC have decreased by 20,629 (-0.1%). This indicates that major stakeholders are accumulating more coins from retail traders, a trend that historically suggests bullish outcomes.

Bitcoin Holders chart. Source: Santiment

QCP Capital’s weekly report noted signs of pessimism for Bitcoin’s price, triggered by allegations of a US government investigation into Tether for potential violations of anti-money laundering (AML) rules and sanctions, which led to a sharp decline in the USDT stablecoin on Friday.

Tether CEO Paolo Ardoino has denied these claims, and it remains unclear whether the allegations will be substantiated, as Tether has faced scrutiny before.

The report also explains, “In the Middle East, tensions continue to intensify as Israel launched retaliatory strikes on Iran for the missile barrage earlier this month. The Israeli retaliatory strikes alongside the USDT fiasco on Friday created some selling pressure in the markets, with the DJIA and S&P 500 down 0.61% and 0.03%, respectively. Crypto fell shortly after, with BTC briefly dipping to 65,500.”

Bitcoin Price Forecast: $66,000 support level holds strong

Bitcoin price found support at around $66,000 on Friday and bounced 1.98% in the next two days. As of Monday, it continues to trade higher, at around $68,500.

If the $66,000 level continues to hold as support, it could rally to reclaim its October 21 high of $69,519. A successful break and close above $70,000 could extend the rally to retest its next key barrier, the all-time high of $73,777 reached mid-March.

The Relative Strength Index (RSI) indicator on the daily chart reads 61, above its neutral level of 50 and pointing upwards, indicating the bullish momentum is gaining traction.

BTC/USDT daily chart

Conversely, if BTC breaks and closes below $66,000, it could decline 5.8% to retest its next support at $62,055, the 61.8% Fibonacci retracement level (drawn from July’s high of $70,079 to August’s low of $49,072).

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.